- Canada

- /

- Auto Components

- /

- TSX:XTC

Should Income Investors Look At Exco Technologies Limited (TSE:XTC) Before Its Ex-Dividend?

Regular readers will know that we love our dividends at Simply Wall St, which is why it's exciting to see Exco Technologies Limited (TSE:XTC) is about to trade ex-dividend in the next 4 days. This means that investors who purchase shares on or after the 16th of March will not receive the dividend, which will be paid on the 31st of March.

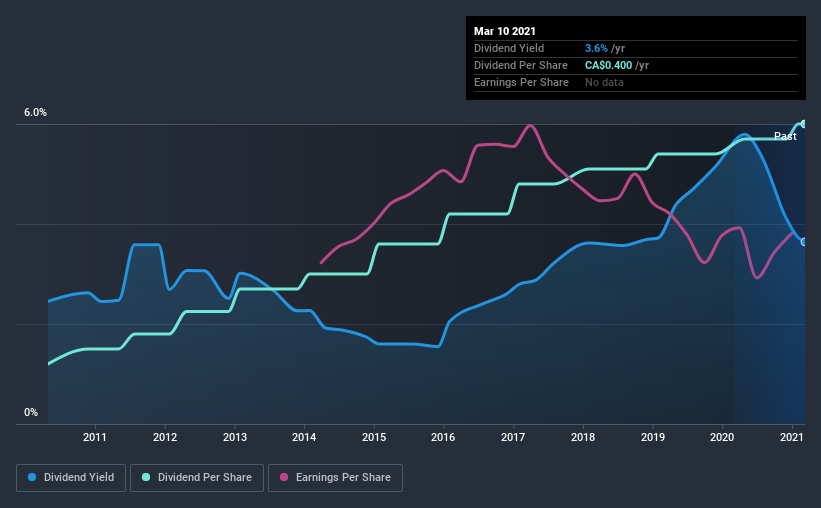

Exco Technologies's next dividend payment will be CA$0.10 per share, on the back of last year when the company paid a total of CA$0.38 to shareholders. Last year's total dividend payments show that Exco Technologies has a trailing yield of 3.6% on the current share price of CA$10.98. If you buy this business for its dividend, you should have an idea of whether Exco Technologies's dividend is reliable and sustainable. So we need to check whether the dividend payments are covered, and if earnings are growing.

See our latest analysis for Exco Technologies

Dividends are usually paid out of company profits, so if a company pays out more than it earned then its dividend is usually at greater risk of being cut. Exco Technologies paid out a comfortable 50% of its profit last year. That said, even highly profitable companies sometimes might not generate enough cash to pay the dividend, which is why we should always check if the dividend is covered by cash flow. It distributed 34% of its free cash flow as dividends, a comfortable payout level for most companies.

It's encouraging to see that the dividend is covered by both profit and cash flow. This generally suggests the dividend is sustainable, as long as earnings don't drop precipitously.

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with falling earnings are riskier for dividend shareholders. Investors love dividends, so if earnings fall and the dividend is reduced, expect a stock to be sold off heavily at the same time. So we're not too excited that Exco Technologies's earnings are down 4.6% a year over the past five years.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Exco Technologies has lifted its dividend by approximately 17% a year on average.

To Sum It Up

Has Exco Technologies got what it takes to maintain its dividend payments? Earnings per share are down meaningfully, although at least the company is paying out a low and conservative percentage of both its earnings and cash flow. It's definitely not great to see earnings falling, but at least there may be some buffer before the dividend needs to be cut. In summary, it's hard to get excited about Exco Technologies from a dividend perspective.

On that note, you'll want to research what risks Exco Technologies is facing. Case in point: We've spotted 2 warning signs for Exco Technologies you should be aware of.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

If you decide to trade Exco Technologies, use the lowest-cost* platform that is rated #1 Overall by Barron’s, Interactive Brokers. Trade stocks, options, futures, forex, bonds and funds on 135 markets, all from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exco Technologies might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisThis article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About TSX:XTC

Exco Technologies

Designs, develops, manufactures, and sells dies, molds, components and assemblies, and consumable equipment for the die-cast, extrusion, and automotive industries.

6 star dividend payer with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)