- Canada

- /

- Capital Markets

- /

- TSX:GCG.A

Guardian Capital Group And 2 Other Undervalued Small Caps In Canada With Insider Buying

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 2.3%, although it is up 9.5% over the past year with earnings forecast to grow by 15% annually. In this context, identifying undervalued small-cap stocks with insider buying can be a strategic move for investors looking to capitalize on potential growth opportunities in a fluctuating market.

Top 10 Undervalued Small Caps With Insider Buying In Canada

| Name | PE | PS | Discount to Fair Value | Value Rating |

|---|---|---|---|---|

| Dundee Precious Metals | 8.1x | 3.0x | 30.81% | ★★★★★★ |

| Nexus Industrial REIT | 2.6x | 3.3x | 24.76% | ★★★★★☆ |

| Russel Metals | 10.9x | 0.5x | 47.95% | ★★★★★☆ |

| Trican Well Service | 8.2x | 1.0x | 5.49% | ★★★★☆☆ |

| Guardian Capital Group | 10.5x | 4.1x | 37.94% | ★★★★☆☆ |

| Calfrac Well Services | 2.7x | 0.2x | -30.70% | ★★★★☆☆ |

| Primaris Real Estate Investment Trust | 11.1x | 3.0x | 45.60% | ★★★★☆☆ |

| Sagicor Financial | 1.1x | 0.4x | -63.32% | ★★★★☆☆ |

| Hemisphere Energy | 6.8x | 2.5x | 14.11% | ★★★☆☆☆ |

| Westshore Terminals Investment | 14.2x | 3.8x | 25.19% | ★★★☆☆☆ |

We're going to check out a few of the best picks from our screener tool.

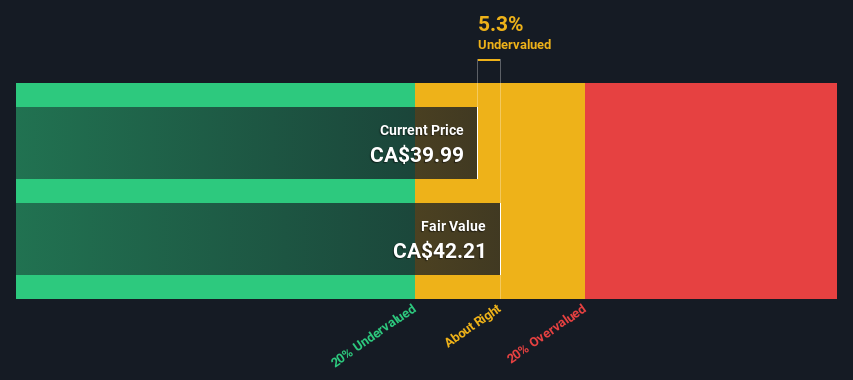

Guardian Capital Group (TSX:GCG.A)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Guardian Capital Group is a financial services company primarily engaged in investment and wealth management, with a market cap of CA$1.02 billion.

Operations: The company generates revenue primarily through its Investment Management (Including Wealth Management) and Corporate Activities and Investments segments, totaling CA$250.41 million. Over the analyzed periods, the gross profit margin has varied, reaching up to 57.75%.

PE: 10.5x

Guardian Capital Group, a small Canadian investment firm, has seen insider confidence with recent share purchases. From January to March 2024, the company repurchased 94,000 shares for C$4.15 million. Despite a decline in earnings over the past five years at an annual rate of 15.7%, Q1 2024 revenue rose to C$62.5 million from C$54.49 million year-on-year. However, net income plummeted to C$21.17 million from last year's C$487.6 million due to higher risk funding sources and external borrowing reliance.

- Click to explore a detailed breakdown of our findings in Guardian Capital Group's valuation report.

Gain insights into Guardian Capital Group's past trends and performance with our Past report.

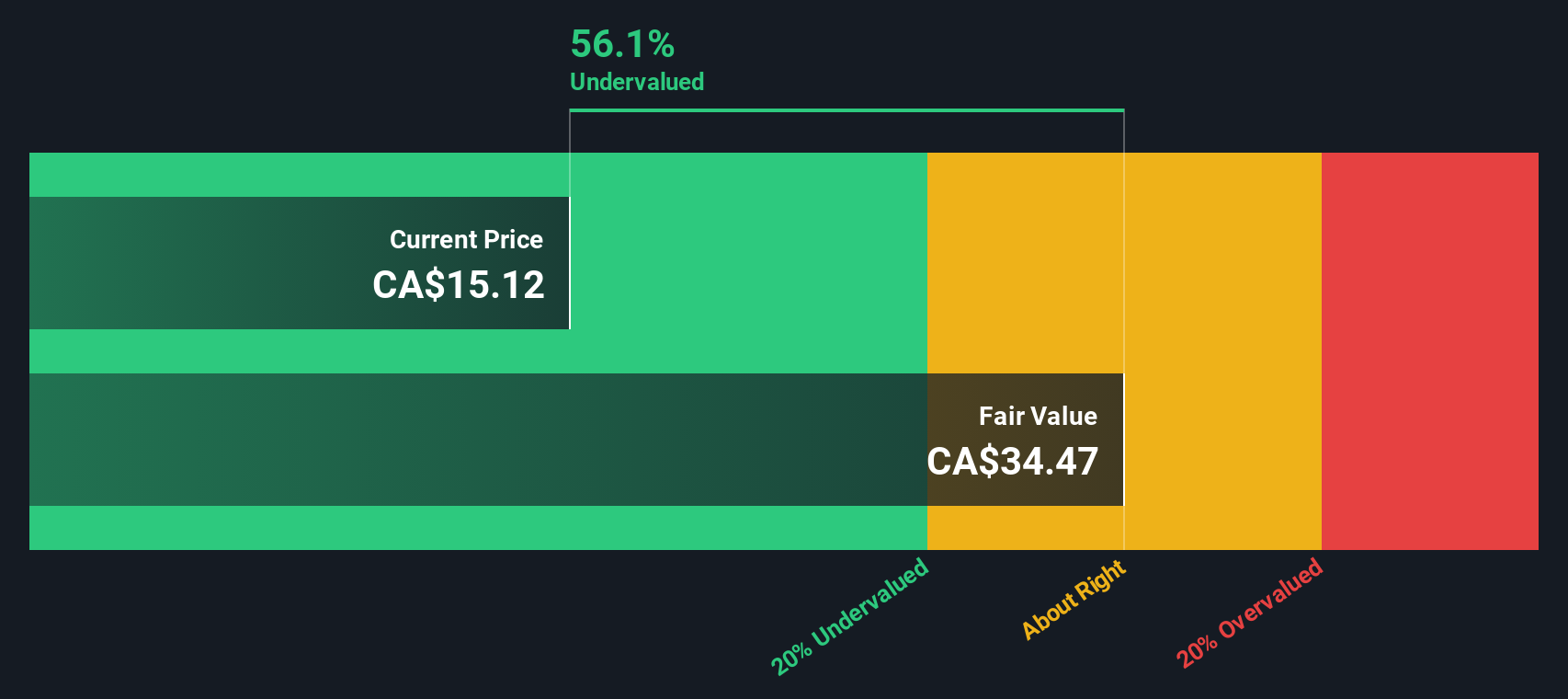

Primaris Real Estate Investment Trust (TSX:PMZ.UN)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Primaris Real Estate Investment Trust focuses on the ownership, management, and development of its investment properties with a market cap of CA$1.58 billion.

Operations: Primaris Real Estate Investment Trust generates revenue primarily from the ownership, management, and development of its investment properties. For the period ending June 30, 2024, it reported a gross profit margin of 56.92% and a net income margin of 26.69%.

PE: 11.1x

Primaris Real Estate Investment Trust, a small cap in Canada, has shown promising financial performance recently. For Q2 2024, it reported CAD 120.01 million in sales and CAD 42.25 million in net income, up from CAD 95.97 million and CAD 32.6 million respectively a year ago. The company declared consistent monthly dividends of $0.07 per unit for May to July 2024, totaling $0.84 annually per unit. Insider confidence is evident with recent share purchases by key executives throughout the past few months, suggesting potential growth ahead despite its higher-risk funding structure reliant on external borrowing rather than customer deposits.

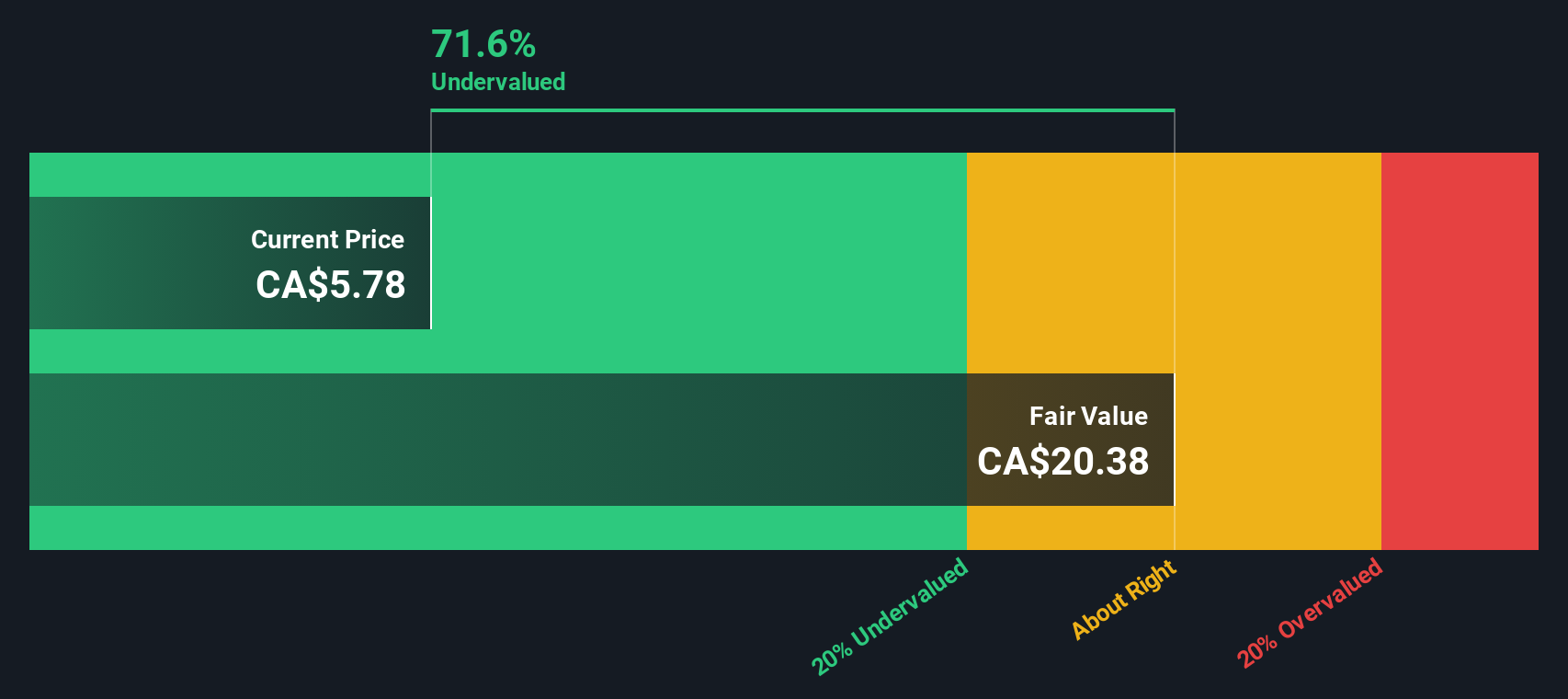

Trican Well Service (TSX:TCW)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Trican Well Service provides oil well equipment and services, with a market cap of approximately CA$1.02 billion.

Operations: The company generates revenue primarily from Oil Well Equipment & Services, amounting to CA$991.15 million. The net income margin has shown improvement, reaching 0.12363% as of the latest period, while the gross profit margin stands at 28.05%.

PE: 8.2x

Trican Well Service, a Canadian energy services company, has shown promising signs of being undervalued. For Q2 2024, they reported CAD 211.81 million in sales and CAD 16.23 million in net income, both up from the previous year. Insider confidence is evident with recent share purchases by company insiders throughout 2024. Additionally, Trican's partnership with Source Energy Services to build a new terminal in British Columbia could enhance future growth prospects despite forecasted earnings declines over the next three years.

Summing It All Up

- Dive into all 28 of the Undervalued TSX Small Caps With Insider Buying we have identified here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:GCG.A

Guardian Capital Group

Through its subsidiaries, primarily engages in the provision of investment services to a range of clients in Canada, the United States, the United Kingdom, the Caribbean, and internationally.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives