- Brazil

- /

- Electric Utilities

- /

- BOVESPA:CPFE3

CPFL Energia S.A. (BVMF:CPFE3) Stock Goes Ex-Dividend In Just Four Days

Readers hoping to buy CPFL Energia S.A. (BVMF:CPFE3) for its dividend will need to make their move shortly, as the stock is about to trade ex-dividend. The ex-dividend date is two business days before a company's record date in most cases, which is the date on which the company determines which shareholders are entitled to receive a dividend. It is important to be aware of the ex-dividend date because any trade on the stock needs to have been settled on or before the record date. Thus, you can purchase CPFL Energia's shares before the 30th of April in order to receive the dividend, which the company will pay on the 30th of December.

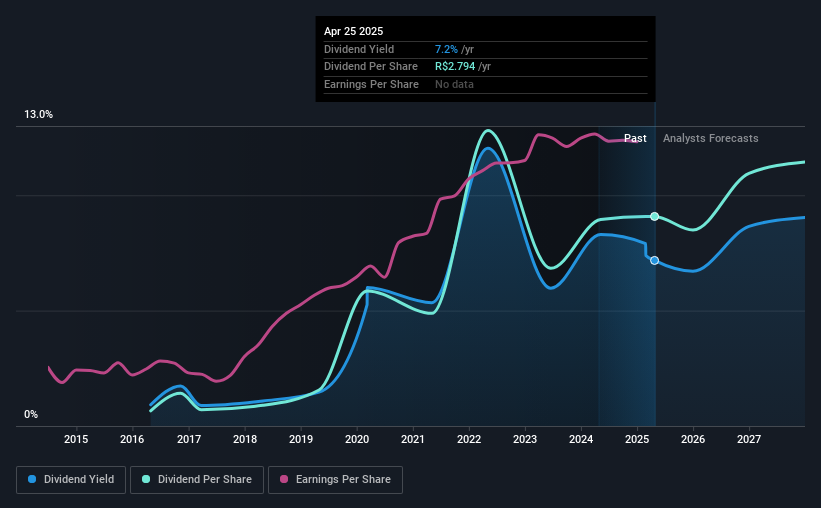

The company's upcoming dividend is R$2.7941766 a share, following on from the last 12 months, when the company distributed a total of R$2.79 per share to shareholders. Calculating the last year's worth of payments shows that CPFL Energia has a trailing yield of 7.2% on the current share price of R$38.95. If you buy this business for its dividend, you should have an idea of whether CPFL Energia's dividend is reliable and sustainable. So we need to investigate whether CPFL Energia can afford its dividend, and if the dividend could grow.

We've discovered 2 warning signs about CPFL Energia. View them for free.If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. CPFL Energia paid out more than half (59%) of its earnings last year, which is a regular payout ratio for most companies. Yet cash flow is typically more important than profit for assessing dividend sustainability, so we should always check if the company generated enough cash to afford its dividend. Over the last year, it paid out dividends equivalent to 203% of what it generated in free cash flow, a disturbingly high percentage. Unless there were something in the business we're not grasping, this could signal a risk that the dividend may have to be cut in the future.

While CPFL Energia's dividends were covered by the company's reported profits, cash is somewhat more important, so it's not great to see that the company didn't generate enough cash to pay its dividend. Cash is king, as they say, and were CPFL Energia to repeatedly pay dividends that aren't well covered by cashflow, we would consider this a warning sign.

See our latest analysis for CPFL Energia

Click here to see the company's payout ratio, plus analyst estimates of its future dividends.

Have Earnings And Dividends Been Growing?

Companies with consistently growing earnings per share generally make the best dividend stocks, as they usually find it easier to grow dividends per share. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. For this reason, we're glad to see CPFL Energia's earnings per share have risen 14% per annum over the last five years. Earnings have been growing at a decent rate, but we're concerned dividend payments consumed most of the company's cash flow over the past year.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the past nine years, CPFL Energia has increased its dividend at approximately 34% a year on average. Both per-share earnings and dividends have both been growing rapidly in recent times, which is great to see.

To Sum It Up

From a dividend perspective, should investors buy or avoid CPFL Energia? Earnings per share growth is a positive, and the company's payout ratio looks normal. However, we note CPFL Energia paid out a much higher percentage of its free cash flow, which makes us uncomfortable. It might be worth researching if the company is reinvesting in growth projects that could grow earnings and dividends in the future, but for now we're not all that optimistic on its dividend prospects.

However if you're still interested in CPFL Energia as a potential investment, you should definitely consider some of the risks involved with CPFL Energia. For example, we've found 2 warning signs for CPFL Energia that we recommend you consider before investing in the business.

A common investing mistake is buying the first interesting stock you see. Here you can find a full list of high-yield dividend stocks.

If you're looking to trade CPFL Energia, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CPFE3

CPFL Energia

Engages in the generation, transmission, distribution, and commercialization of electricity to residential, industrial, and commercial customers in Brazil.

Good value with questionable track record.

Market Insights

Community Narratives