Over the last 7 days, the Canadian market has dropped 2.3%, driven by a pullback of 2.9% in the Financials sector, although it is up 9.5% over the past year with earnings forecast to grow by 15% annually. In this context, finding strong dividend stocks can provide stability and income potential amidst market fluctuations.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Bank of Nova Scotia (TSX:BNS) | 6.70% | ★★★★★★ |

| Whitecap Resources (TSX:WCP) | 7.38% | ★★★★★★ |

| Secure Energy Services (TSX:SES) | 3.38% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.94% | ★★★★★☆ |

| Enghouse Systems (TSX:ENGH) | 3.45% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.35% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.54% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.81% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.85% | ★★★★★☆ |

| Canadian Western Bank (TSX:CWB) | 3.01% | ★★★★★☆ |

Click here to see the full list of 34 stocks from our Top TSX Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

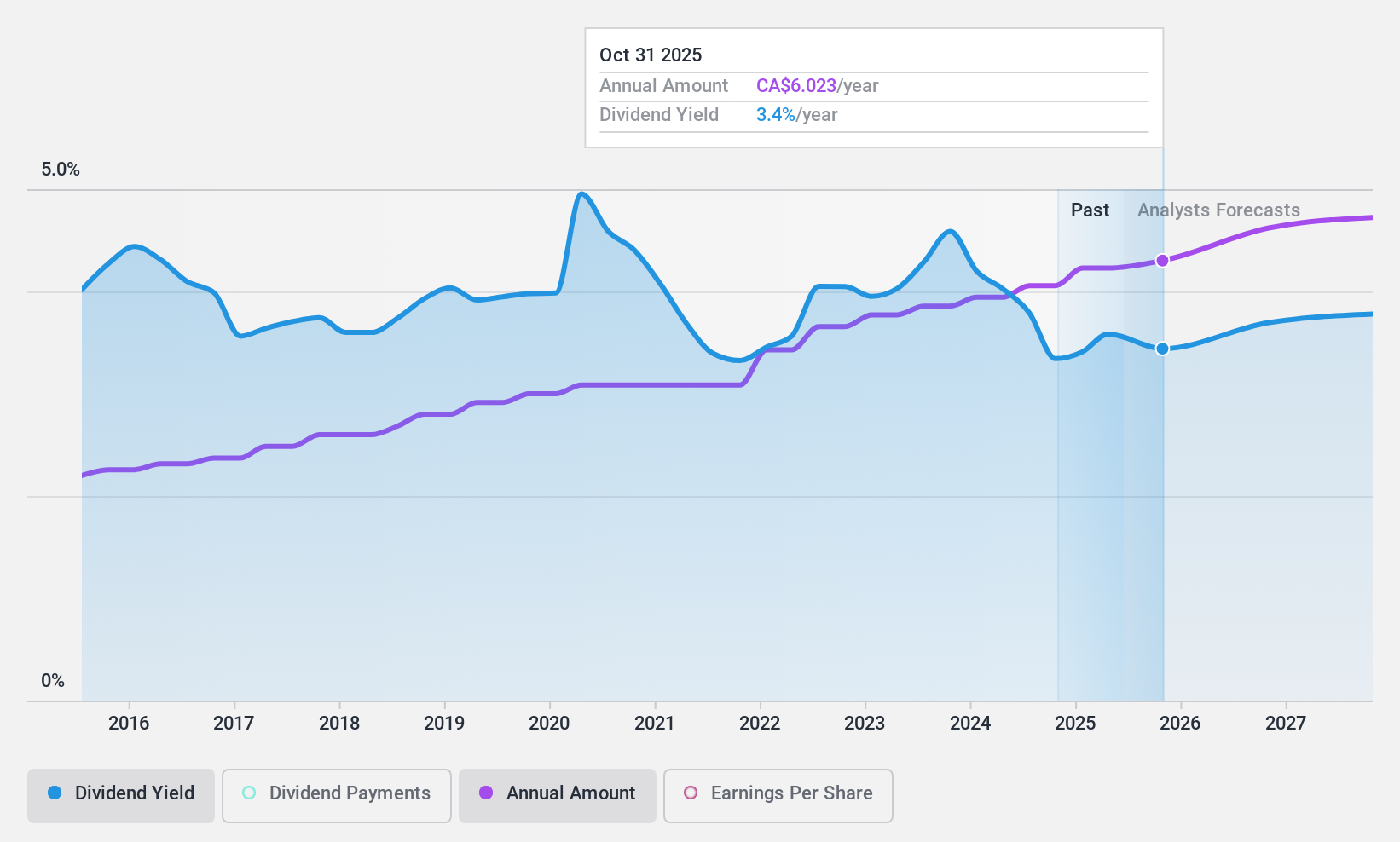

National Bank of Canada (TSX:NA)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: National Bank of Canada offers financial services to individuals, businesses, institutional clients, and governments both domestically and internationally, with a market cap of CA$38.42 billion.

Operations: The company's revenue segments include Wealth Management (CA$2.61 billion), Personal and Commercial (CA$4.33 billion), Financial Markets excluding USSF&I (CA$2.76 billion), and U.S. Specialty Finance and International (USSF&I) (CA$1.16 billion).

Dividend Yield: 3.9%

National Bank of Canada has demonstrated consistent dividend growth over the past decade, with current payments well covered by earnings (42.5% payout ratio). Despite a lower yield (3.9%) compared to top Canadian dividend payers, its dividends are reliable and stable. Recent financial moves include a CAD 500 million equity offering and $1.1 billion in fixed-income offerings, enhancing liquidity and stability. The appointment of Scott Burrows to the Board may bolster financial oversight given his extensive experience in capital markets.

- Click here and access our complete dividend analysis report to understand the dynamics of National Bank of Canada.

- Our expertly prepared valuation report National Bank of Canada implies its share price may be lower than expected.

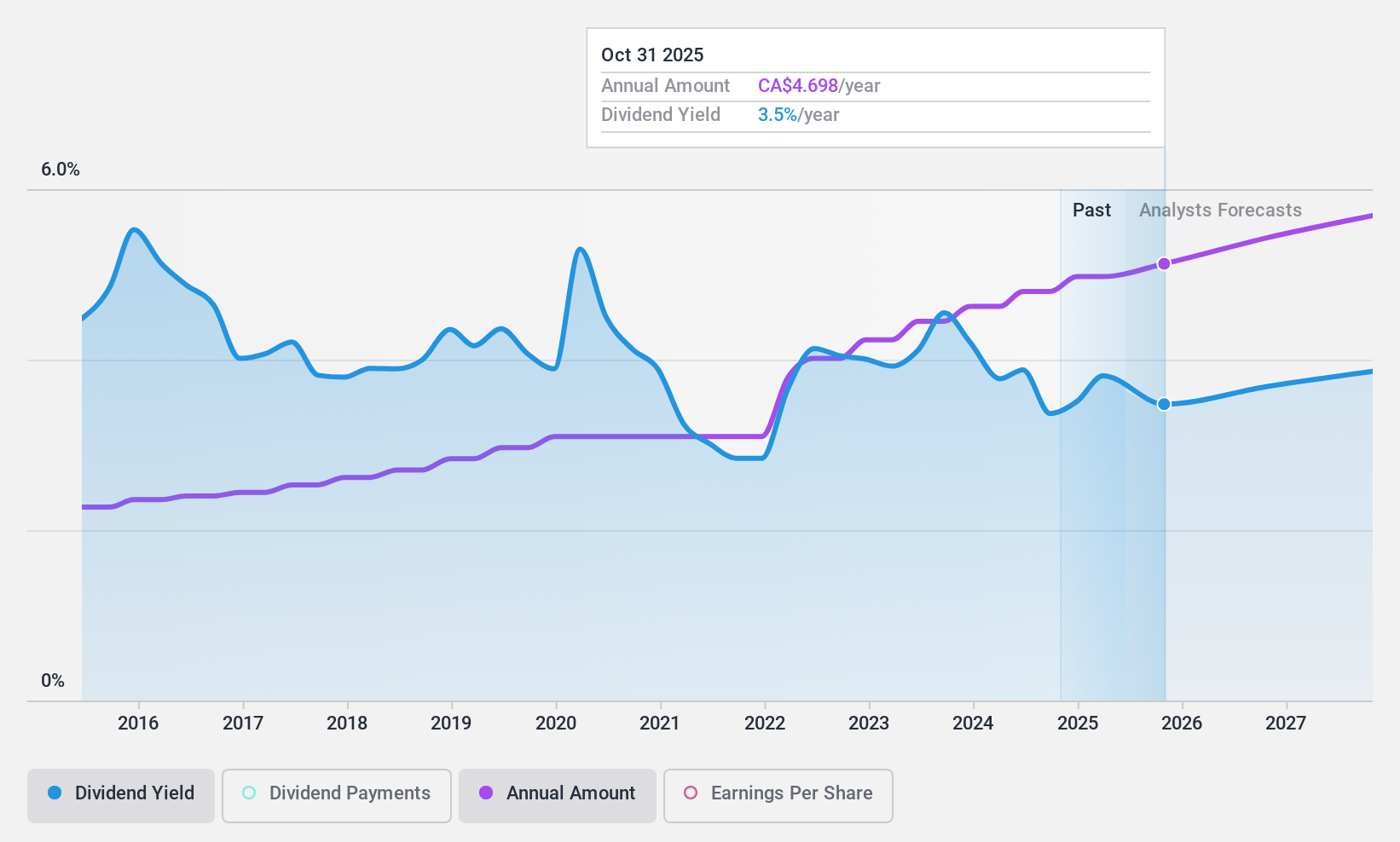

Royal Bank of Canada (TSX:RY)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Royal Bank of Canada operates as a diversified financial service company worldwide with a market cap of CA$210.63 billion.

Operations: Royal Bank of Canada's revenue segments include Personal & Commercial Banking (CA$20.92 billion), Wealth Management (CA$17.47 billion), Capital Markets (CA$10.70 billion), and Insurance (CA$5.91 billion).

Dividend Yield: 3.8%

Royal Bank of Canada offers a stable dividend with a current yield of 3.81%, supported by a low payout ratio of 50%. Dividends have been reliable and growing over the past decade, with future payouts forecasted to remain well-covered by earnings. Recent financial activities include numerous fixed-income offerings and a $1.25 billion NVCC subordinated debenture issuance, aimed at bolstering liquidity and capital structure.

- Click here to discover the nuances of Royal Bank of Canada with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Royal Bank of Canada is priced higher than what may be justified by its financials.

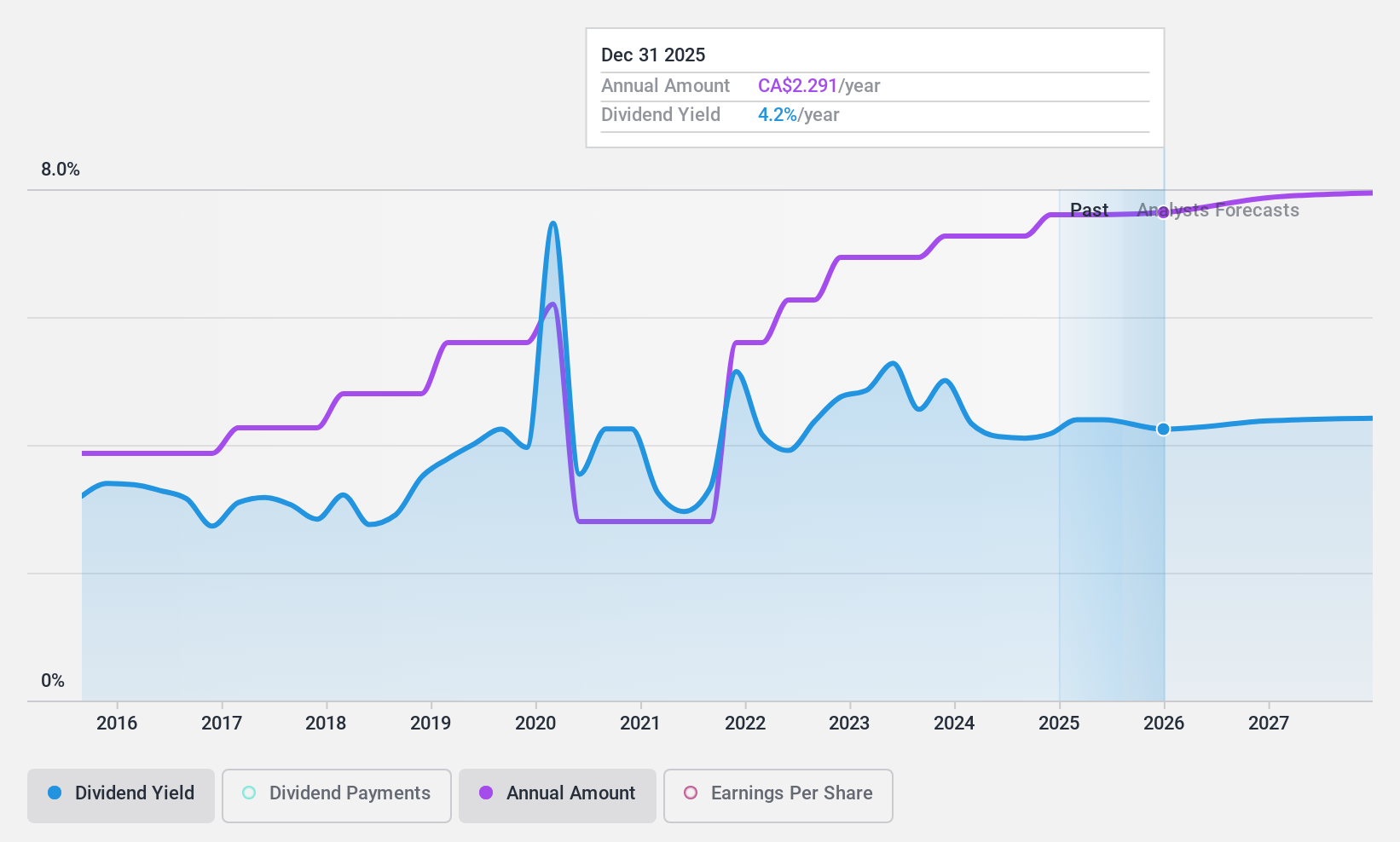

Suncor Energy (TSX:SU)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Suncor Energy Inc., with a market cap of CA$64.98 billion, operates as an integrated energy company in Canada, the United States, and internationally.

Operations: Suncor Energy Inc.'s revenue segments include CA$23.76 billion from Oil Sands, CA$31.51 billion from Refining and Marketing, and CA$2.17 billion from Exploration and Production.

Dividend Yield: 4.3%

Suncor Energy's dividend payments have grown over the past decade but have been volatile, with an annual drop of over 20% at times. Despite this, the dividends are well-covered by earnings (payout ratio: 35.2%) and cash flows (cash payout ratio: 34.9%). The company recently declared a quarterly dividend of C$0.545 per share and completed significant share buybacks totaling C$2.40 billion in early 2024, reflecting strong capital management efforts.

- Delve into the full analysis dividend report here for a deeper understanding of Suncor Energy.

- Insights from our recent valuation report point to the potential undervaluation of Suncor Energy shares in the market.

Summing It All Up

- Access the full spectrum of 34 Top TSX Dividend Stocks by clicking on this link.

- Got skin in the game with these stocks? Elevate how you manage them by using Simply Wall St's portfolio, where intuitive tools await to help optimize your investment outcomes.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Flawless balance sheet established dividend payer.