- Canada

- /

- Capital Markets

- /

- TSX:SII

3 Canadian Dividend Stocks On TSX Yielding Up To 5.3%

Reviewed by Simply Wall St

As we enter 2025, the Canadian market is navigating a landscape marked by political transitions and evolving central-bank policies, with higher government bond yields impacting stock valuations. Amidst this backdrop of uncertainty and potential volatility, dividend stocks on the TSX offer investors an opportunity to focus on income stability and diversification.

Top 10 Dividend Stocks In Canada

| Name | Dividend Yield | Dividend Rating |

| Whitecap Resources (TSX:WCP) | 7.14% | ★★★★★★ |

| Acadian Timber (TSX:ADN) | 6.82% | ★★★★★★ |

| Olympia Financial Group (TSX:OLY) | 6.76% | ★★★★★☆ |

| Russel Metals (TSX:RUS) | 4.25% | ★★★★★☆ |

| Power Corporation of Canada (TSX:POW) | 5.32% | ★★★★★☆ |

| Royal Bank of Canada (TSX:RY) | 3.47% | ★★★★★☆ |

| Canadian Natural Resources (TSX:CNQ) | 4.62% | ★★★★★☆ |

| Firm Capital Mortgage Investment (TSX:FC) | 8.48% | ★★★★★☆ |

| Richards Packaging Income Fund (TSX:RPI.UN) | 5.66% | ★★★★★☆ |

| Sun Life Financial (TSX:SLF) | 4.08% | ★★★★★☆ |

Click here to see the full list of 28 stocks from our Top TSX Dividend Stocks screener.

We'll examine a selection from our screener results.

Bank of Montreal (TSX:BMO)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Bank of Montreal offers diversified financial services primarily in North America and has a market capitalization of approximately CA$102.66 billion.

Operations: Bank of Montreal's revenue segments include Canadian Personal and Commercial Banking at CA$9.78 billion, U.S. Personal and Commercial Banking at CA$8.10 billion, BMO Capital Markets at CA$6.15 billion, and BMO Wealth Management at CA$5.62 billion.

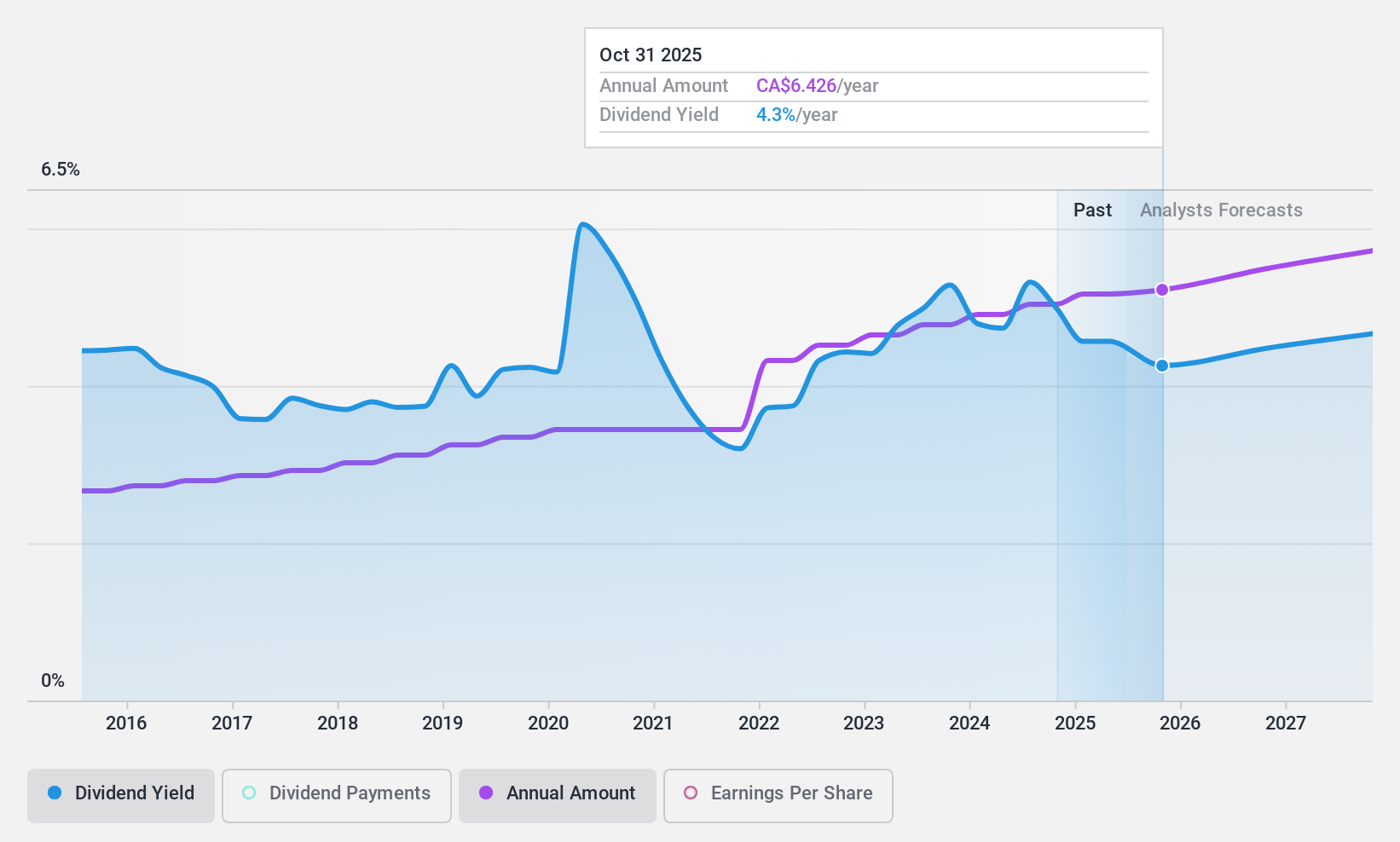

Dividend Yield: 4.6%

Bank of Montreal has demonstrated a consistent dividend history, with payments increasing over the past decade and maintaining stability. The bank's current payout ratio of 64.2% indicates that dividends are well-covered by earnings, with future coverage expected to improve to 46.2%. Despite being lower than the top quartile of Canadian dividend payers, its yield remains attractive at 4.56%. Recent fixed-income offerings highlight BMO's ongoing efforts in capital management and financial stability.

- Click here to discover the nuances of Bank of Montreal with our detailed analytical dividend report.

- Our comprehensive valuation report raises the possibility that Bank of Montreal is priced higher than what may be justified by its financials.

Power Corporation of Canada (TSX:POW)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Power Corporation of Canada is an international management and holding company providing financial services across North America, Europe, and Asia, with a market cap of CA$27.68 billion.

Operations: Power Corporation of Canada's revenue segments include Lifeco at CA$39.10 billion, Power Financial - IGM at CA$3.64 billion, and Holding Company at CA$56 million.

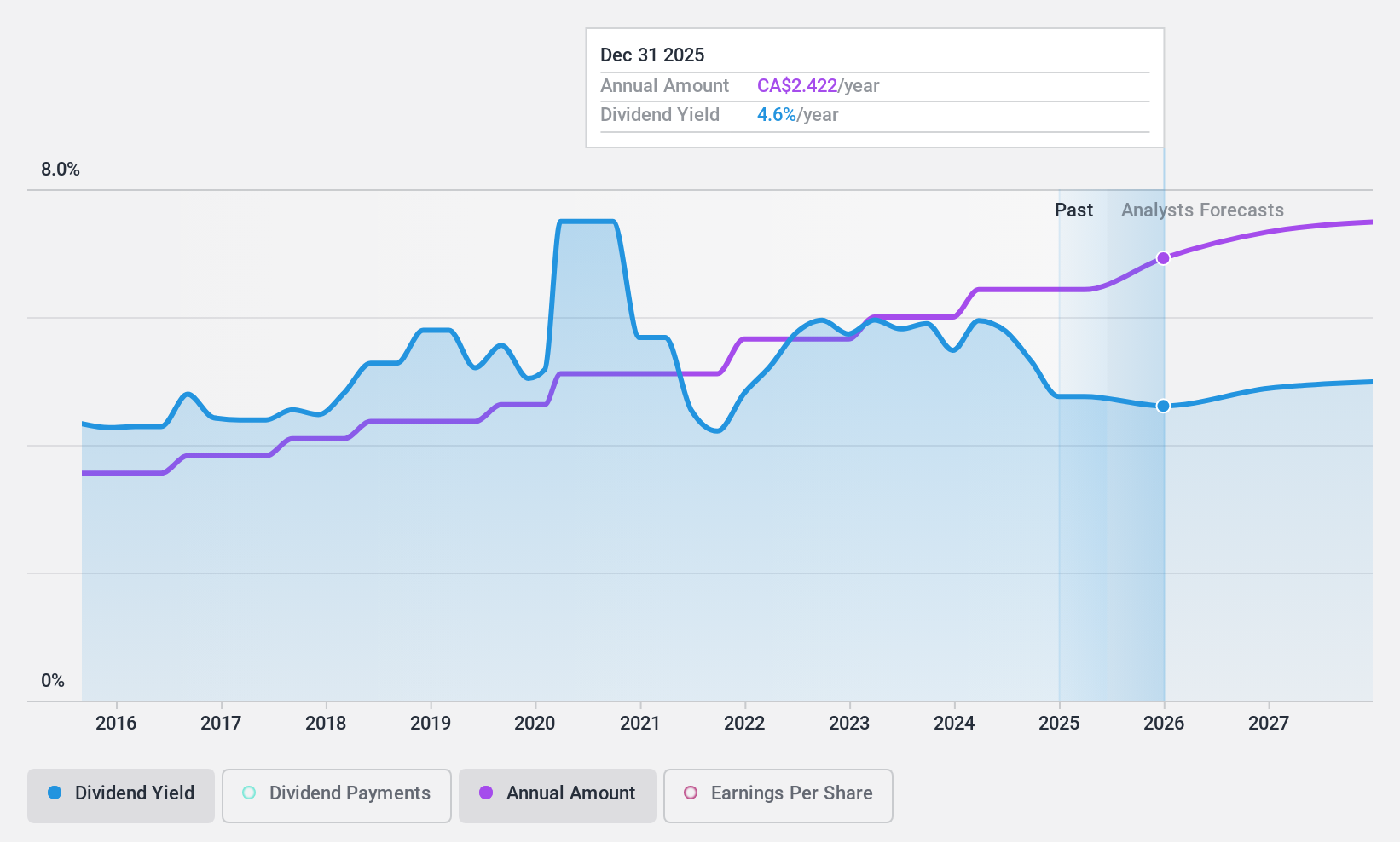

Dividend Yield: 5.3%

Power Corporation of Canada offers a stable dividend, supported by a payout ratio of 61.8% and cash flow coverage at 29.5%. Despite its yield of 5.32% being below the top Canadian payers, dividends have grown over the past decade. Recent earnings showed mixed results with net income for Q3 at C$384 million, down from C$988 million last year. The company completed a share buyback worth C$257 million, enhancing shareholder value through capital management initiatives.

- Click here and access our complete dividend analysis report to understand the dynamics of Power Corporation of Canada.

- Our expertly prepared valuation report Power Corporation of Canada implies its share price may be lower than expected.

Sprott (TSX:SII)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Sprott Inc. is a publicly owned asset management holding company with a market cap of approximately CA$1.50 billion.

Operations: Sprott Inc.'s revenue is primarily derived from Managed Equities ($38.82 million), Private Strategies ($28.35 million), and Exchange Listed Products ($128.05 million).

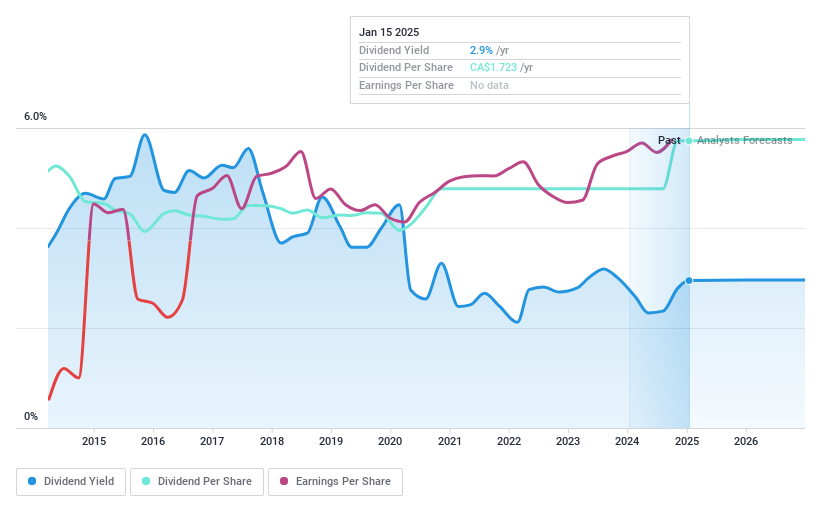

Dividend Yield: 3%

Sprott Inc.'s recent earnings report shows a significant increase in revenue and net income, with Q3 2024 revenue at US$46.51 million. The company announced a 20% dividend increase to US$0.30 per share, reflecting growing dividends over the past decade despite historical volatility. With a payout ratio of 56.3% and cash payout ratio of 63.5%, dividends are well-covered by earnings and cash flows, though its yield of 3.03% remains below top-tier Canadian dividend payers.

- Get an in-depth perspective on Sprott's performance by reading our dividend report here.

- Insights from our recent valuation report point to the potential overvaluation of Sprott shares in the market.

Where To Now?

- Reveal the 28 hidden gems among our Top TSX Dividend Stocks screener with a single click here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:SII

Flawless balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives