For beginners, it can seem like a good idea (and an exciting prospect) to buy a company that tells a good story to investors, even if it currently lacks a track record of revenue and profit. But as Peter Lynch said in One Up On Wall Street, 'Long shots almost never pay off.' A loss-making company is yet to prove itself with profit, and eventually the inflow of external capital may dry up.

So if this idea of high risk and high reward doesn't suit, you might be more interested in profitable, growing companies, like Linamar (TSE:LNR). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out our latest analysis for Linamar

Linamar's Earnings Per Share Are Growing

The market is a voting machine in the short term, but a weighing machine in the long term, so you'd expect share price to follow earnings per share (EPS) outcomes eventually. So it makes sense that experienced investors pay close attention to company EPS when undertaking investment research. It certainly is nice to see that Linamar has managed to grow EPS by 24% per year over three years. If the company can sustain that sort of growth, we'd expect shareholders to come away satisfied.

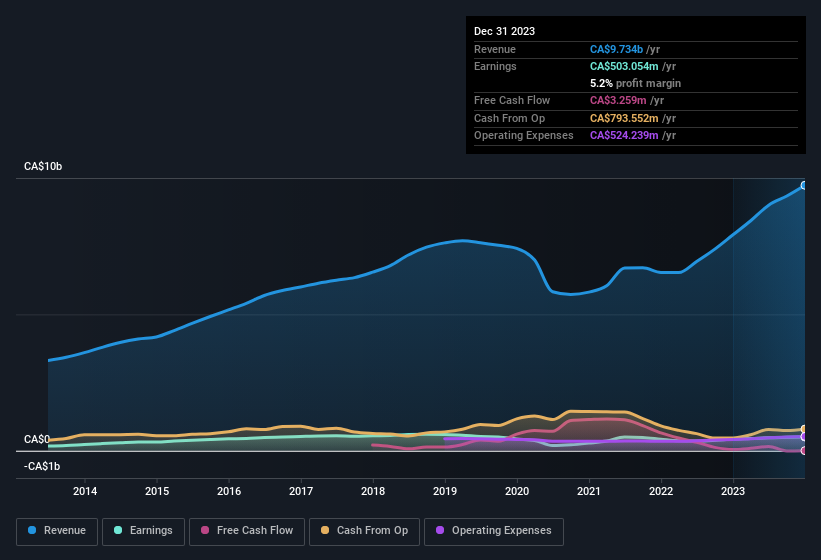

Top-line growth is a great indicator that growth is sustainable, and combined with a high earnings before interest and taxation (EBIT) margin, it's a great way for a company to maintain a competitive advantage in the market. EBIT margins for Linamar remained fairly unchanged over the last year, however the company should be pleased to report its revenue growth for the period of 23% to CA$9.7b. That's encouraging news for the company!

The chart below shows how the company's bottom and top lines have progressed over time. For finer detail, click on the image.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Linamar?

Are Linamar Insiders Aligned With All Shareholders?

It's said that there's no smoke without fire. For investors, insider buying is often the smoke that indicates which stocks could set the market alight. That's because insider buying often indicates that those closest to the company have confidence that the share price will perform well. Of course, we can never be sure what insiders are thinking, we can only judge their actions.

Although we did see some insider selling (worth CA$873k) this was overshadowed by a mountain of buying, totalling CA$3.1m in just one year. This bodes well for Linamar as it highlights the fact that those who are important to the company having a lot of faith in its future. Zooming in, we can see that the biggest insider purchase was by Executive Chairman of the Board & CEO Linda Hasenfratz for CA$2.9m worth of shares, at about CA$57.89 per share.

The good news, alongside the insider buying, for Linamar bulls is that insiders (collectively) have a meaningful investment in the stock. We note that their impressive stake in the company is worth CA$1.5b. This totals to 34% of shares in the company. Enough to lead management's decision making process down a path that brings the most benefit to shareholders. So there is opportunity here to invest in a company whose management have tangible incentives to deliver.

Should You Add Linamar To Your Watchlist?

You can't deny that Linamar has grown its earnings per share at a very impressive rate. That's attractive. Not only that, but we can see that insiders both own a lot of, and are buying more shares in the company. Astute investors will want to keep this stock on watch. We should say that we've discovered 1 warning sign for Linamar that you should be aware of before investing here.

The good news is that Linamar is not the only growth stock with insider buying. Here's a list of growth-focused companies in CA with insider buying in the last three months!

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About TSX:LNR

Linamar

Manufactures and sells engineered products in Canada, Europe, the Asia Pacific, and rest of North America.

Flawless balance sheet and fair value.

Similar Companies

Market Insights

Community Narratives