TSX Stocks Estimated To Be Trading At A Discount In May 2025

Reviewed by Simply Wall St

With Canada's recent election removing a source of uncertainty, the focus has shifted to addressing key economic issues such as trade and fiscal policy. As the Canadian market navigates these evolving conditions, investors may find opportunities in stocks that are trading at a discount, offering potential value amidst current challenges and uncertainties.

Top 10 Undervalued Stocks Based On Cash Flows In Canada

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Badger Infrastructure Solutions (TSX:BDGI) | CA$40.39 | CA$76.05 | 46.9% |

| Docebo (TSX:DCBO) | CA$43.88 | CA$79.08 | 44.5% |

| Savaria (TSX:SIS) | CA$17.98 | CA$30.20 | 40.5% |

| Enterprise Group (TSX:E) | CA$1.61 | CA$2.82 | 42.9% |

| VersaBank (TSX:VBNK) | CA$15.46 | CA$30.63 | 49.5% |

| Lithium Royalty (TSX:LIRC) | CA$5.39 | CA$8.37 | 35.6% |

| A & W Food Services of Canada (TSX:AW) | CA$32.51 | CA$61.23 | 46.9% |

| AtkinsRéalis Group (TSX:ATRL) | CA$70.58 | CA$112.73 | 37.4% |

| Obsidian Energy (TSX:OBE) | CA$5.44 | CA$8.59 | 36.7% |

| CAE (TSX:CAE) | CA$35.10 | CA$57.26 | 38.7% |

Let's explore several standout options from the results in the screener.

Cineplex (TSX:CGX)

Overview: Cineplex Inc., along with its subsidiaries, operates as an entertainment and media company in Canada and internationally, with a market cap of CA$656.47 million.

Operations: The company's revenue segments include Media at CA$133.80 million, Location-Based Entertainment at CA$128.62 million, and Film Entertainment and Content at CA$1.07 billion.

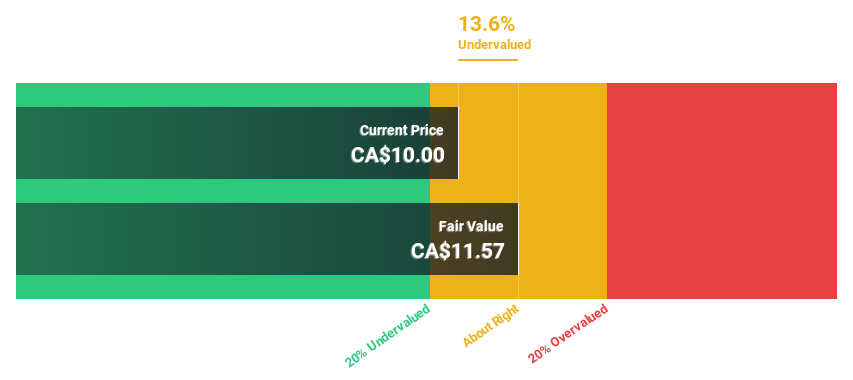

Estimated Discount To Fair Value: 10.8%

Cineplex is trading at CA$9.85, below its estimated fair value of CA$11.04, making it an undervalued stock based on cash flows. Despite recent challenges, including a net loss of CA$37.68 million in 2024 and declining box office revenues in early 2025, Cineplex's revenue is forecast to grow faster than the Canadian market at 5.8% annually. Analysts expect profitability within three years, with earnings projected to grow significantly each year.

- The growth report we've compiled suggests that Cineplex's future prospects could be on the up.

- Get an in-depth perspective on Cineplex's balance sheet by reading our health report here.

Obsidian Energy (TSX:OBE)

Overview: Obsidian Energy Ltd. is involved in the exploration, development, and production of oil and natural gas properties in Western Canada, with a market cap of CA$424.42 million.

Operations: The company's revenue from its oil and gas exploration and production segment is CA$731.20 million.

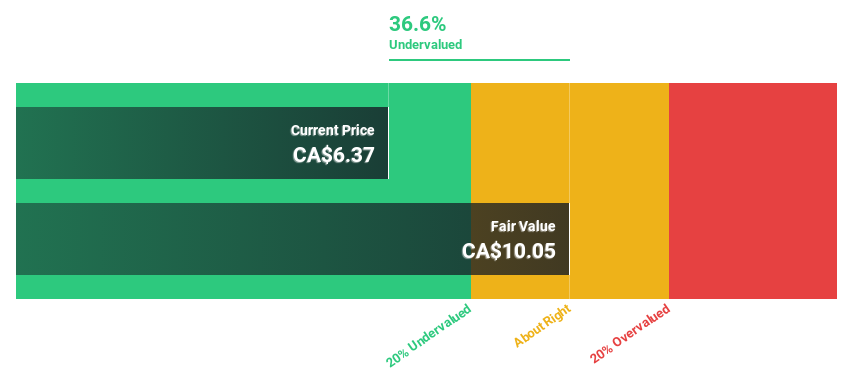

Estimated Discount To Fair Value: 36.7%

Obsidian Energy, trading at CA$5.44, is undervalued based on cash flows with an estimated fair value of CA$8.59. The company is expected to become profitable in three years, with earnings growth forecasted at a very large rate annually. Recent debt financing reduced its credit facility usage to CA$30 million, and the share repurchase program aims to buy back 9.7% of outstanding shares by March 2026, enhancing shareholder value amidst robust revenue growth projections surpassing the Canadian market average.

- According our earnings growth report, there's an indication that Obsidian Energy might be ready to expand.

- Click here and access our complete balance sheet health report to understand the dynamics of Obsidian Energy.

VersaBank (TSX:VBNK)

Overview: VersaBank offers a range of banking products and services in Canada and the United States, with a market cap of CA$510.54 million.

Operations: VersaBank's revenue is primarily derived from Digital Banking Canada, which contributes CA$98.06 million, and DRTC, encompassing cybersecurity services and financial technology development, which adds CA$9.71 million.

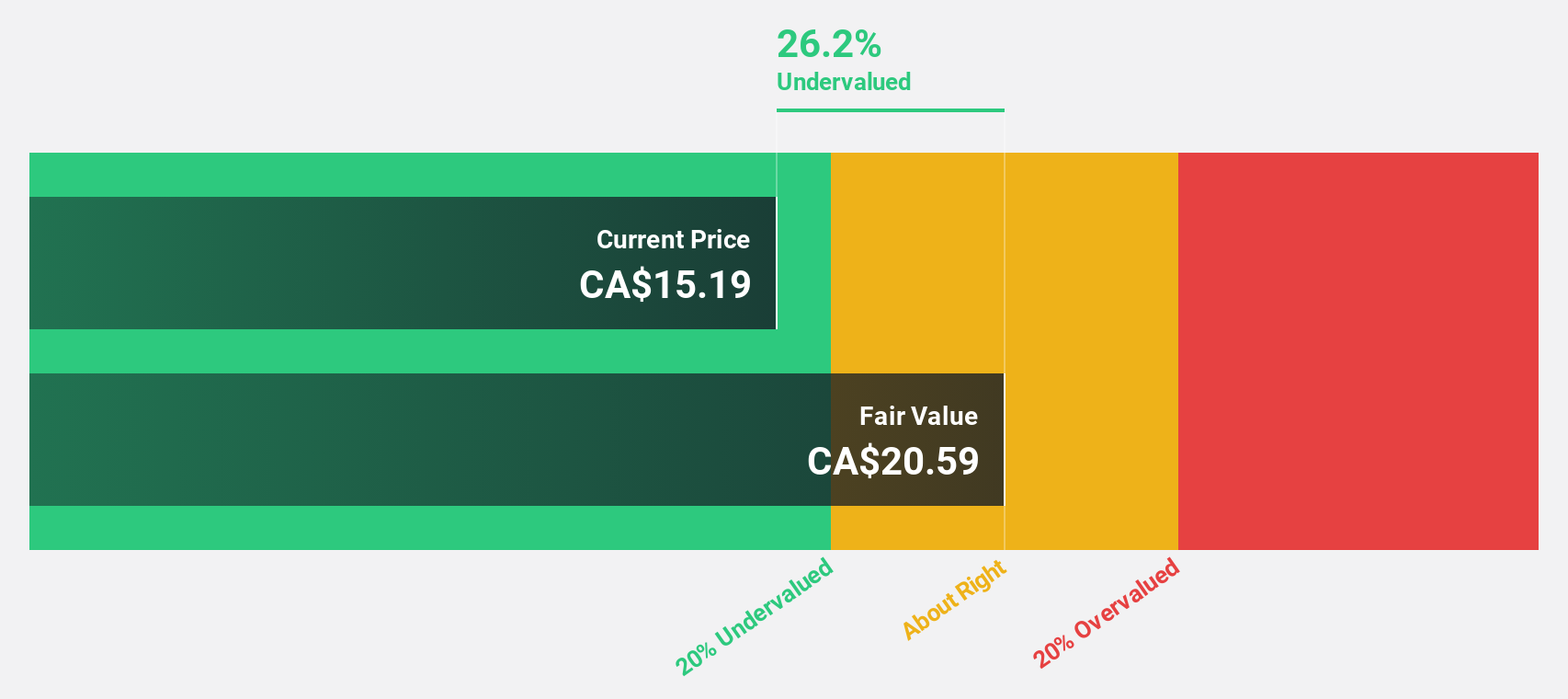

Estimated Discount To Fair Value: 49.5%

VersaBank, trading at CA$15.46, is highly undervalued with an estimated fair value of CA$30.63. Its earnings and revenue are forecast to grow significantly faster than the Canadian market, at 53.5% and 32.5% per year respectively. Despite recent earnings declines, a share repurchase program aims to buy back up to 6.15% of shares by April 2026, potentially enhancing shareholder value amid strong growth projections in profit and revenue streams.

- The analysis detailed in our VersaBank growth report hints at robust future financial performance.

- Navigate through the intricacies of VersaBank with our comprehensive financial health report here.

Next Steps

- Get an in-depth perspective on all 20 Undervalued TSX Stocks Based On Cash Flows by using our screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:VBNK

VersaBank

Provides various banking products and services in Canada and the United States.

Flawless balance sheet with high growth potential.

Market Insights

Community Narratives