Earnings are growing at Canada Goose Holdings (TSE:GOOS) but shareholders still don't like its prospects

As an investor, mistakes are inevitable. But really big losses can really drag down an overall portfolio. So take a moment to sympathize with the long term shareholders of Canada Goose Holdings Inc. (TSE:GOOS), who have seen the share price tank a massive 78% over a three year period. That would be a disturbing experience. Unfortunately the share price momentum is still quite negative, with prices down 17% in thirty days.

If the past week is anything to go by, investor sentiment for Canada Goose Holdings isn't positive, so let's see if there's a mismatch between fundamentals and the share price.

View our latest analysis for Canada Goose Holdings

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

During the unfortunate three years of share price decline, Canada Goose Holdings actually saw its earnings per share (EPS) improve by 4.0% per year. This is quite a puzzle, and suggests there might be something temporarily buoying the share price. Or else the company was over-hyped in the past, and so its growth has disappointed.

After considering the numbers, we'd posit that the the market had higher expectations of EPS growth, three years back. However, taking a look at other business metrics might shed a bit more light on the share price action.

We note that, in three years, revenue has actually grown at a 11% annual rate, so that doesn't seem to be a reason to sell shares. This analysis is just perfunctory, but it might be worth researching Canada Goose Holdings more closely, as sometimes stocks fall unfairly. This could present an opportunity.

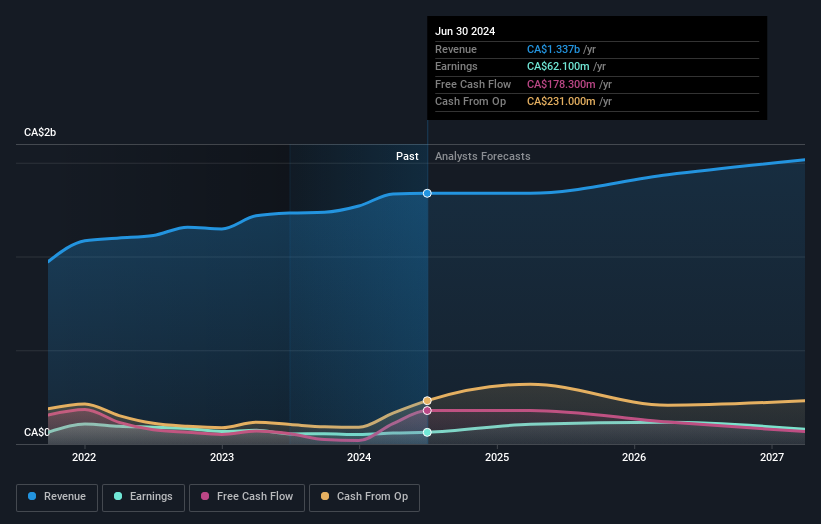

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

We like that insiders have been buying shares in the last twelve months. Even so, future earnings will be far more important to whether current shareholders make money. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Canada Goose Holdings shareholders are down 1.8% for the year, but the market itself is up 25%. However, keep in mind that even the best stocks will sometimes underperform the market over a twelve month period. Unfortunately, longer term shareholders are suffering worse, given the loss of 12% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. It's always interesting to track share price performance over the longer term. But to understand Canada Goose Holdings better, we need to consider many other factors. Take risks, for example - Canada Goose Holdings has 2 warning signs we think you should be aware of.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Canadian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:GOOS

Canada Goose Holdings

Designs, manufactures, and sells performance luxury apparel for men, women, youth, children, and babies in Canada, the United States, Greater China, rest of the Asia Pacific, Europe, the Middle East, and Africa.

Acceptable track record with mediocre balance sheet.

Similar Companies

Market Insights

Community Narratives