- Canada

- /

- Oil and Gas

- /

- TSX:FRU

Undiscovered Gems in Canada Top Picks for November 2024

Reviewed by Simply Wall St

As the Canadian economy experiences a softening labor market and anticipates further rate cuts from the Bank of Canada, investors are navigating an environment that could favor both equity and bond markets. With these economic conditions in mind, identifying undiscovered gems in Canada's stock market involves seeking companies that can thrive amid easing monetary policies and a stabilizing economic backdrop.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Reconnaissance Energy Africa | NA | 15.28% | 7.58% | ★★★★★★ |

| Taiga Building Products | NA | 6.05% | 10.50% | ★★★★★★ |

| Westshore Terminals Investment | NA | -2.67% | -9.77% | ★★★★★☆ |

| Tornado Global Hydrovacs | 14.62% | 24.52% | 64.90% | ★★★★★☆ |

| Grown Rogue International | 24.92% | 43.35% | 67.95% | ★★★★★☆ |

| Mako Mining | 22.90% | 38.12% | 54.79% | ★★★★★☆ |

| Pizza Pizza Royalty | 15.66% | 3.64% | 3.95% | ★★★★☆☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

Freehold Royalties (TSX:FRU)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Freehold Royalties Ltd. focuses on acquiring and managing royalty interests in crude oil, natural gas, natural gas liquids, and potash properties across Western Canada and the United States, with a market capitalization of CA$2.05 billion.

Operations: Freehold Royalties Ltd. generates revenue primarily from its oil and gas exploration and production segment, amounting to CA$323.04 million. The company's market capitalization stands at approximately CA$2.05 billion.

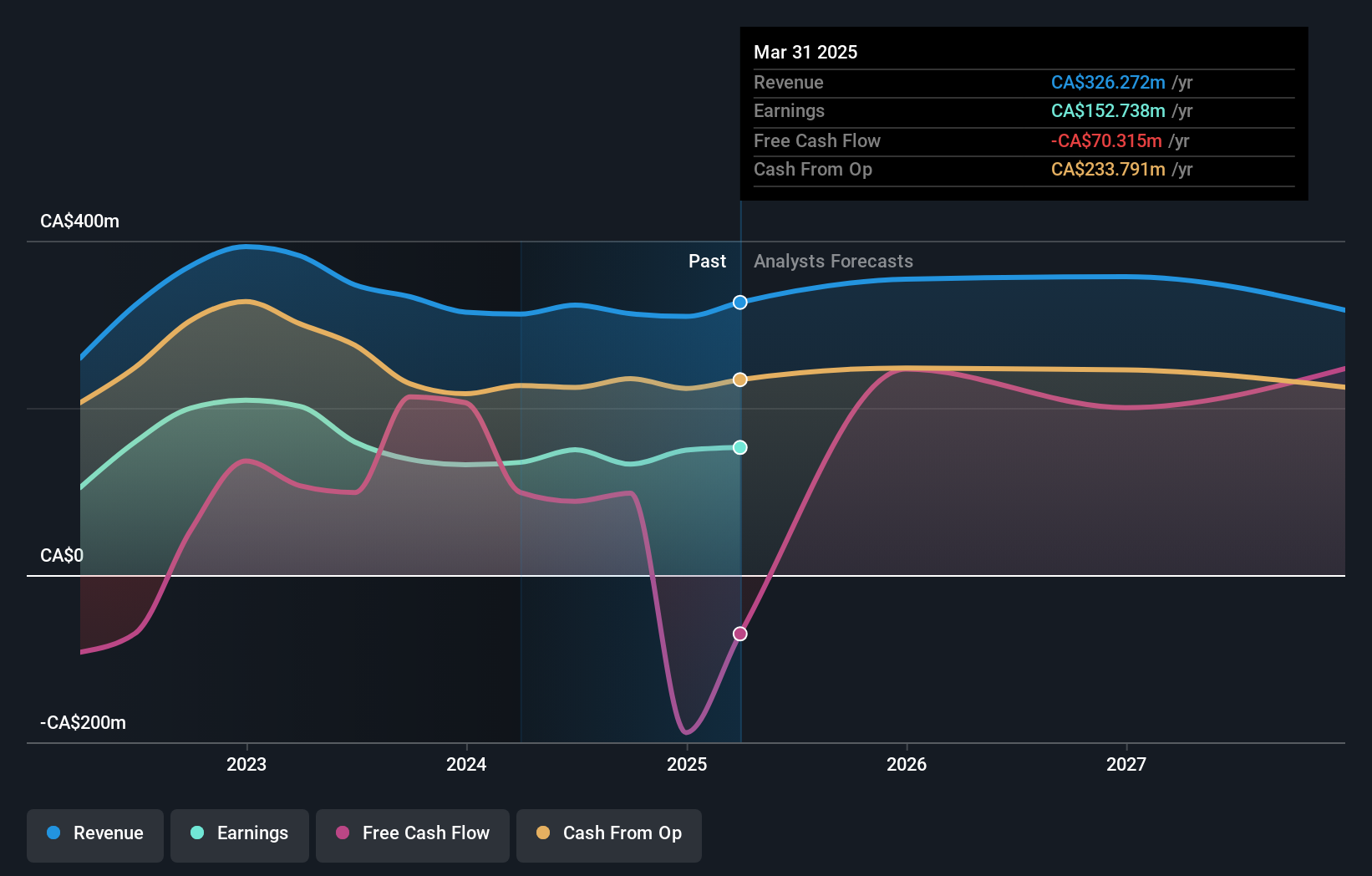

Freehold Royalties, a smaller player in the Canadian oil and gas sector, showcases a satisfactory net debt to equity ratio of 24.6%, indicating manageable leverage. Despite negative earnings growth of 5.9% over the past year, it outperformed the broader industry average of 37.1%. The company's interest payments are well covered by EBIT at 15.3 times, reflecting strong financial health in this aspect. Trading at 51% below its estimated fair value suggests potential upside for investors seeking undervalued opportunities. Recent dividend affirmations highlight consistent shareholder returns with CAD$0.09 per share payouts reaffirmed for upcoming months.

- Unlock comprehensive insights into our analysis of Freehold Royalties stock in this health report.

Understand Freehold Royalties' track record by examining our Past report.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. operates through its subsidiaries to provide retail services for food and everyday products in rural communities and urban neighborhoods across northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of approximately CA$2.53 billion.

Operations: North West generates revenue primarily from its retail operations, amounting to CA$2.52 billion.

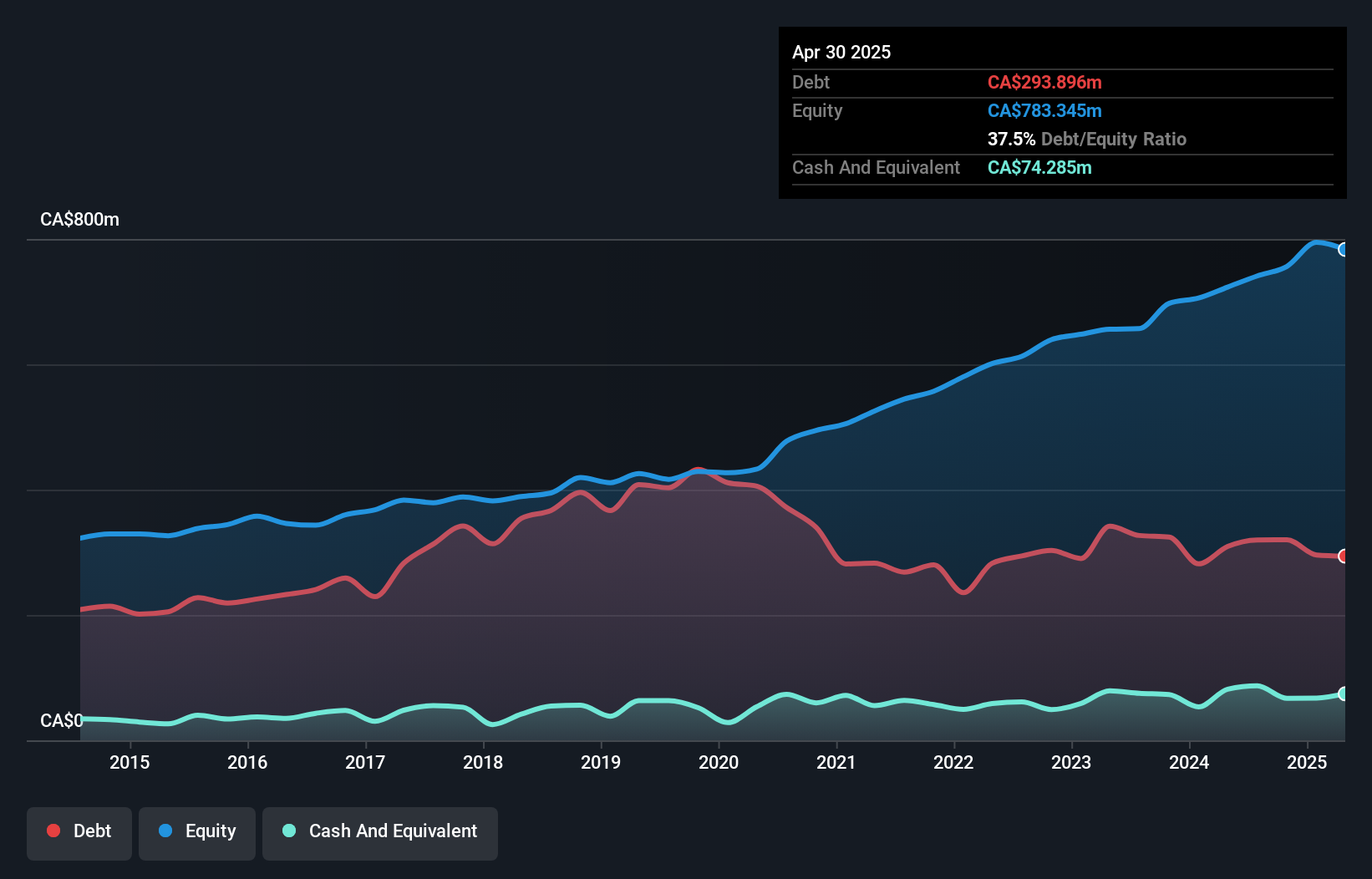

North West, a Canadian retail company, has shown robust performance with earnings growth of 9.5% over the past year, outpacing the consumer retailing industry's -11.7%. The company trades at 53.1% below its estimated fair value and maintains a satisfactory net debt to equity ratio of 31.4%, reduced from 96.7% five years ago. While significant insider selling was noted recently, North West's interest payments are well covered by EBIT at 10.9x coverage, indicating strong financial health despite these sales activities. Recent quarterly sales reached CAD 646 million with a net income of CAD 35 million, reflecting steady operational outcomes amidst market fluctuations.

- Click to explore a detailed breakdown of our findings in North West's health report.

Assess North West's past performance with our detailed historical performance reports.

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★★

Overview: VersaBank provides various banking products and services in Canada and the United States with a market capitalization of CA$551.78 million.

Operations: VersaBank generates revenue primarily from its Digital Banking segment, contributing CA$105.16 million, and its DRTC division, which adds CA$10.75 million.

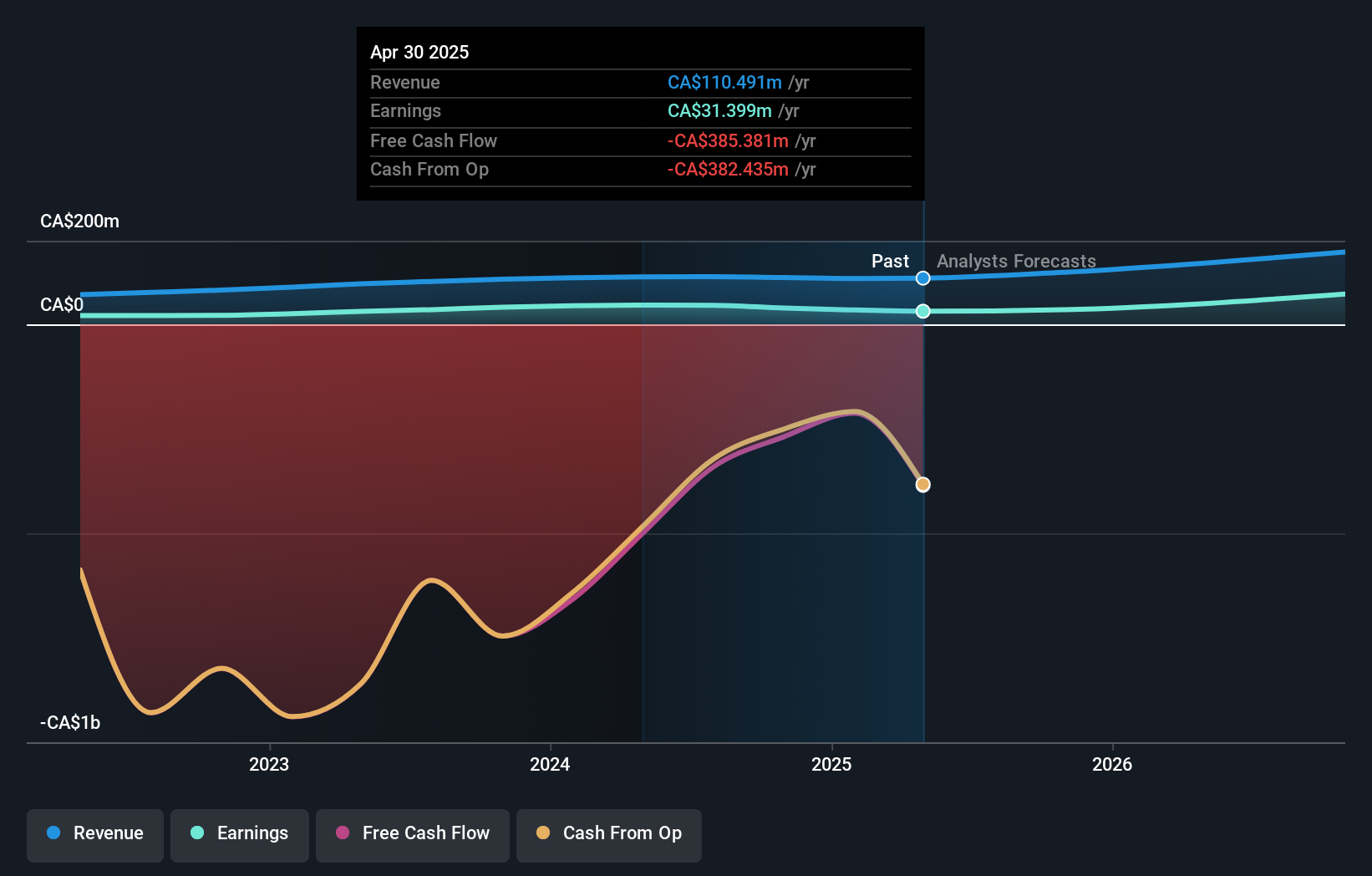

VersaBank, a Canadian financial institution with total assets of CA$4.5 billion and equity of CA$409 million, is making waves with its strong performance metrics. The bank's earnings growth over the past year hit 30.2%, outpacing the industry average of 11.2%. With customer deposits comprising 93% of its liabilities, it enjoys a stable funding base and has an appropriate bad loans level at 0%. Despite recent insider selling, VersaBank maintains high-quality earnings and offers a price-to-earnings ratio (12.1x) below the Canadian market average (14.9x), suggesting good value potential for investors exploring smaller opportunities in Canada’s banking sector.

- Take a closer look at VersaBank's potential here in our health report.

Gain insights into VersaBank's historical performance by reviewing our past performance report.

Summing It All Up

- Reveal the 48 hidden gems among our TSX Undiscovered Gems With Strong Fundamentals screener with a single click here.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:FRU

Freehold Royalties

Engages in the acquiring and managing royalty interests in the crude oil, natural gas, natural gas liquids, and potash properties in Western Canada and the United States.

Adequate balance sheet and fair value.

Market Insights

Community Narratives