- Canada

- /

- Professional Services

- /

- TSX:LWRK

Here's Why We're Wary Of Buying Morneau Shepell's (TSE:MSI) For Its Upcoming Dividend

Morneau Shepell Inc. (TSE:MSI) stock is about to trade ex-dividend in three days. If you purchase the stock on or after the 27th of November, you won't be eligible to receive this dividend, when it is paid on the 15th of December.

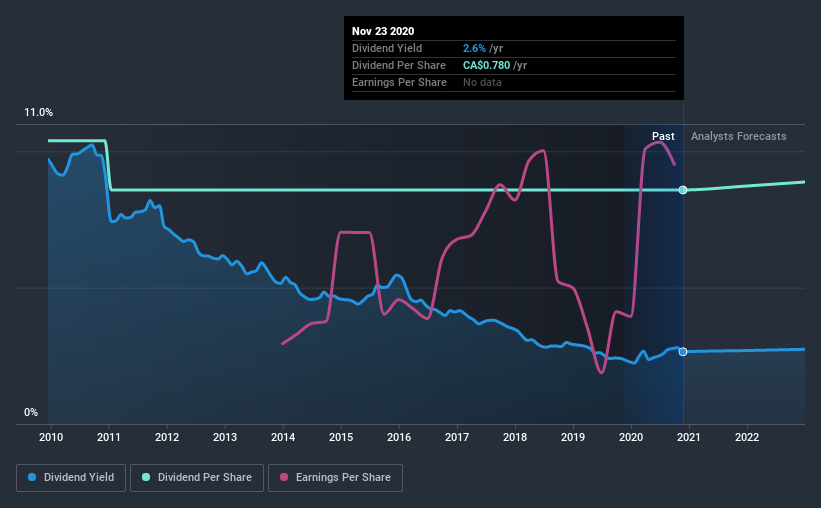

Morneau Shepell's next dividend payment will be CA$0.065 per share, on the back of last year when the company paid a total of CA$0.78 to shareholders. Calculating the last year's worth of payments shows that Morneau Shepell has a trailing yield of 2.6% on the current share price of CA$29.45. We love seeing companies pay a dividend, but it's also important to be sure that laying the golden eggs isn't going to kill our golden goose! As a result, readers should always check whether Morneau Shepell has been able to grow its dividends, or if the dividend might be cut.

View our latest analysis for Morneau Shepell

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Morneau Shepell distributed an unsustainably high 113% of its profit as dividends to shareholders last year. Without more sustainable payment behaviour, the dividend looks precarious. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It paid out 90% of its free cash flow in the form of dividends last year, which is outside the comfort zone for most businesses. Companies usually need cash more than they need earnings - expenses don't pay themselves - so it's not great to see it paying out so much of its cash flow.

Cash is slightly more important than profit from a dividend perspective, but given Morneau Shepell's payouts were not well covered by either earnings or cash flow, we would be concerned about the sustainability of this dividend.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If earnings fall far enough, the company could be forced to cut its dividend. This is why it's a relief to see Morneau Shepell earnings per share are up 6.2% per annum over the last five years. Earnings per share have been growing steadily, although a payout ratio this high suggests future growth is likely to slow, and the dividend may also be at risk of a cut if business enters a downturn.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. Morneau Shepell's dividend payments per share have declined at 1.9% per year on average over the past 10 years, which is uninspiring.

To Sum It Up

Is Morneau Shepell an attractive dividend stock, or better left on the shelf? Morneau Shepell is paying out an uncomfortably high percentage of both earnings and cash flow as dividends, although at least earnings per share are growing somewhat. Overall it doesn't look like the most suitable dividend stock for a long-term buy and hold investor.

So if you're still interested in Morneau Shepell despite it's poor dividend qualities, you should be well informed on some of the risks facing this stock. Be aware that Morneau Shepell is showing 3 warning signs in our investment analysis, and 2 of those shouldn't be ignored...

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Morneau Shepell, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About TSX:LWRK

LifeWorks

LifeWorks Inc. provides digital and in-person solutions for wellbeing of individuals in Canada, the United States and internationally.

Moderate growth potential unattractive dividend payer.

Similar Companies

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Watch Pulse Seismic Outperform with 13.6% Revenue Growth in the Coming Years

Significantly undervalued gold explorer in Timmins, finally getting traction

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026