TSX's April 2025 High Growth Companies With Strong Insider Ownership

Reviewed by Simply Wall St

As the Canadian market navigates a period of cautious optimism, with the TSX only 4% off its record high thanks to strong performances in sectors like materials, investors are keenly observing developments that could influence future growth. In such an environment, companies with high insider ownership often stand out, as this can signal confidence in their long-term potential and alignment with shareholder interests.

Top 10 Growth Companies With High Insider Ownership In Canada

| Name | Insider Ownership | Earnings Growth |

| Propel Holdings (TSX:PRL) | 36.5% | 35.7% |

| Robex Resources (TSXV:RBX) | 25.6% | 147.4% |

| Allied Gold (TSX:AAUC) | 17% | 63.2% |

| Almonty Industries (TSX:AII) | 16.6% | 49.8% |

| Aritzia (TSX:ATZ) | 17.5% | 39.1% |

| Intermap Technologies (TSX:IMP) | 14.5% | 78.8% |

| Enterprise Group (TSX:E) | 32.2% | 41.9% |

| Burcon NutraScience (TSX:BU) | 16.4% | 152.2% |

| SolarBank (NEOE:SUNN) | 17.6% | 178.3% |

| Ivanhoe Mines (TSX:IVN) | 12.5% | 43.1% |

Let's take a closer look at a couple of our picks from the screened companies.

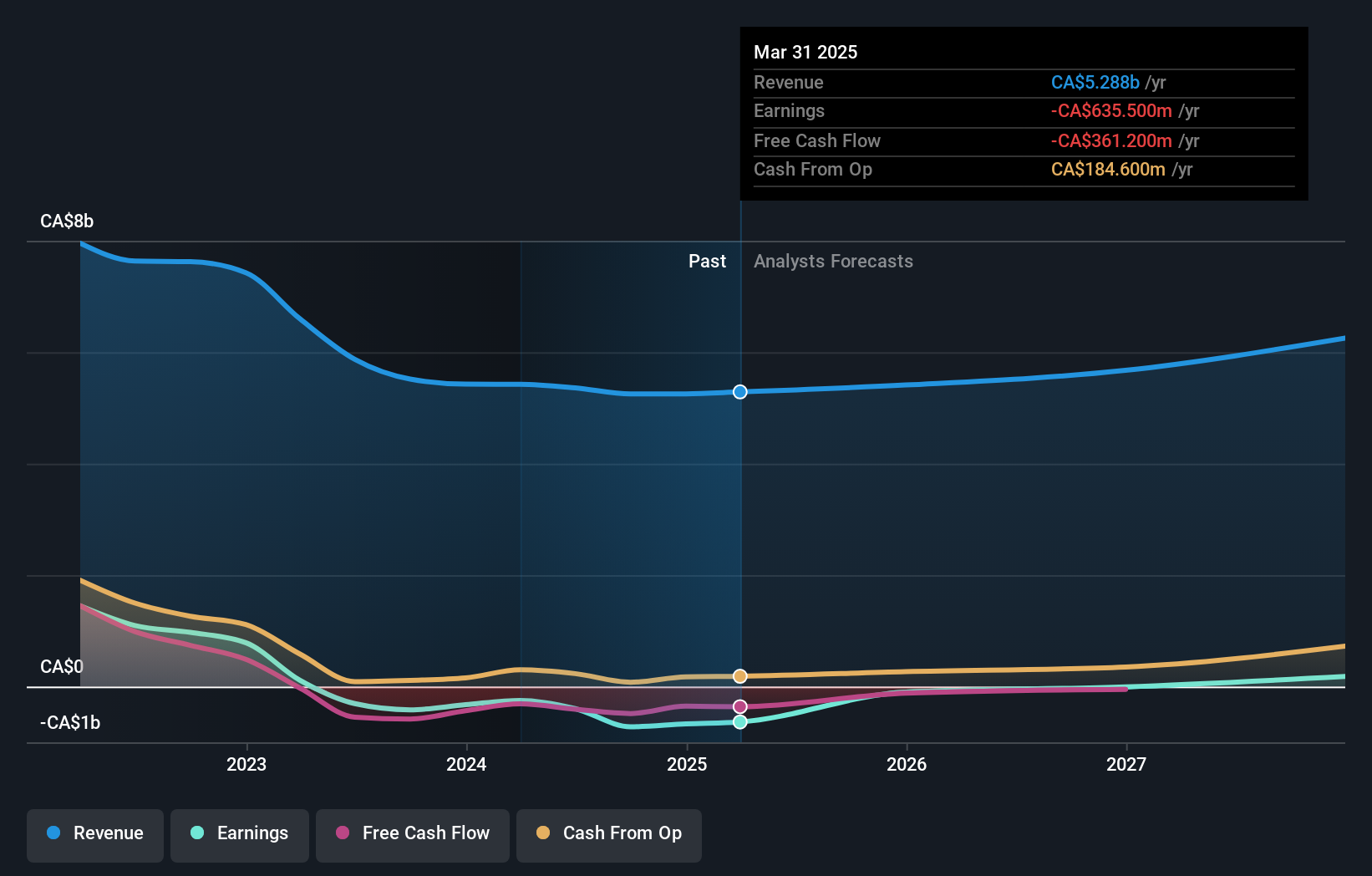

Canfor (TSX:CFP)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Canfor Corporation is an integrated forest products company operating in the United States, Asia, Canada, Europe, and internationally with a market cap of CA$1.57 billion.

Operations: The company's revenue is primarily derived from its Lumber segment at CA$4.58 billion and Pulp & Paper segment at CA$798.60 million.

Insider Ownership: 22.5%

Canfor Corporation exhibits strong insider ownership with substantial recent insider buying and no significant selling, indicating confidence in future prospects. Despite a current net loss, Canfor is expected to become profitable over the next three years with earnings forecasted to grow significantly at 74.21% annually. The company trades at good value compared to peers, and its revenue growth of 6% per year outpaces the Canadian market average. Additionally, a share repurchase program may enhance shareholder value.

- Delve into the full analysis future growth report here for a deeper understanding of Canfor.

- According our valuation report, there's an indication that Canfor's share price might be on the cheaper side.

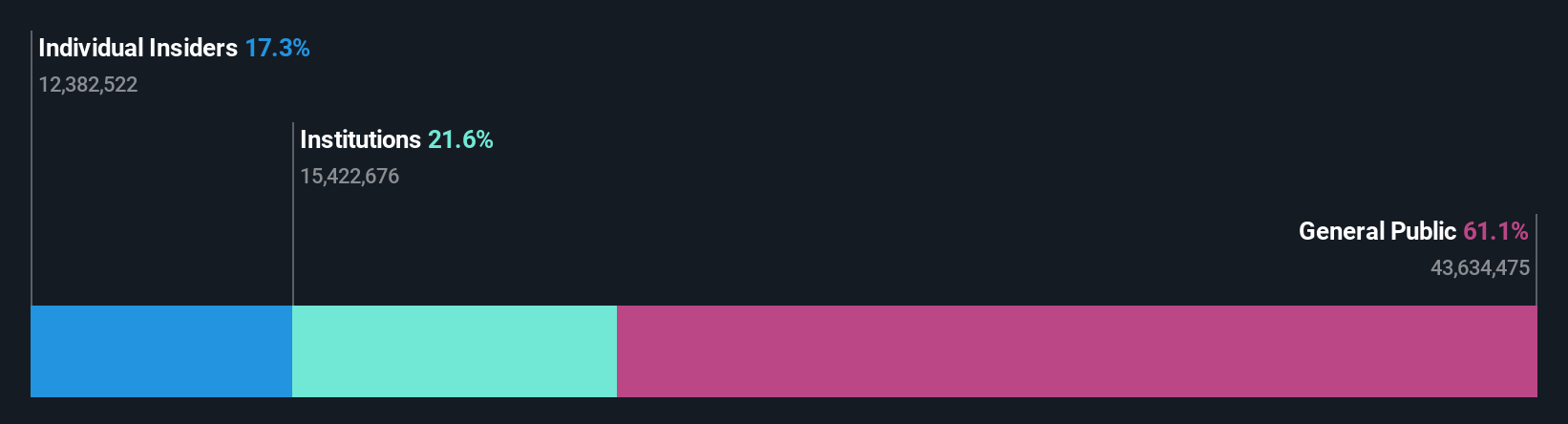

Savaria (TSX:SIS)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Savaria Corporation offers accessibility solutions for the elderly and physically challenged individuals across Canada, the United States, Europe, and internationally, with a market cap of CA$1.23 billion.

Operations: The company's revenue segments consist of CA$193.88 million from Patient Care and CA$673.88 million from Accessibility, which includes Adapted Vehicles.

Insider Ownership: 17.3%

Savaria demonstrates strong insider confidence with substantial recent buying and no significant selling. Its earnings are forecasted to grow significantly at 22.4% annually, outpacing the Canadian market's growth expectations. Despite slower revenue growth of 5.5% per year, Savaria trades at a considerable discount to its estimated fair value, suggesting potential upside according to analysts' price targets. Recent earnings reports show improved profitability with net income rising from C$37.84 million to C$48.51 million year-over-year.

- Click to explore a detailed breakdown of our findings in Savaria's earnings growth report.

- The valuation report we've compiled suggests that Savaria's current price could be quite moderate.

