3 TSX Stocks Estimated To Be Trading Up To 46.2% Below Intrinsic Value

Reviewed by Simply Wall St

As the TSX reaches new all-time highs, fueled by optimism surrounding central bank policies and robust corporate earnings, investors are navigating a market landscape that remains resilient despite looming U.S. election uncertainties. In this environment of cautious optimism, identifying stocks trading below their intrinsic value can present unique opportunities for those looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Computer Modelling Group (TSX:CMG) | CA$11.12 | CA$22.04 | 49.5% |

| Savaria (TSX:SIS) | CA$22.13 | CA$41.12 | 46.2% |

| Endeavour Mining (TSX:EDV) | CA$32.18 | CA$62.27 | 48.3% |

| Real Matters (TSX:REAL) | CA$9.27 | CA$17.62 | 47.4% |

| Viemed Healthcare (TSX:VMD) | CA$10.45 | CA$20.08 | 48% |

| Kinaxis (TSX:KXS) | CA$160.03 | CA$279.60 | 42.8% |

| Bragg Gaming Group (TSX:BRAG) | CA$6.58 | CA$10.62 | 38.1% |

| Blackline Safety (TSX:BLN) | CA$5.88 | CA$11.02 | 46.7% |

| Boyd Group Services (TSX:BYD) | CA$205.00 | CA$336.50 | 39.1% |

| Opsens (TSX:OPS) | CA$2.90 | CA$4.64 | 37.5% |

We'll examine a selection from our screener results.

GFL Environmental (TSX:GFL)

Overview: GFL Environmental Inc. provides non-hazardous solid waste management and environmental services across Canada and the United States, with a market cap of CA$21.04 billion.

Operations: The company's revenue segments include CA$4.79 billion from solid waste operations in the USA, CA$2.16 billion from solid waste activities in Canada, and CA$1.67 billion from environmental services.

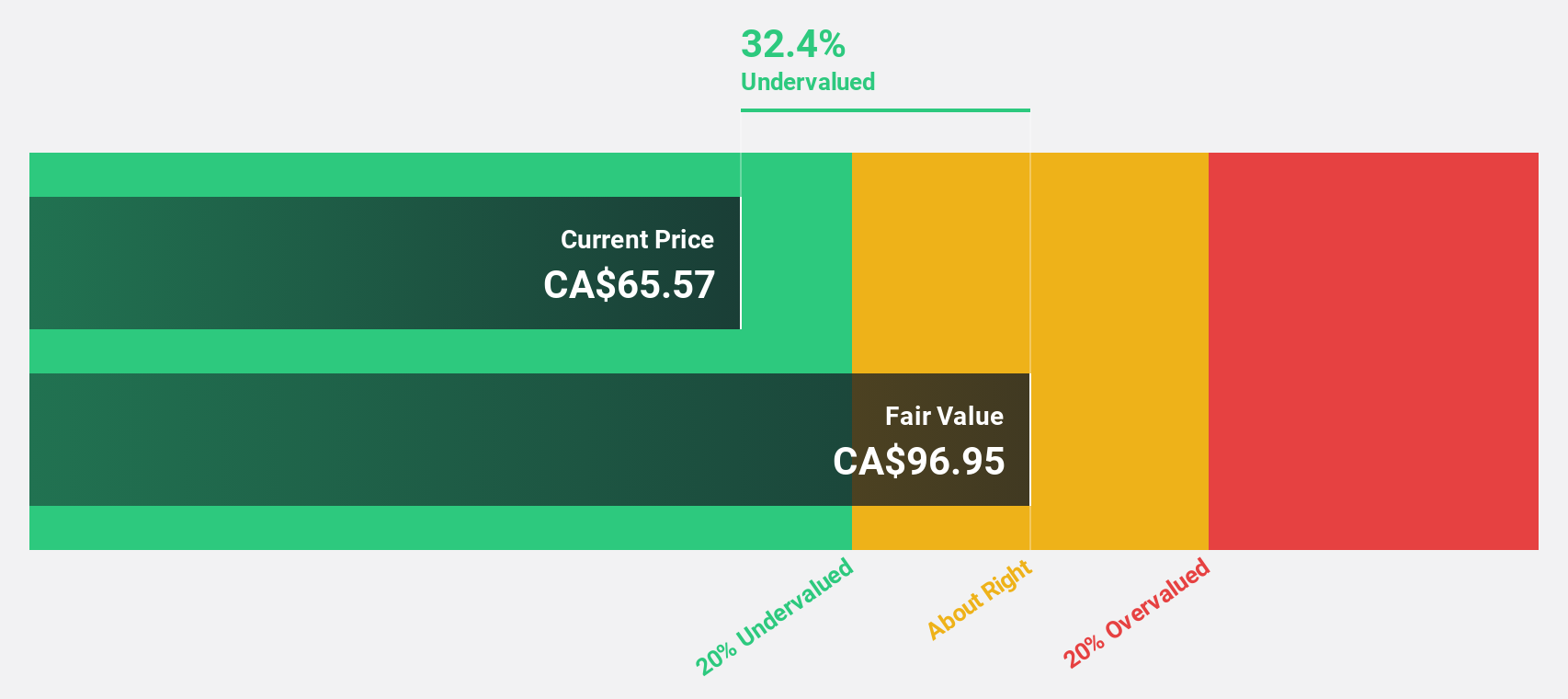

Estimated Discount To Fair Value: 33.3%

GFL Environmental is trading at CA$53.35, significantly below its estimated fair value of CA$79.96, suggesting it may be undervalued based on cash flows. Despite recent net losses, the company has raised its revenue guidance for 2024 to between $7.9 billion and $7.925 billion and forecasts earnings growth of over 115% annually, becoming profitable in three years with above-market growth expectations. However, shareholders experienced dilution recently and significant insider selling occurred last quarter.

- The analysis detailed in our GFL Environmental growth report hints at robust future financial performance.

- Click here to discover the nuances of GFL Environmental with our detailed financial health report.

Ivanhoe Mines (TSX:IVN)

Overview: Ivanhoe Mines Ltd. is involved in the mining, development, and exploration of minerals and precious metals primarily in Africa, with a market cap of CA$27.42 billion.

Operations: Ivanhoe Mines Ltd. generates its revenue through activities related to the extraction, development, and exploration of minerals and precious metals in Africa.

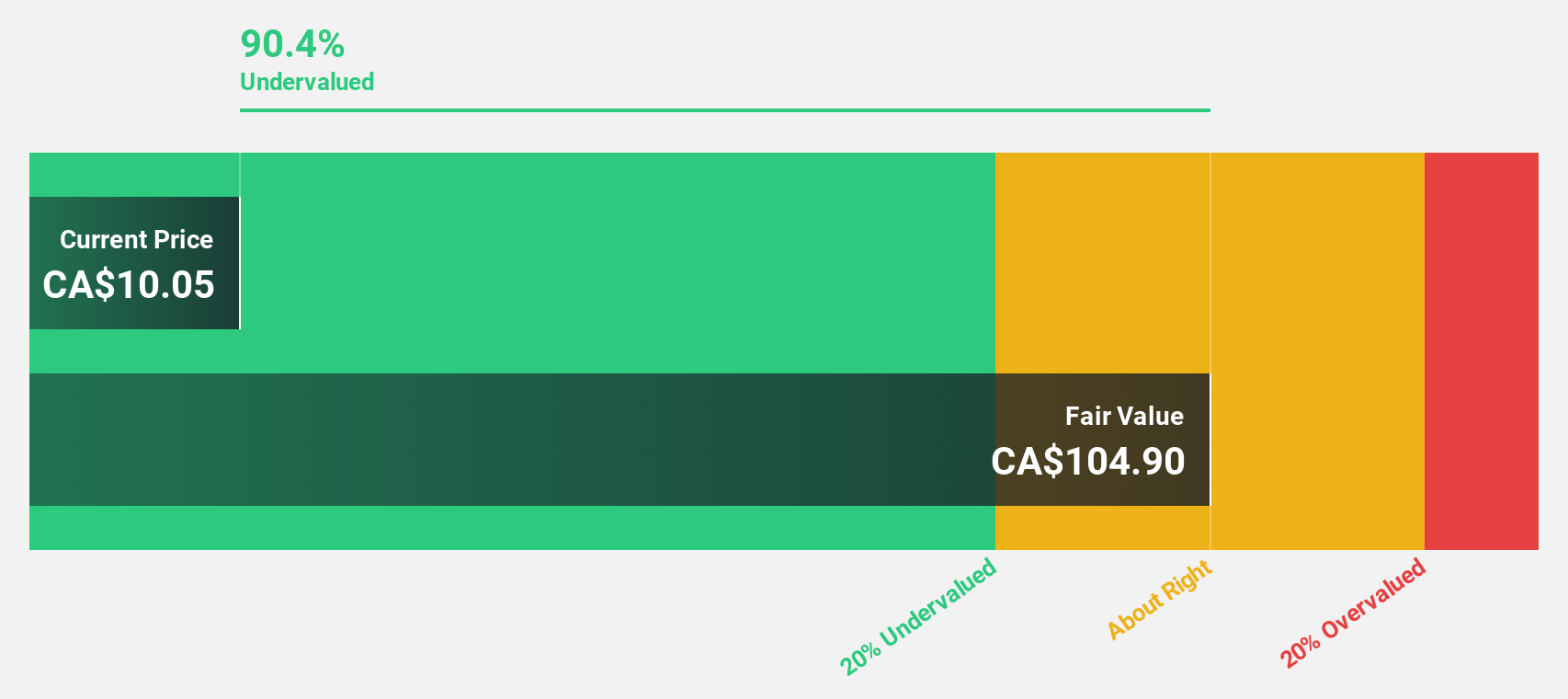

Estimated Discount To Fair Value: 14.0%

Ivanhoe Mines is trading at CA$20.16, slightly below its fair value estimate of CA$23.43, reflecting potential undervaluation based on cash flows. The company has achieved record copper production and milling rates at the Kamoa-Kakula Copper Complex, with further improvements expected as new equipment comes online. Despite recent earnings declines, Ivanhoe forecasts robust revenue growth of 84.2% annually and a significant profit increase of 67.7%, though shareholder dilution has occurred recently.

- In light of our recent growth report, it seems possible that Ivanhoe Mines' financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Ivanhoe Mines' balance sheet health report.

Savaria (TSX:SIS)

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged across Canada, the United States, Europe, and internationally with a market cap of CA$1.57 billion.

Operations: The company generates revenue from its Patient Care segment amounting to CA$183.98 million, with a Segment Adjustment of CA$673.74 million.

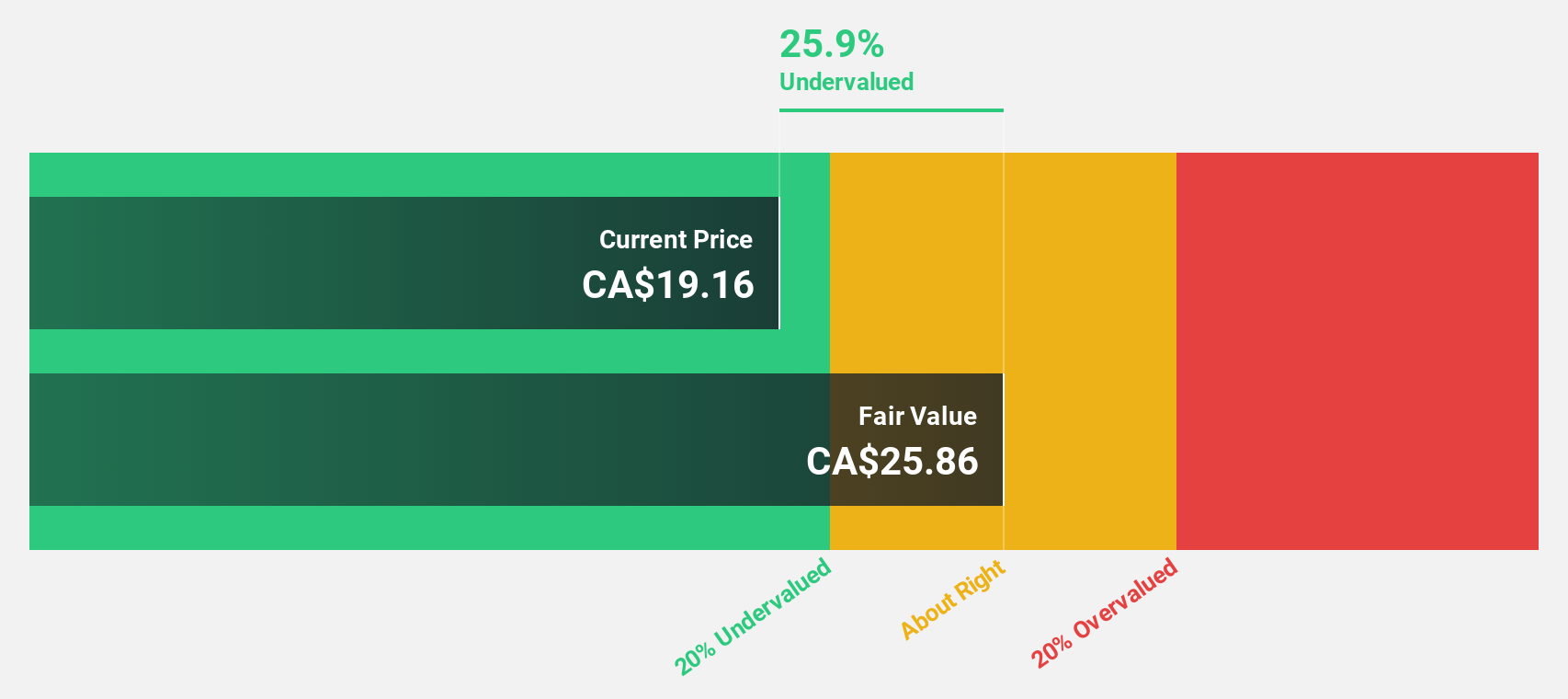

Estimated Discount To Fair Value: 46.2%

Savaria Corporation is trading at CA$22.13, significantly below its estimated fair value of CA$41.12, indicating undervaluation based on cash flows. The company reported a rise in quarterly sales to CA$221.34 million and net income to CA$10.96 million, showing improved financial performance. Despite significant insider selling recently, earnings are forecasted to grow substantially at 30% annually over the next three years, outpacing the Canadian market growth rate of 14.6%.

- The growth report we've compiled suggests that Savaria's future prospects could be on the up.

- Navigate through the intricacies of Savaria with our comprehensive financial health report here.

Summing It All Up

- Discover the full array of 24 Undervalued TSX Stocks Based On Cash Flows right here.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives