- Canada

- /

- Metals and Mining

- /

- TSX:OSK

Unveiling Canada's Hidden Gems for August 2024

Reviewed by Simply Wall St

Over the last 7 days, the Canadian market has dropped 2.3%, but it remains up 9.5% over the past year with earnings forecast to grow by 15% annually. In this dynamic environment, identifying stocks with strong fundamentals and growth potential can uncover hidden gems poised for future success.

Top 10 Undiscovered Gems With Strong Fundamentals In Canada

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Alvopetro Energy | NA | 52.76% | 59.10% | ★★★★★★ |

| TWC Enterprises | 6.74% | 10.99% | 25.68% | ★★★★★★ |

| Taiga Building Products | NA | 7.62% | 15.46% | ★★★★★★ |

| Frontera Energy | 28.78% | -0.59% | 34.36% | ★★★★★☆ |

| Reconnaissance Energy Africa | NA | 31.73% | -6.92% | ★★★★★☆ |

| Mako Mining | 28.08% | 39.01% | 48.79% | ★★★★★☆ |

| Firan Technology Group | 17.91% | 3.75% | 23.32% | ★★★★★☆ |

| Queen's Road Capital Investment | 7.20% | 22.14% | 22.20% | ★★★★☆☆ |

| Genesis Land Development | 53.32% | 25.58% | 47.05% | ★★★★☆☆ |

| Senvest Capital | 54.38% | 2.12% | -0.88% | ★★★★☆☆ |

Let's uncover some gems from our specialized screener.

North West (TSX:NWC)

Simply Wall St Value Rating: ★★★★★★

Overview: The North West Company Inc. (TSX:NWC) operates through its subsidiaries to retail food and everyday products and services in rural communities and urban neighborhood markets across northern Canada, rural Alaska, the South Pacific, and the Caribbean, with a market cap of CA$2.13 billion.

Operations: North West generates CA$2.50 billion in revenue from retailing food and everyday products and services across various regions. The company's market cap stands at CA$2.13 billion.

North West has shown robust performance with a 15.8% earnings growth over the past year, outpacing the Consumer Retailing industry’s 3.5%. Trading at 54.2% below its estimated fair value, it appears undervalued. The company's net debt to equity ratio is satisfactory at 31.5%, and interest payments are well covered by EBIT (10.9x). Recent results indicate sales of CAD 617.52 million, net income of CAD 25.53 million, and EPS of CAD 0.53 for Q1 2024.

- Click to explore a detailed breakdown of our findings in North West's health report.

Examine North West's past performance report to understand how it has performed in the past.

Osisko Mining (TSX:OSK)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Osisko Mining Inc. is a mineral exploration company focused on acquiring, exploring, and developing precious mineral deposits in Canada with a market cap of CA$1.16 billion.

Operations: Osisko Mining generates revenue primarily through the acquisition, exploration, and development of precious mineral deposits in Canada. The company has a market cap of CA$1.16 billion.

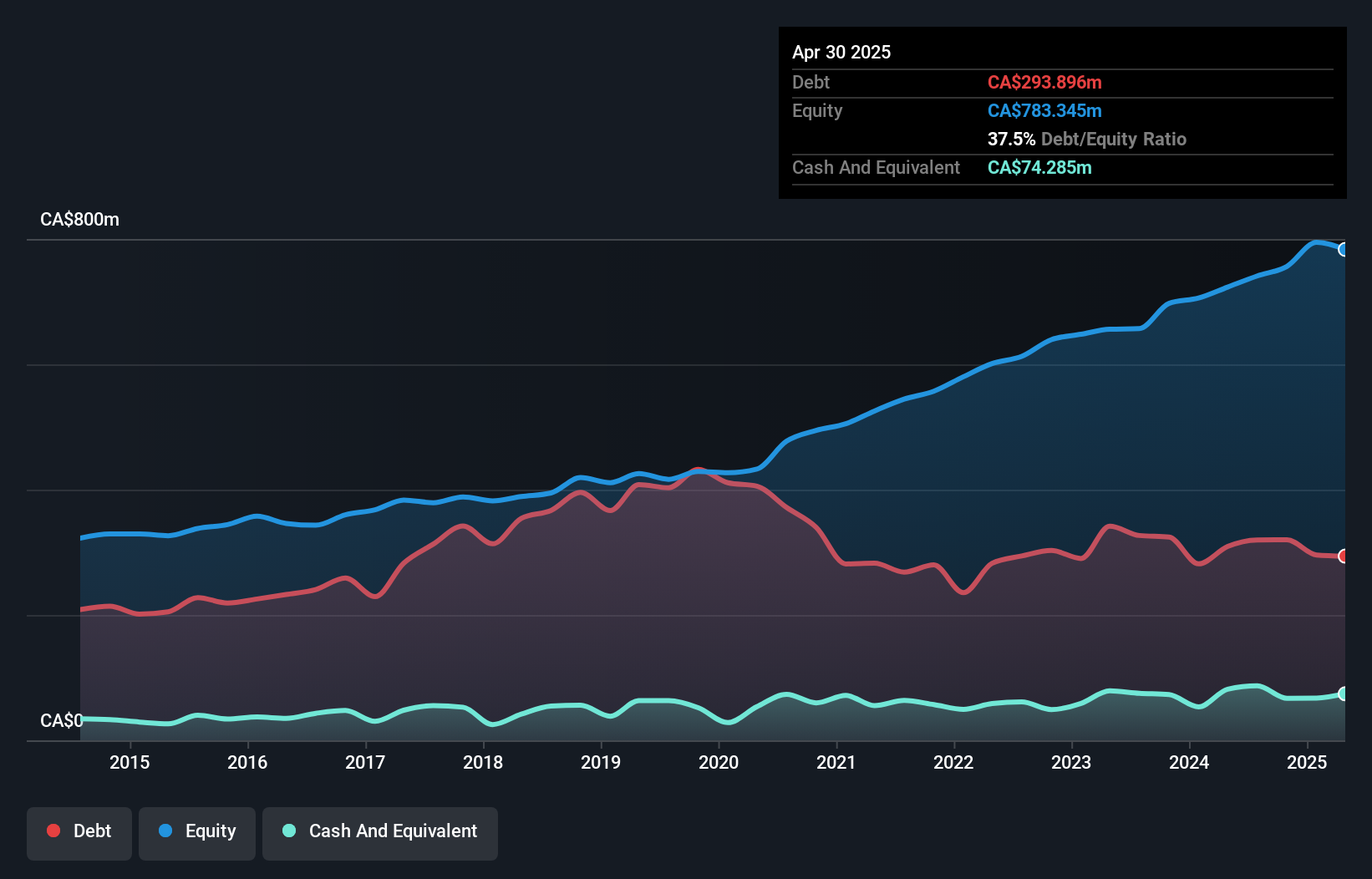

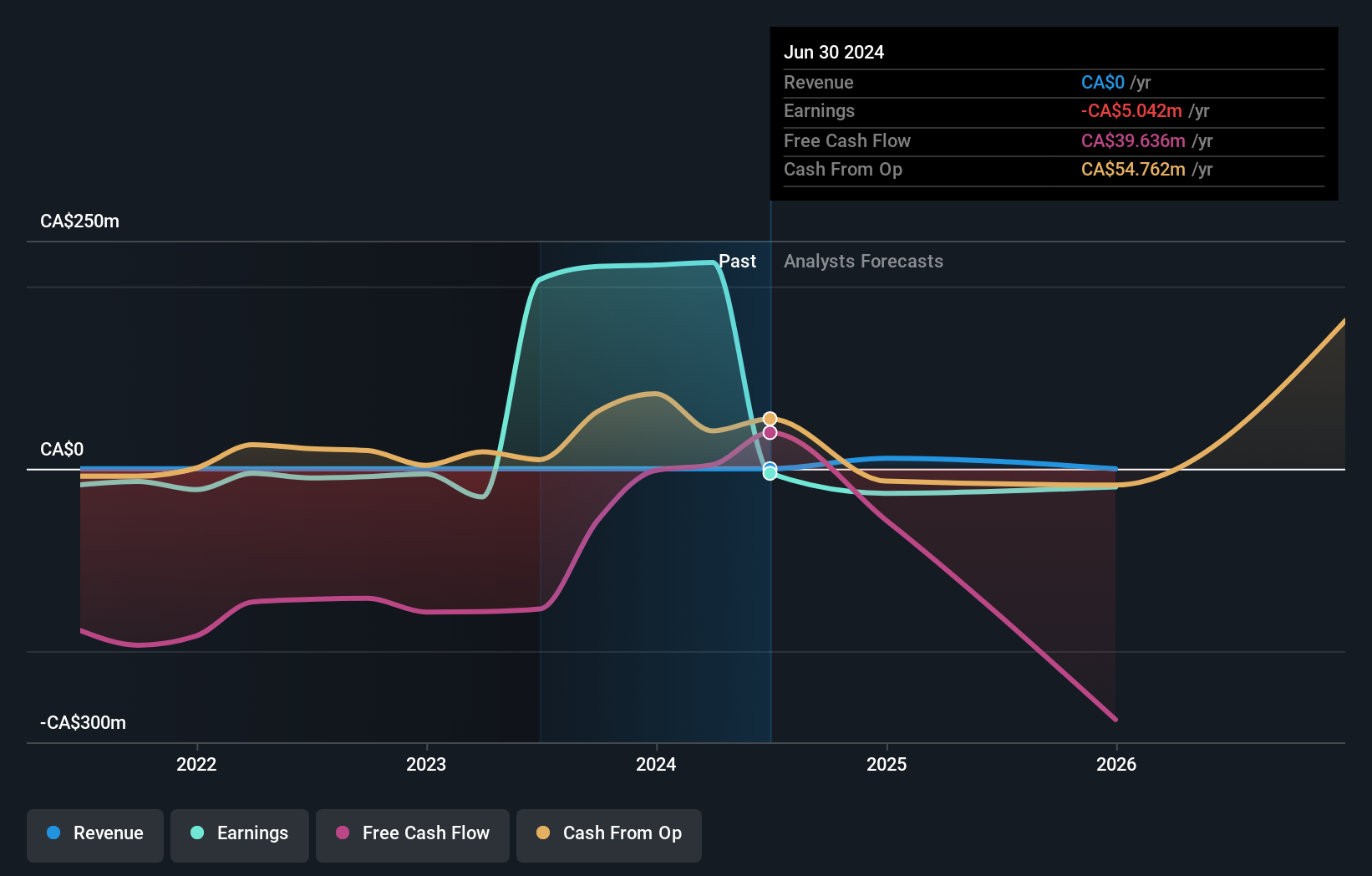

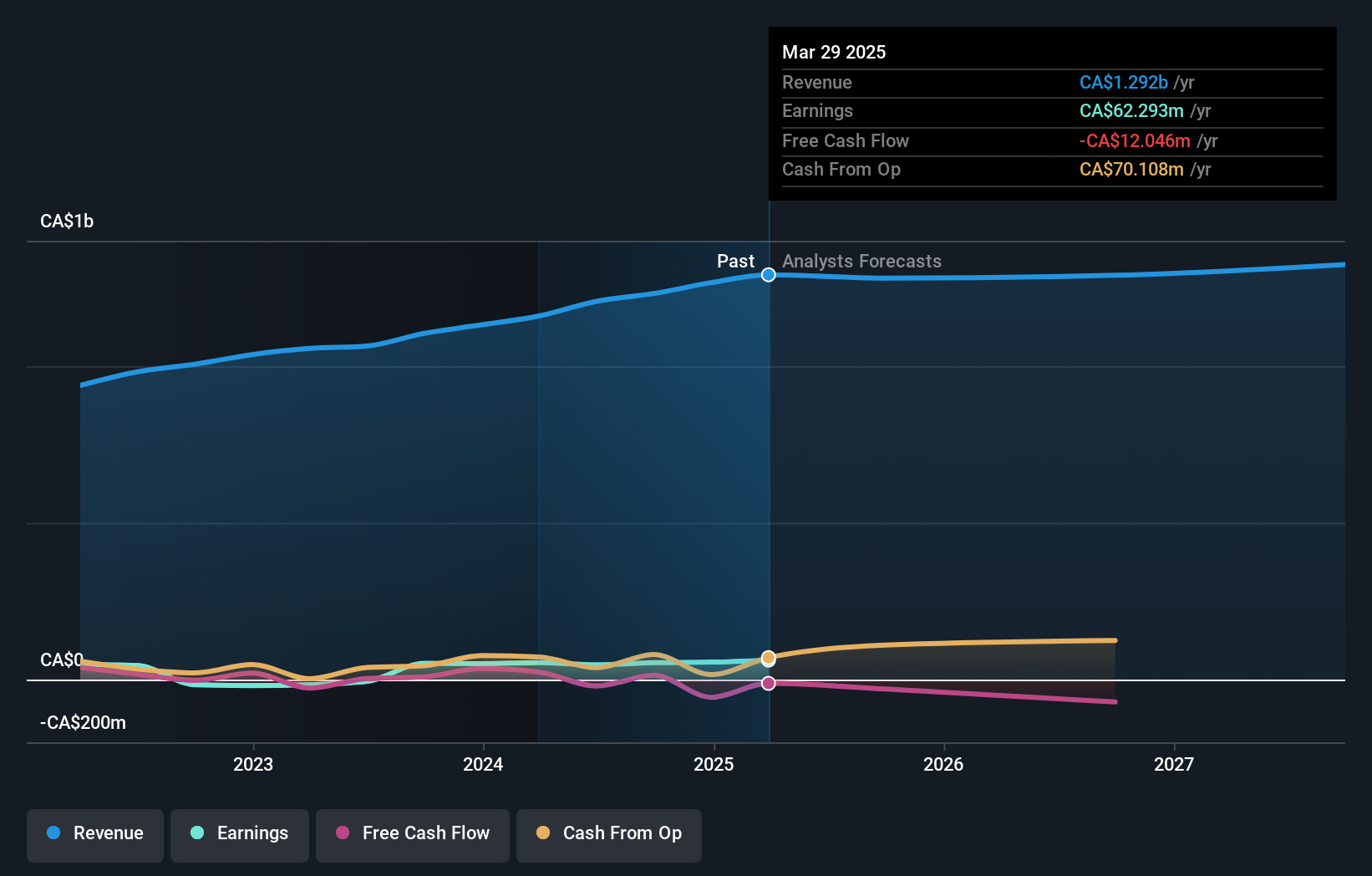

Osisko Mining, a small-cap stock in the Canadian market, has shown significant financial resilience. Trading at a P/E ratio of 5.1x, it offers good value compared to the broader Canadian market's 13.8x. The company has become profitable this year and holds more cash than its total debt, showcasing strong fiscal health. However, earnings are forecasted to decline by an average of 14.8% annually over the next three years, posing potential risks for investors looking ahead.

- Delve into the full analysis health report here for a deeper understanding of Osisko Mining.

Evaluate Osisko Mining's historical performance by accessing our past performance report.

Rogers Sugar (TSX:RSI)

Simply Wall St Value Rating: ★★★★★☆

Overview: Rogers Sugar Inc. engages in refining, packaging, marketing, and distribution of sugar and maple products in Canada, the United States, Europe, and internationally with a market cap of CA$732.96 million.

Operations: Rogers Sugar generates revenue primarily from its sugar segment, amounting to CA$944.83 million, and maple products segment, contributing CA$215.14 million. The company has a market cap of CA$732.96 million.

Rogers Sugar (RSI) has seen its debt to equity ratio improve from 100.3% to 83.8% over five years, though the current net debt to equity ratio of 82.1% remains high. The company turned profitable last year, with earnings covering interest payments four times over, indicating solid financial health despite high debt levels. Recent results show sales rising to CAD 300.94 million for Q2 2024, up from CAD 272.95 million a year ago, with net income reaching CAD 13.94 million compared to CAD 11.06 million previously.

- Dive into the specifics of Rogers Sugar here with our thorough health report.

Review our historical performance report to gain insights into Rogers Sugar's's past performance.

Turning Ideas Into Actions

- Access the full spectrum of 46 TSX Undiscovered Gems With Strong Fundamentals by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:OSK

Osisko Mining

A mineral exploration company, engages in the acquisition, exploration, and development of precious mineral deposits in Canada.

Adequate balance sheet low.

Similar Companies

Market Insights

Community Narratives