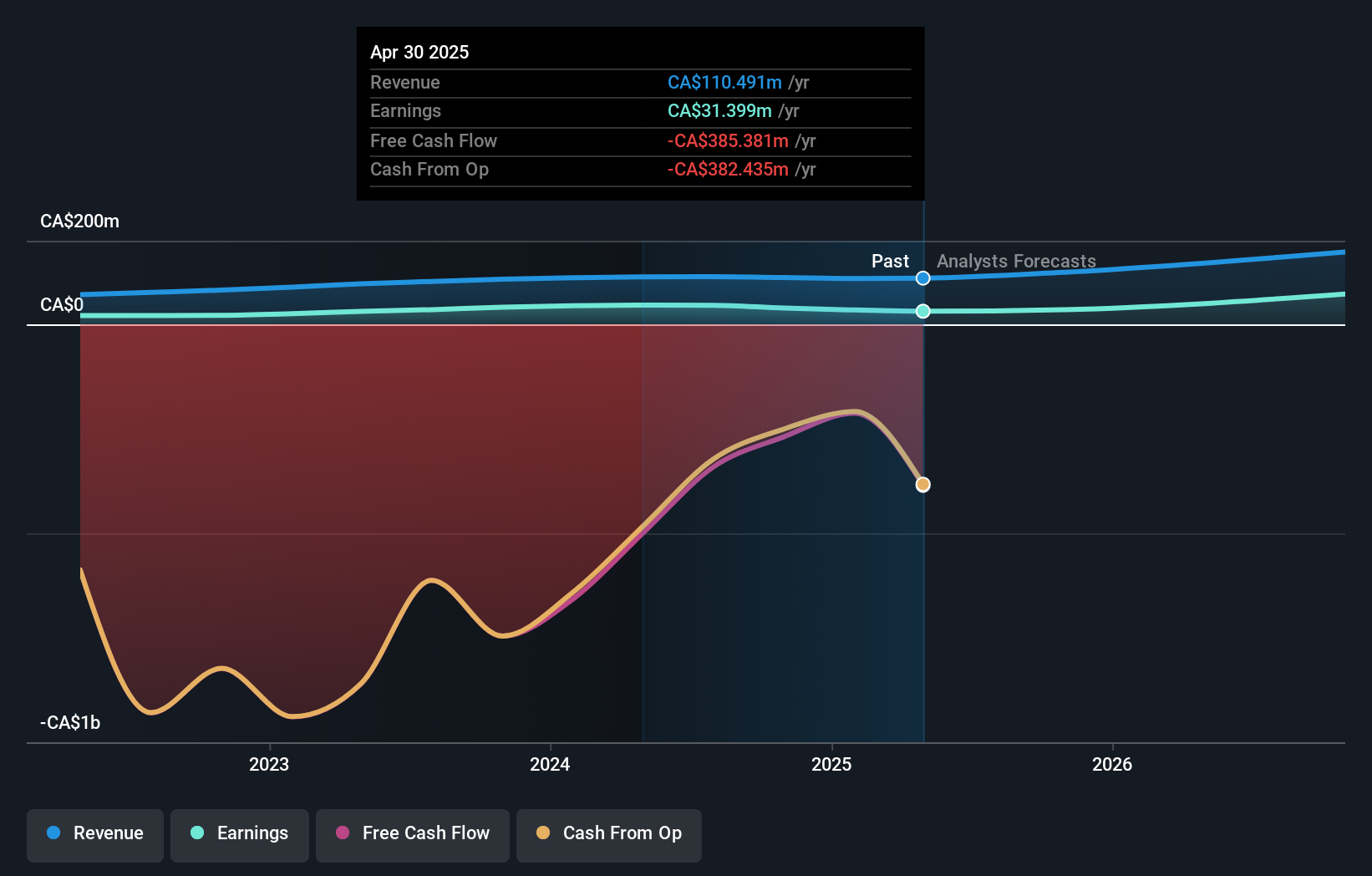

VersaBank (TSX:VBNK)

Simply Wall St Growth Rating: ★★★★★☆

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$494.94 million.

Operations: VersaBank generates revenue primarily from its Digital Banking Canada segment, which accounts for CA$98.06 million, and its DRTC segment, encompassing cybersecurity services and financial technology development, contributing CA$9.71 million.

Insider Ownership: 10.4%

VersaBank's growth prospects are underscored by a forecasted 32.5% annual revenue increase, significantly outpacing the Canadian market. Earnings are expected to grow at an impressive 53.51% annually, with substantial insider buying recently indicating strong internal confidence. Despite past shareholder dilution, VersaBank trades at over 50% below its estimated fair value. The recent announcement of a share buyback program further reflects management's commitment to enhancing shareholder value amidst declining quarterly earnings and net income figures.

- Click here and access our complete growth analysis report to understand the dynamics of VersaBank.

- Our valuation report here indicates VersaBank may be undervalued.

Taking Advantage

- Reveal the 36 hidden gems among our Fast Growing TSX Companies With High Insider Ownership screener with a single click here.

- Ready For A Different Approach? Outshine the giants: these 26 early-stage AI stocks could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SIS

Savaria

Provides accessibility solutions for the elderly and physically challenged people in Canada, the United States, Europe, and internationally.

Established dividend payer and good value.

Market Insights

Community Narratives