- Canada

- /

- Communications

- /

- TSX:STC

3 TSX Growth Stocks Insiders Own With Up To 173% Earnings Growth

Reviewed by Simply Wall St

As the Canadian market navigates through uncertainties stemming from new U.S. policies on tariffs and energy, the TSX index has shown resilience with gains since Inauguration Day. In this environment, growth companies with high insider ownership can be appealing to investors as they often indicate confidence in the company's future prospects and alignment of interests between insiders and shareholders.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 38.9% |

| Robex Resources (TSXV:RBX) | 28.2% | 130.7% |

| Allied Gold (TSX:AAUC) | 17.7% | 84% |

| West Red Lake Gold Mines (TSXV:WRLG) | 13.4% | 77.6% |

| Almonty Industries (TSX:AII) | 17.2% | 43.9% |

| Alvopetro Energy (TSXV:ALV) | 19.4% | 33% |

| Aritzia (TSX:ATZ) | 18.6% | 45.1% |

| Enterprise Group (TSX:E) | 32.2% | 56.3% |

| Colliers International Group (TSX:CIGI) | 14.1% | 24.1% |

| CHAR Technologies (TSXV:YES) | 10.8% | 58.3% |

Let's uncover some gems from our specialized screener.

Black Diamond Group (TSX:BDI)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Black Diamond Group Limited rents and sells modular space and workforce accommodation solutions, with a market cap of CA$562.82 million.

Operations: The company's revenue is derived from two main segments: Workforce Solutions, contributing CA$170.76 million, and Modular Space Solutions, generating CA$202.88 million.

Insider Ownership: 26.1%

Earnings Growth Forecast: 24.6% p.a.

Black Diamond Group, while facing a decline in recent quarterly earnings with sales at C$101.19 million and net income at C$7.37 million, shows promising growth potential with expected annual profit increases of 24.6%, outpacing the Canadian market's 15.7%. Despite high debt levels and no substantial insider buying recently, the stock is trading 26.1% below its estimated fair value, suggesting good relative value compared to peers and industry standards.

- Get an in-depth perspective on Black Diamond Group's performance by reading our analyst estimates report here.

- Our valuation report here indicates Black Diamond Group may be undervalued.

Knight Therapeutics (TSX:GUD)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Knight Therapeutics Inc. is a company that develops, manufactures, acquires, licenses, markets, and distributes pharmaceutical and consumer health products as well as medical devices globally with a market cap of CA$572.68 million.

Operations: The company's revenue is primarily derived from its pharmaceuticals segment, which generated CA$348.64 million.

Insider Ownership: 22.5%

Earnings Growth Forecast: 173.2% p.a.

Knight Therapeutics, with substantial insider buying recently, is poised for growth as its revenue is forecast to grow at 6.5% annually, outpacing the Canadian market's 4.7%. Despite recent earnings challenges with a net loss of C$6.4 million over nine months and low return on equity forecasts, the company trades significantly below fair value estimates and aims for profitability within three years. Recent product approvals in Canada further bolster its growth prospects in ADHD treatment markets.

- Unlock comprehensive insights into our analysis of Knight Therapeutics stock in this growth report.

- In light of our recent valuation report, it seems possible that Knight Therapeutics is trading behind its estimated value.

Sangoma Technologies (TSX:STC)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Sangoma Technologies Corporation, along with its subsidiaries, focuses on developing, manufacturing, distributing, and supporting voice and data connectivity components for software-based communication applications both in the United States and internationally, with a market cap of CA$369.91 million.

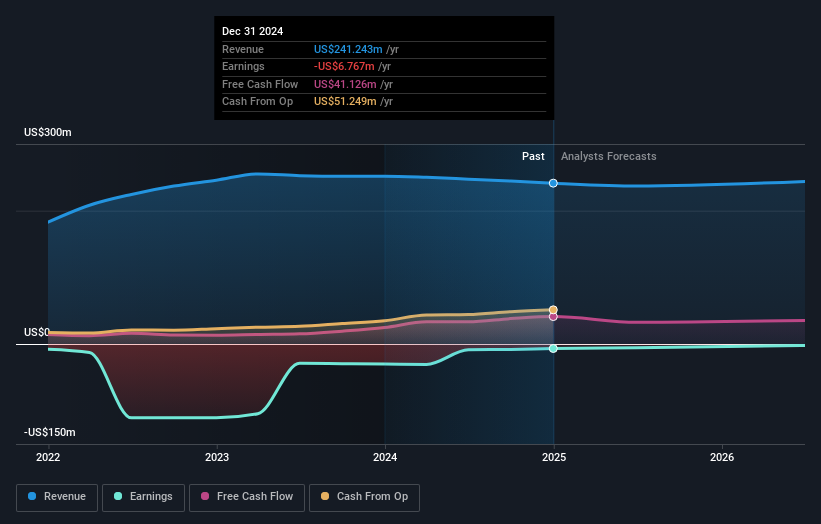

Operations: The company's revenue is primarily derived from its voice and data connectivity components segment, which generated $244.41 million.

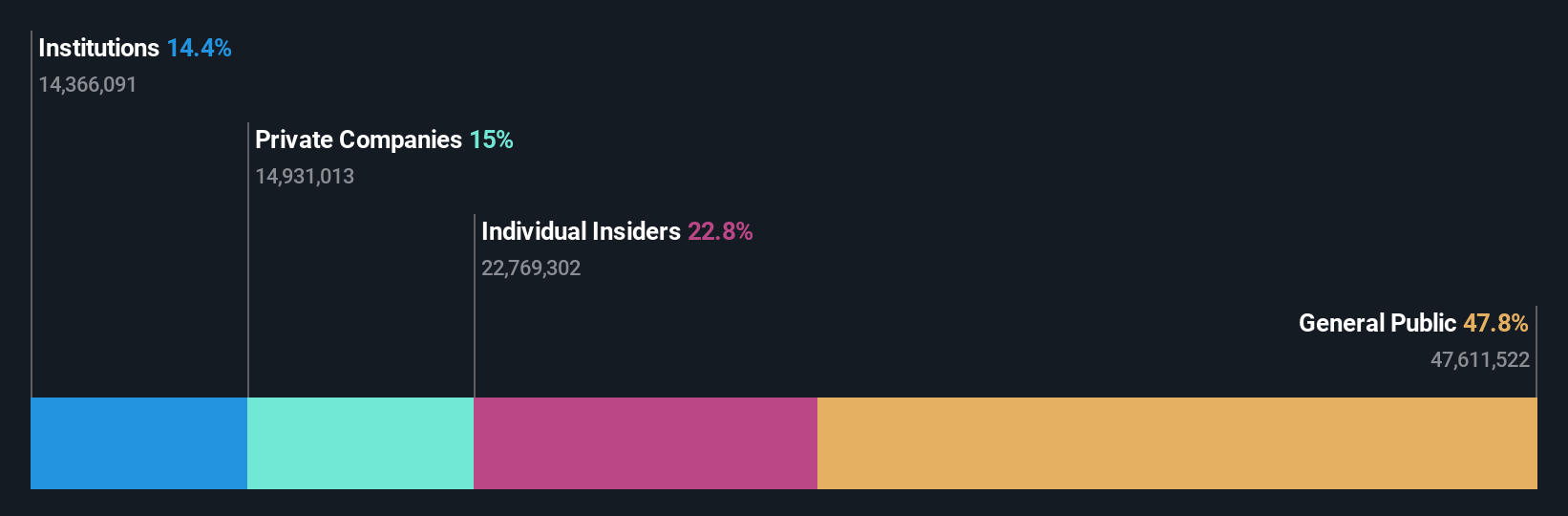

Insider Ownership: 22.8%

Earnings Growth Forecast: 165.7% p.a.

Sangoma Technologies, experiencing more insider buying than selling recently, is forecast to grow earnings by 165.69% annually and expects revenue between $250 million and $260 million for fiscal 2025. Trading at a significant discount to fair value, it aims for profitability in three years. A recent partnership with Sphinx Medical enhances its unified communications platform, potentially boosting efficiency and revenue in healthcare through improved patient relationship management systems.

- Click here to discover the nuances of Sangoma Technologies with our detailed analytical future growth report.

- The analysis detailed in our Sangoma Technologies valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Delve into our full catalog of 44 Fast Growing TSX Companies With High Insider Ownership here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:STC

Sangoma Technologies

Develops, manufactures, distributes, and supports voice and data connectivity components for software-based communication applications in the United States of America and internationally.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)