Here's Why We're Not At All Concerned With Kelso Technologies' (TSE:KLS) Cash Burn Situation

There's no doubt that money can be made by owning shares of unprofitable businesses. For example, although Amazon.com made losses for many years after listing, if you had bought and held the shares since 1999, you would have made a fortune. But while the successes are well known, investors should not ignore the very many unprofitable companies that simply burn through all their cash and collapse.

Given this risk, we thought we'd take a look at whether Kelso Technologies (TSE:KLS) shareholders should be worried about its cash burn. For the purpose of this article, we'll define cash burn as the amount of cash the company is spending each year to fund its growth (also called its negative free cash flow). We'll start by comparing its cash burn with its cash reserves in order to calculate its cash runway.

View our latest analysis for Kelso Technologies

When Might Kelso Technologies Run Out Of Money?

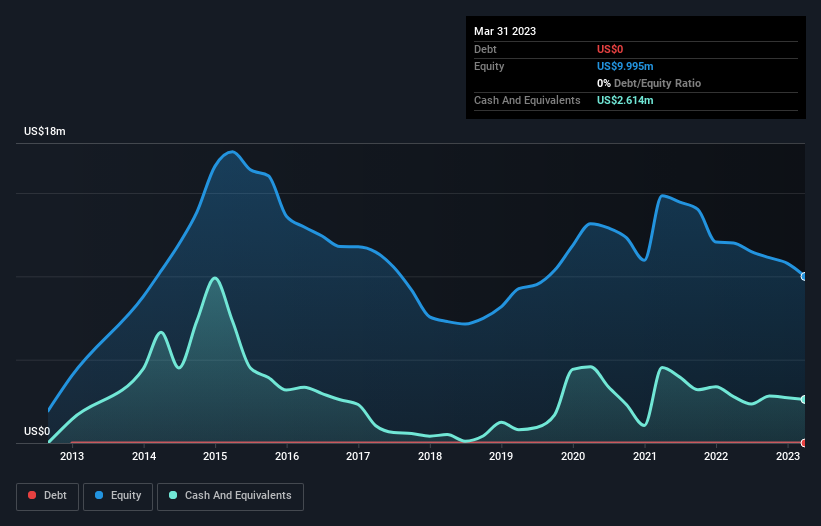

You can calculate a company's cash runway by dividing the amount of cash it has by the rate at which it is spending that cash. In March 2023, Kelso Technologies had US$2.6m in cash, and was debt-free. Importantly, its cash burn was US$25k over the trailing twelve months. So it had a very long cash runway of many years from March 2023. While this is only one measure of its cash burn situation, it certainly gives us the impression that holders have nothing to worry about. The image below shows how its cash balance has been changing over the last few years.

How Well Is Kelso Technologies Growing?

Kelso Technologies managed to reduce its cash burn by 99% over the last twelve months, which is extremely promising, when it comes to considering its need for cash. And it could also show revenue growth of 14% in the same period. It seems to be growing nicely. Of course, we've only taken a quick look at the stock's growth metrics, here. This graph of historic earnings and revenue shows how Kelso Technologies is building its business over time.

Can Kelso Technologies Raise More Cash Easily?

We are certainly impressed with the progress Kelso Technologies has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Companies can raise capital through either debt or equity. Commonly, a business will sell new shares in itself to raise cash and drive growth. We can compare a company's cash burn to its market capitalisation to get a sense for how many new shares a company would have to issue to fund one year's operations.

Kelso Technologies has a market capitalisation of US$21m and burnt through US$25k last year, which is 0.1% of the company's market value. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

So, Should We Worry About Kelso Technologies' Cash Burn?

As you can probably tell by now, we're not too worried about Kelso Technologies' cash burn. In particular, we think its cash burn reduction stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! After taking into account the various metrics mentioned in this report, we're pretty comfortable with how the company is spending its cash. Separately, we looked at different risks affecting the company and spotted 3 warning signs for Kelso Technologies (of which 1 is concerning!) you should know about.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechValuation is complex, but we're here to simplify it.

Discover if Kelso Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:KLS

Kelso Technologies

Designs, engineers, markets, produces and distributes various proprietary pressure relief valves in the United States and Canada.

Flawless balance sheet and good value.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)