Should Toronto-Dominion Bank’s US$3 Billion Debt Issuance and Underwriter Shift Matter to TSX:TD Investors?

Reviewed by Sasha Jovanovic

- Earlier this month, Toronto-Dominion Bank completed several large fixed-income offerings totalling over US$3 billion across fixed and floating rate senior unsecured notes, alongside changes in its syndicate of co-lead underwriters.

- The scale and diversity of these debt issuances reflect the bank’s active approach to capital raising and the significance of its global relationships with leading underwriting institutions.

- We’ll assess how Toronto-Dominion Bank’s multi-billion dollar bond sales and underwriter changes may affect its medium-term investment narrative.

Outshine the giants: these 25 early-stage AI stocks could fund your retirement.

Toronto-Dominion Bank Investment Narrative Recap

To be a shareholder in Toronto-Dominion Bank, you need to believe in the bank's ability to grow fee-based revenue across its Canadian and U.S. segments, maintain resilient profit margins, and manage costs while leveraging its capital strength. The recent US$3 billion in fixed-income offerings and underwriter changes reinforce TD's capital flexibility, but in terms of near-term impact, these moves are not material to the key risk of persistent compliance costs or the main short-term catalyst of margin recovery through digital and AI initiatives.

Among recent announcements, TD's declared quarterly dividend of $1.05 per common share highlights the bank's ongoing commitment to shareholder returns and its solid capital position, which is relevant when viewing the latest bond sales. Consistent dividends can provide support for the investment thesis, even as structural expenses linked to compliance and regulation remain an important factor for profitability and margin expansion. But on the risk side, investors should remember that...

Read the full narrative on Toronto-Dominion Bank (it's free!)

Toronto-Dominion Bank's outlook anticipates revenue of CA$62.5 billion and earnings of CA$14.2 billion by 2028. This scenario is based on a yearly revenue decline of 0.5% and a CA$6.1 billion decrease in earnings from the current CA$20.3 billion.

Uncover how Toronto-Dominion Bank's forecasts yield a CA$109.29 fair value, in line with its current price.

Exploring Other Perspectives

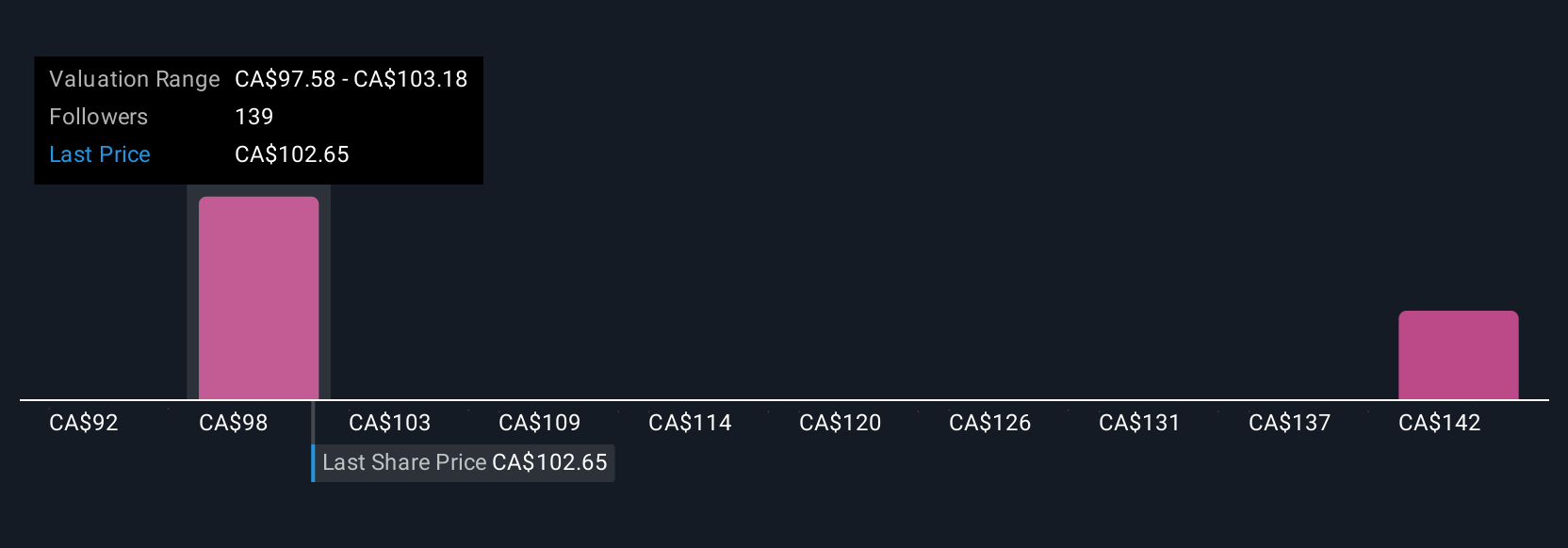

Ten recent fair value estimates from the Simply Wall St Community put TD’s worth anywhere from CA$91.97 to CA$152.25 per share. Despite this spread, many readers are weighing the potential for compliance costs to pressure earnings in the years ahead, keep in mind, your own outlook can meaningfully differ.

Explore 10 other fair value estimates on Toronto-Dominion Bank - why the stock might be worth 18% less than the current price!

Build Your Own Toronto-Dominion Bank Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your Toronto-Dominion Bank research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

- Our free Toronto-Dominion Bank research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate Toronto-Dominion Bank's overall financial health at a glance.

Looking For Alternative Opportunities?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

- The latest GPUs need a type of rare earth metal called Neodymium and there are only 38 companies in the world exploring or producing it. Find the list for free.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Toronto-Dominion Bank might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:TD

Toronto-Dominion Bank

Provides various financial products and services in Canada, the United States, and internationally.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Community Narratives