- Canada

- /

- Commercial Services

- /

- TSX:ANRG

Not Many Are Piling Into Anaergia Inc. (TSE:ANRG) Stock Yet As It Plummets 31%

Anaergia Inc. (TSE:ANRG) shares have retraced a considerable 31% in the last month, reversing a fair amount of their solid recent performance. Of course, over the longer-term many would still wish they owned shares as the stock's price has soared 198% in the last twelve months.

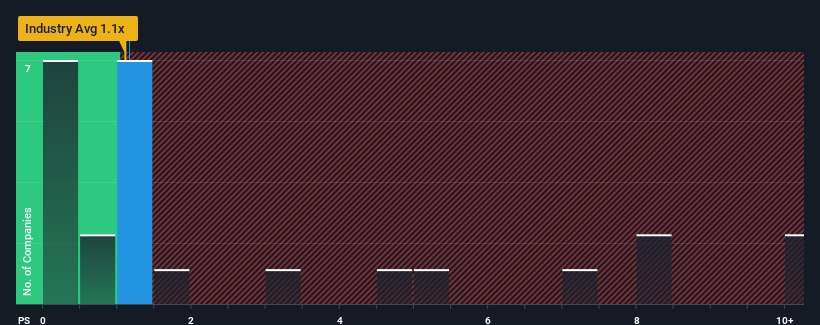

Although its price has dipped substantially, there still wouldn't be many who think Anaergia's price-to-sales (or "P/S") ratio of 1.2x is worth a mention when the median P/S in Canada's Commercial Services industry is similar at about 1.1x. While this might not raise any eyebrows, if the P/S ratio is not justified investors could be missing out on a potential opportunity or ignoring looming disappointment.

View our latest analysis for Anaergia

How Has Anaergia Performed Recently?

While the industry has experienced revenue growth lately, Anaergia's revenue has gone into reverse gear, which is not great. One possibility is that the P/S ratio is moderate because investors think this poor revenue performance will turn around. You'd really hope so, otherwise you're paying a relatively elevated price for a company with this sort of growth profile.

Want the full picture on analyst estimates for the company? Then our free report on Anaergia will help you uncover what's on the horizon.Do Revenue Forecasts Match The P/S Ratio?

Anaergia's P/S ratio would be typical for a company that's only expected to deliver moderate growth, and importantly, perform in line with the industry.

Taking a look back first, the company's revenue growth last year wasn't something to get excited about as it posted a disappointing decline of 27%. That put a dampener on the good run it was having over the longer-term as its three-year revenue growth is still a noteworthy 5.2% in total. Although it's been a bumpy ride, it's still fair to say the revenue growth recently has been mostly respectable for the company.

Looking ahead now, revenue is anticipated to remain buoyant, climbing by 16% during the coming year according to the lone analyst following the company. That would be an excellent outcome when the industry is expected to decline by 3.0%.

With this information, we find it odd that Anaergia is trading at a fairly similar P/S to the industry. It looks like most investors aren't convinced the company can achieve positive future growth in the face of a shrinking broader industry.

The Final Word

Anaergia's plummeting stock price has brought its P/S back to a similar region as the rest of the industry. Generally, our preference is to limit the use of the price-to-sales ratio to establishing what the market thinks about the overall health of a company.

Our examination of Anaergia's analyst forecasts revealed that its superior revenue outlook against a shaky industry isn't resulting in the company trading at a higher P/S, as per our expectations. Given the glowing revenue forecasts, we can only assume potential risks are what might be capping the P/S ratio at its current levels. One such risk is that the company may not live up to analysts' revenue trajectories in tough industry conditions. However, if you agree with the analysts' forecasts, you may be able to pick up the stock at an attractive price.

Plus, you should also learn about these 5 warning signs we've spotted with Anaergia (including 3 which are concerning).

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:ANRG

Anaergia

Provides solutions for the generation of renewable energy and conversion of waste to resources in Italy, North America, Europe, the Middle East and Africa, and the Asia Pacific.

High growth potential with adequate balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

Not a Bubble, But the "Industrial Revolution 4.0" Engine

The "David vs. Goliath" AI Trade – Why Second Place is Worth Billions

The "Sleeping Giant" Wakes Up – Efficiency & Monetization

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026