RBC (TSX:RY) Valuation Check as Optimism Grows After Strong Earnings and Bank Sector Outperformance

Reviewed by Kshitija Bhandaru

Royal Bank of Canada (TSX:RY) is enjoying renewed attention as Canadian banks continue to outperform the TSX this year. Investor sentiment has shifted positively, fueled by steady earnings and resilience in core business lines.

See our latest analysis for Royal Bank of Canada.

Royal Bank of Canada’s share price has kept up its momentum, climbing 18.5% year-to-date and closing recently at $204.19, even as the broader TSX lags behind. Major moves such as a $4.1 million bond issue this month and a string of strong quarterly results have sparked growing investor confidence. This has helped deliver an impressive total shareholder return of 23% over the past year. Both short- and long-term performance point to building optimism in the bank’s outlook.

If you’re interested in seeing what else is gaining traction outside the banking sector, now’s a great moment to broaden your search and discover fast growing stocks with high insider ownership

Yet with Royal Bank of Canada’s stock nearing analyst targets and a strong run already in the books, the big question is whether there is still room for upside or if the market has already priced in future growth.

Most Popular Narrative: 1.8% Undervalued

Royal Bank of Canada is trading just below what the dominant narrative considers its fair value, with the consensus indicating the stock may hold modest upside from current levels. This is setting up a tight debate about future growth and what really underpins today’s price.

Strategic investments in AI and digitalization, such as the ATOM Foundation and Lumina platform, expanded use of data analytics, and digital banking product launches, are driving cost efficiencies, deeper customer engagement, and higher transaction volumes. These factors may support future revenue and net margin growth.

Want to know which projections power this valuation? Hint: The growth engine relies on bold digital ambitions, sharpening margins, and a looming profit leap. Which metrics push Royal Bank of Canada just into undervalued territory? Read on and uncover the precise assumptions that fuel this fair value judgment.

Result: Fair Value of $207.93 (UNDERVALUED)

Have a read of the narrative in full and understand what's behind the forecasts.

However, persistent macroeconomic uncertainty or a rise in credit losses could easily challenge Royal Bank of Canada’s otherwise optimistic outlook.

Find out about the key risks to this Royal Bank of Canada narrative.

Another View: Multiples Tell a Different Story

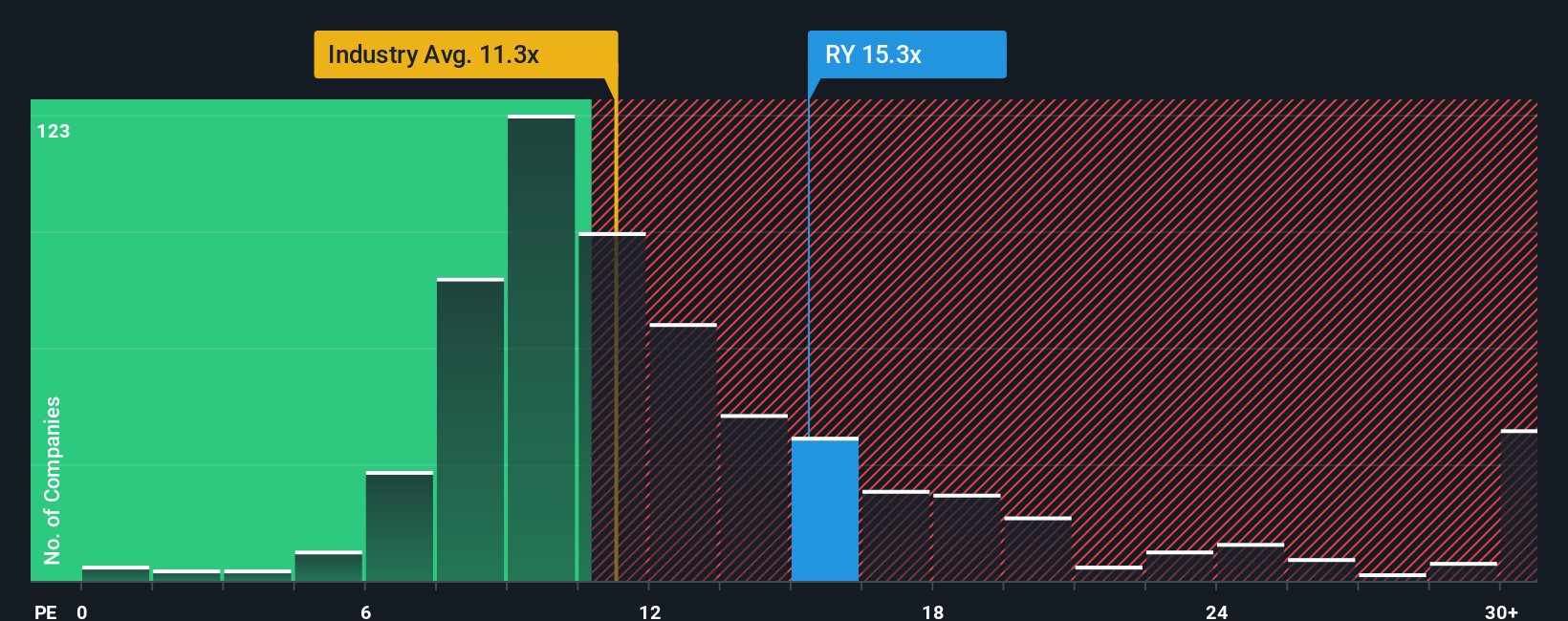

While some valuation models see Royal Bank of Canada as slightly undervalued, a look at its price-to-earnings ratio paints a different picture. The stock trades at 15.3x earnings, higher than both the North American banks industry average of 11.7x and its peer group’s 13.8x. Even compared to a fair ratio of 14.1x, Royal Bank of Canada looks relatively expensive, suggesting there may be less upside than first appears.

See what the numbers say about this price — find out in our valuation breakdown.

Build Your Own Royal Bank of Canada Narrative

If you see things differently or want to build a valuation based on your own insights, you can dive into the numbers and assemble your own perspective in just a few minutes. Do it your way

A great starting point for your Royal Bank of Canada research is our analysis highlighting 4 key rewards and 1 important warning sign that could impact your investment decision.

Looking for More Investment Ideas?

Stay a step ahead by tapping into breakthrough sectors and powerful trends with investment opportunities you could be missing out on right now.

- Capture steady income streams by pursuing these 18 dividend stocks with yields > 3% offering yields above 3% and proven payout histories.

- Ride the AI innovation wave by targeting these 25 AI penny stocks positioned at the forefront of machine learning and automation gains.

- Unlock hidden value with these 877 undervalued stocks based on cash flows that the market has overlooked but strong cash flows reveal as potential bargains.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:RY

Royal Bank of Canada

Operates as a diversified financial service company worldwide.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives