- Canada

- /

- Commercial Services

- /

- TSX:CGY

Undervalued Canadian Small Caps With Insider Action In October 2024

Reviewed by Simply Wall St

The Canadian market has experienced a significant upswing, rising 23% over the last 12 months, with earnings projected to grow by 15% annually. In this environment, identifying stocks that are potentially undervalued and have insider activity can be an intriguing strategy for investors seeking opportunities amid broader market growth.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| First National Financial | 10.4x | 3.3x | 49.98% | ★★★★★☆ |

| Trican Well Service | 7.3x | 0.9x | 18.26% | ★★★★★☆ |

| Spartan Delta | 4.6x | 2.3x | 34.60% | ★★★★★☆ |

| AutoCanada | NA | 0.1x | 40.70% | ★★★★★☆ |

| Nexus Industrial REIT | 3.7x | 3.6x | 18.08% | ★★★★☆☆ |

| Rogers Sugar | 15.7x | 0.6x | 47.26% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 12.7x | 3.4x | 45.18% | ★★★★☆☆ |

| Sagicor Financial | 1.3x | 0.3x | -43.73% | ★★★★☆☆ |

| Calfrac Well Services | 2.5x | 0.2x | 17.65% | ★★★★☆☆ |

| Vermilion Energy | NA | 1.2x | -10.38% | ★★★☆☆☆ |

Let's take a closer look at a couple of our picks from the screened companies.

Badger Infrastructure Solutions (TSX:BDGI)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Badger Infrastructure Solutions specializes in providing non-destructive excavating services, with a market cap of approximately C$1.01 billion.

Operations: The company generates revenue primarily from non-destructive excavating services, with a recent gross profit margin of 28.29%. Operating expenses have been consistently significant, impacting net income margins, which were reported at 5.81% in the latest period.

PE: 24.3x

Badger Infrastructure Solutions, a Canadian small cap, shows potential despite high debt levels and reliance on external borrowing. The company reported second-quarter sales of US$186.84 million, up from last year's US$171.89 million, with net income rising to US$11.91 million from US$11.01 million. Insider confidence is evident with recent share purchases by board members in July 2024. Although earnings are forecasted to grow annually by 36%, the company's financial position remains a key consideration for investors seeking undervalued opportunities in Canada’s market.

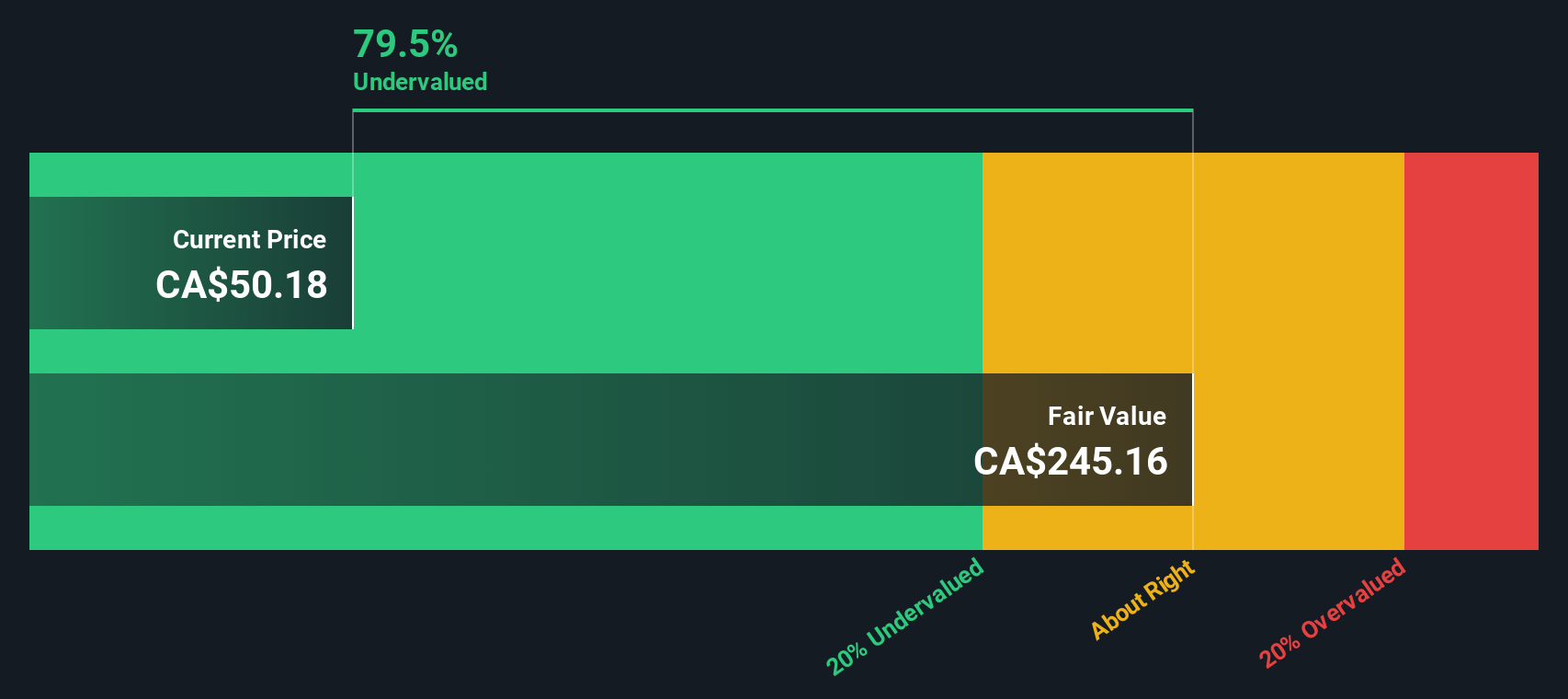

Calian Group (TSX:CGY)

Simply Wall St Value Rating: ★★★☆☆☆

Overview: Calian Group is a diversified company operating in IT and Cyber Solutions, Health, Learning, and Advanced Technologies sectors with a market capitalization of CA$0.97 billion.

Operations: The company generates revenue from four main segments: ITCS, Health, Learning, and Advanced Technologies. Over recent periods, the gross profit margin has shown an upward trend, reaching 33.17% as of June 2024. Operating expenses have been significant with a notable portion allocated to general and administrative costs.

PE: 35.6x

Calian Group, a Canadian company in the tech and health sectors, is capturing attention with its strategic alliances and insider confidence. Recent collaborations with Walmart Canada and Microsoft highlight its focus on expanding digital health and cybersecurity services. The company's share repurchase program aims to buy back up to 995,904 shares by August 2025, signaling potential value recognition. Despite recent earnings dips—net income fell from C$4.67 million to C$1.3 million—future revenue is projected between C$750 million and C$810 million for the year ending September 2024, suggesting growth opportunities in diverse markets like healthcare and defense.

- Take a closer look at Calian Group's potential here in our valuation report.

Assess Calian Group's past performance with our detailed historical performance reports.

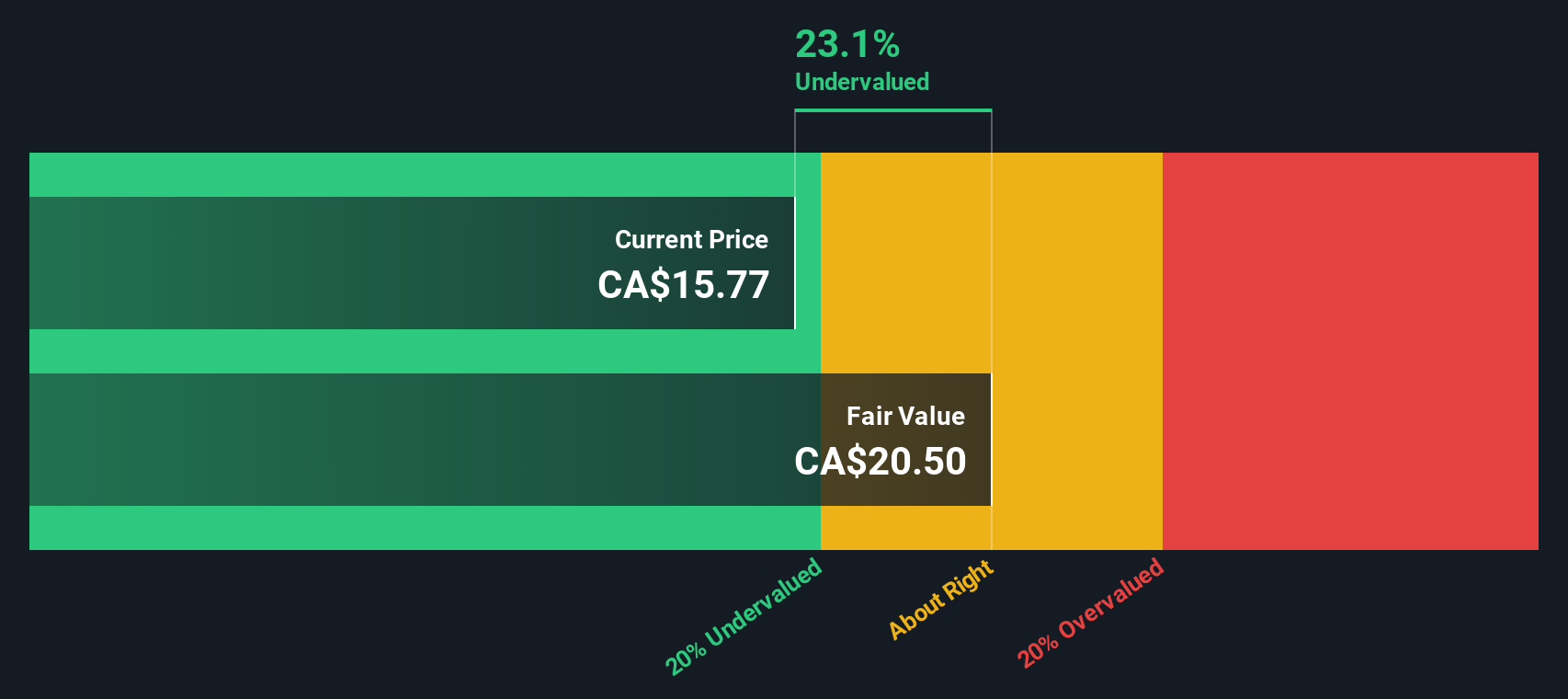

VersaBank (TSX:VBNK)

Simply Wall St Value Rating: ★★★★★☆

Overview: VersaBank operates as a digital banking institution with additional services in cybersecurity and financial technology development, holding a market cap of CA$0.34 billion.

Operations: VersaBank generates revenue primarily from digital banking services, contributing CA$105.16 million, and DRTC's cybersecurity and financial technology services, adding CA$10.75 million. The company consistently achieves a gross profit margin of 100%, with operating expenses being a significant cost component. Recent net income margins show an upward trend, reaching 40.54% by April 2024.

PE: 11.7x

VersaBank, a Canadian financial institution, demonstrates insider confidence with recent share purchases. Despite a slight dip in Q3 net income to C$9.71 million from C$10 million last year, their earnings per share remained stable at C$0.36. The bank's strategic expansion into the U.S., marked by key executive appointments for its new subsidiary, suggests growth potential. With earnings projected to grow 30% annually, VersaBank is positioned as an intriguing prospect among Canadian small caps.

- Delve into the full analysis valuation report here for a deeper understanding of VersaBank.

Examine VersaBank's past performance report to understand how it has performed in the past.

Where To Now?

- Click here to access our complete index of 21 Undervalued TSX Small Caps With Insider Buying.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:CGY

Calian Group

Provides business products and solutions in Canada and internationally.

Excellent balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives