Should You Reconsider RBC Stock After Its 19.8% Climb in 2025?

Reviewed by Bailey Pemberton

Trying to figure out what to do with Royal Bank of Canada stock? You’re not alone. This is one of those names that lands in almost every conversation about stable, blue-chip growth on the TSX. The stock recently closed at $206.30, and its returns have definitely caught attention. If you’ve been holding on this year, you’ve enjoyed a solid 19.8% gain. Over the past twelve months, that jumps further to 23.1%. Stretch the timeline out to five years, and the bank’s shares have soared an impressive 158.3%. Very few large-cap financials can match that run. Short-term moves are positive, too, with a 1.9% bump over the last week and 3.0% over the last month, as investors seem to be weighing up the latest economic signals and the bank’s enduring strength in a changing market environment.

Now, strong price performance is great, but it also raises the question: is the stock still offering value, or have we missed the boat? To help answer that, we’ll dig into how Royal Bank of Canada stacks up on key valuation checks. The valuation score comes out to 2 out of 6, meaning it’s considered undervalued by only two of the six main methods analysts use. But of course, numbers can only tell you so much. Let’s break down these valuation approaches, and stick around, because there’s a smarter, more insightful angle to judging value that we’ll explore at the end.

Royal Bank of Canada scores just 2/6 on our valuation checks. See what other red flags we found in the full valuation breakdown.

Approach 1: Royal Bank of Canada Excess Returns Analysis

The Excess Returns valuation model looks at how efficiently a company generates returns above its cost of capital. Instead of focusing on projected cash flows, this method examines how much value is created on each dollar of invested shareholder equity. This can be especially meaningful for banks like Royal Bank of Canada.

For Royal Bank of Canada, the average return on equity is an impressive 15.84%, with a stable earnings per share (EPS) estimate of CA$15.19 according to future analyst projections. The book value per share stands at CA$88.30, rising to a stable forecast of CA$95.93 per share. The bank’s estimated cost of equity is CA$6.97 per share. It is expected to generate an excess return of CA$8.22 per share. This means Royal Bank consistently produces profits above what investors require for the risk they are taking on, which is a key sign of quality and enduring value.

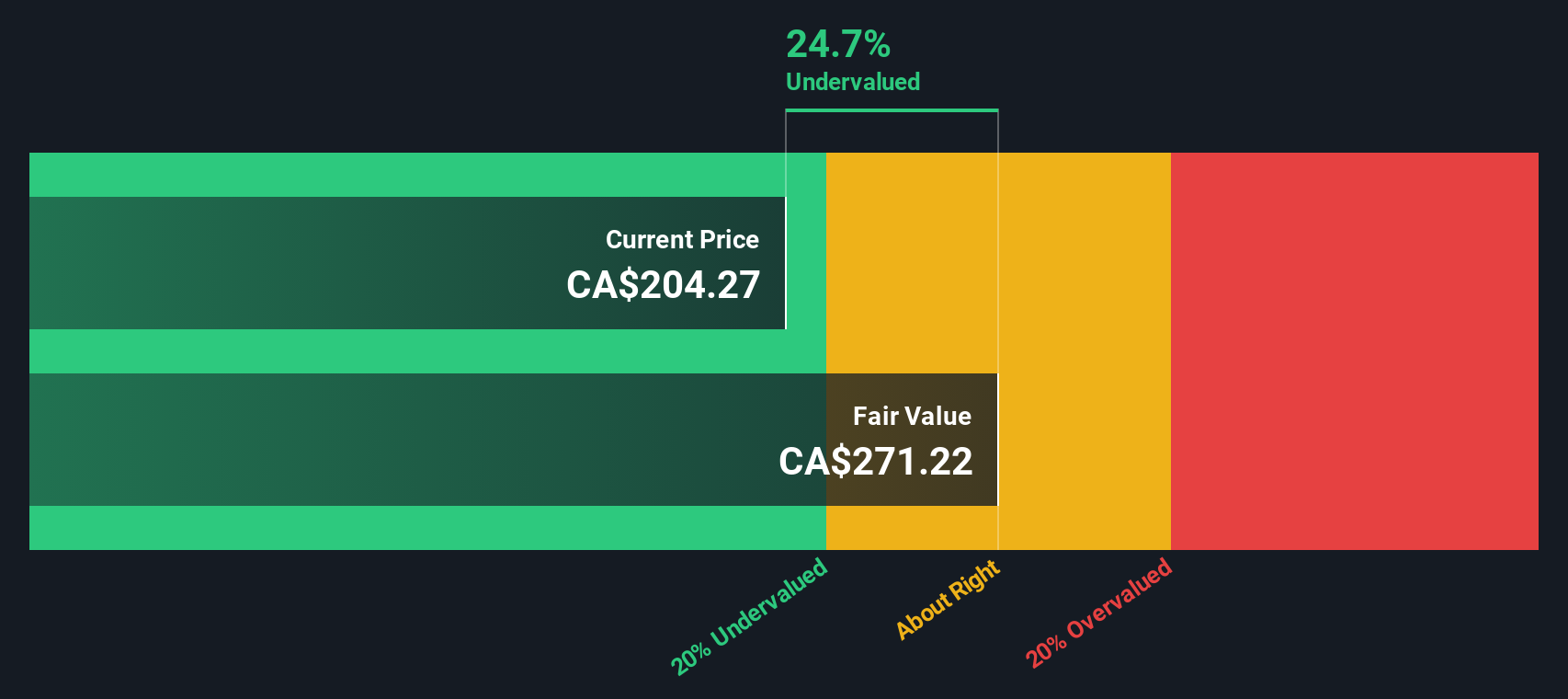

This approach estimates an intrinsic value for Royal Bank of Canada well above its current market price. This implies the stock is 24.2% undervalued right now. Based on this analysis, the market seems to be underappreciating the bank’s ability to deliver sustained, superior returns on its capital.

Result: UNDERVALUED

Our Excess Returns analysis suggests Royal Bank of Canada is undervalued by 24.2%. Track this in your watchlist or portfolio, or discover more undervalued stocks.

Approach 2: Royal Bank of Canada Price vs Earnings

The Price-to-Earnings (P/E) ratio is a popular valuation tool for profitable companies like Royal Bank of Canada because it shows how much investors are willing to pay for every dollar of current earnings. This metric is especially useful when comparing established firms, as it neatly incorporates both earnings power and market expectations.

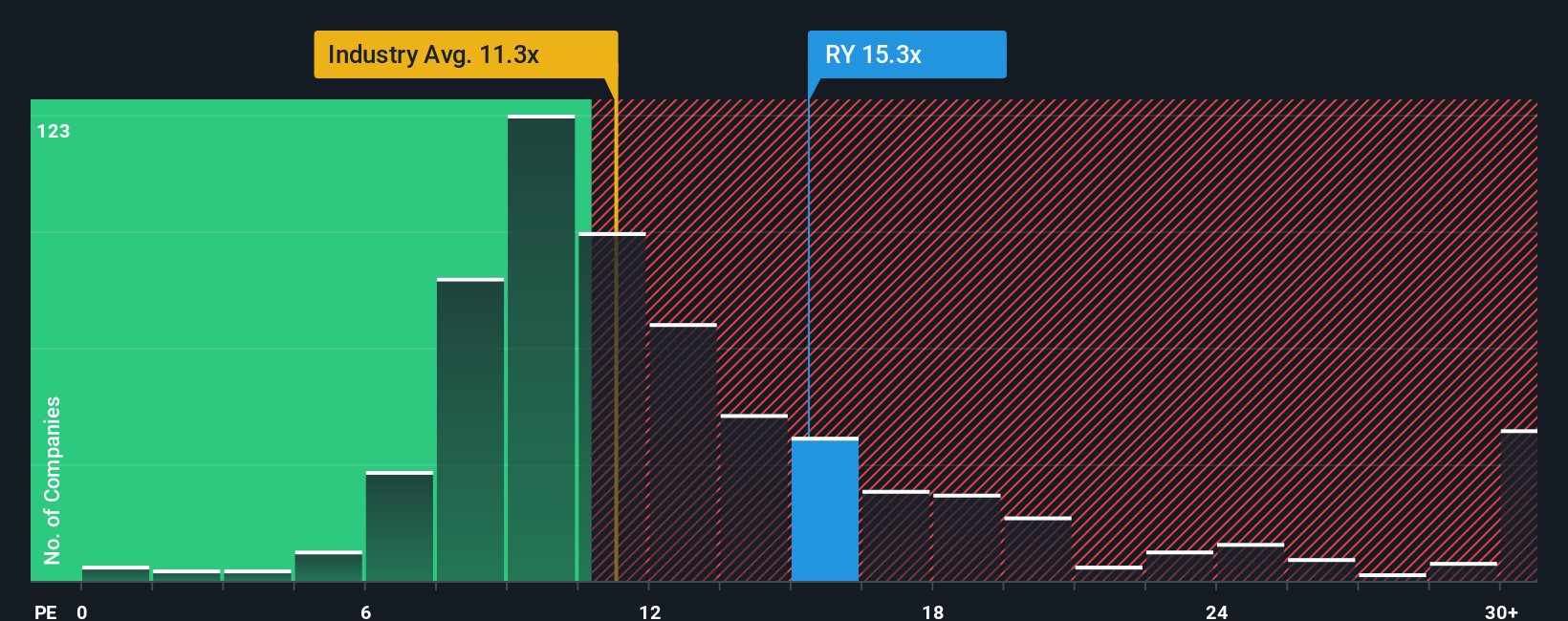

Growth outlook and business risk are two major factors that influence what a "normal" or "fair" P/E ratio should be. Investors typically accept higher P/E multiples for companies with above-average growth prospects or lower perceived risk, while slower growers or riskier banks tend to trade at lower multiples. In this context, Royal Bank of Canada is trading at a P/E of 15.5x, whereas the average among its direct peers stands at 13.9x and the broader banks industry sits lower at 10.3x.

Simply Wall St’s proprietary “Fair Ratio” aims to bridge the gap between simple peer or industry comparisons by factoring in Royal Bank of Canada’s earnings growth, risk, profit margins, market size and more. For Royal Bank of Canada, the Fair Ratio comes out to 14.1x, reflecting the balance of these company-specific factors. This approach produces a more tailored and objective benchmark than relying solely on sector-wide numbers, which can miss important nuances. Since Royal Bank of Canada’s actual P/E is just a bit above the Fair Ratio (15.5x versus 14.1x), this suggests the current price is broadly in line with what you’d expect, given the bank’s outlook and risk profile.

Result: ABOUT RIGHT

PE ratios tell one story, but what if the real opportunity lies elsewhere? Discover companies where insiders are betting big on explosive growth.

Upgrade Your Decision Making: Choose your Royal Bank of Canada Narrative

Earlier we mentioned there’s an even better way to understand valuation, so let’s introduce you to Narratives. A Narrative is simply your story or perspective about a company’s future, including how you see its business, risks, and outlook. This is directly connected to your financial expectations like future revenue, earnings, margin trends, and a fair value for the shares.

Unlike traditional metrics, Narratives let you map your view of Royal Bank of Canada’s strengths, challenges, and catalysts to a financial scenario, then instantly see what that would mean for the share price. Narratives are always available on Simply Wall St’s Community page, making it easy to join millions of other investors using this dynamic, accessible tool.

Here’s how it helps: you can see at a glance whether your Fair Value estimate justifies buying, selling or holding, compared to today’s Price. Plus, because Narratives update automatically when news or earnings are released, your decisions always reflect the most current information.

For Royal Bank of Canada, for example, some investors believe digital transformation and U.S. expansion could drive the shares as high as CA$227.0. Others, who are more cautious on credit risk and costs, see a fair value as low as CA$169.0, each driven by their own Narrative.

Do you think there's more to the story for Royal Bank of Canada? Create your own Narrative to let the Community know!

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives