- Canada

- /

- Aerospace & Defense

- /

- TSX:BBD.B

Bombardier's (TSE:BBD.B) Stock Price Has Reduced 81% In The Past Three Years

It is a pleasure to report that the Bombardier Inc. (TSE:BBD.B) is up 54% in the last quarter. But that is meagre solace in the face of the shocking decline over three years. In that time the share price has melted like a snowball in the desert, down 81%. So we're relieved for long term holders to see a bit of uplift. But the more important question is whether the underlying business can justify a higher price still.

We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

See our latest analysis for Bombardier

Bombardier isn't currently profitable, so most analysts would look to revenue growth to get an idea of how fast the underlying business is growing. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

In the last three years Bombardier saw its revenue shrink by 16% per year. That's definitely a weaker result than most pre-profit companies report. The swift share price decline at an annual compound rate of 22%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

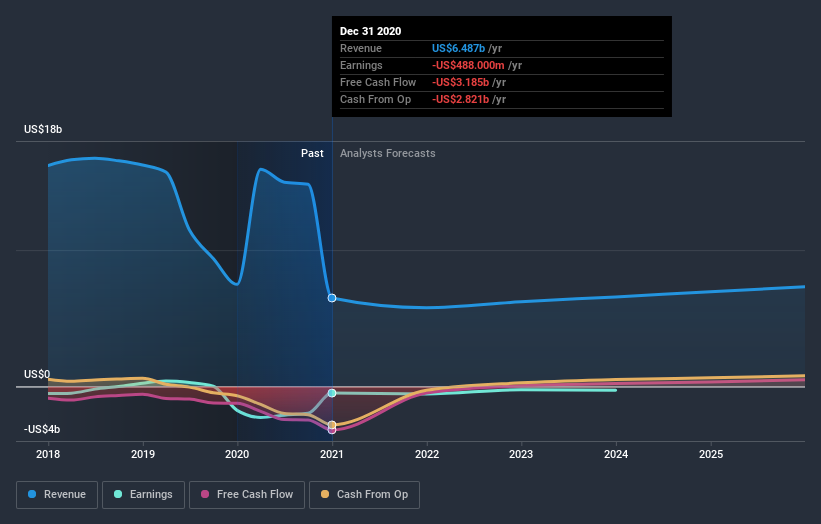

The graphic below depicts how earnings and revenue have changed over time (unveil the exact values by clicking on the image).

Bombardier is well known by investors, and plenty of clever analysts have tried to predict the future profit levels. So we recommend checking out this free report showing consensus forecasts

A Different Perspective

Investors in Bombardier had a tough year, with a total loss of 9.0%, against a market gain of about 47%. Even the share prices of good stocks drop sometimes, but we want to see improvements in the fundamental metrics of a business, before getting too interested. Unfortunately, longer term shareholders are suffering worse, given the loss of 8% doled out over the last five years. We would want clear information suggesting the company will grow, before taking the view that the share price will stabilize. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 4 warning signs with Bombardier (at least 1 which can't be ignored) , and understanding them should be part of your investment process.

Of course Bombardier may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on CA exchanges.

If you’re looking to trade Bombardier, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

Valuation is complex, but we're here to simplify it.

Discover if Bombardier might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:BBD.B

Bombardier

Engages in the design, manufacture, and sale of business aircraft and aircraft structural components worldwide.

Undervalued slight.