ClearSale S.A. (BVMF:CLSA3) Analysts Just Slashed Next Year's Revenue Estimates By 15%

The latest analyst coverage could presage a bad day for ClearSale S.A. (BVMF:CLSA3), with the analysts making across-the-board cuts to their statutory estimates that might leave shareholders a little shell-shocked. There was a fairly draconian cut to their revenue estimates, perhaps an implicit admission that previous forecasts were much too optimistic.

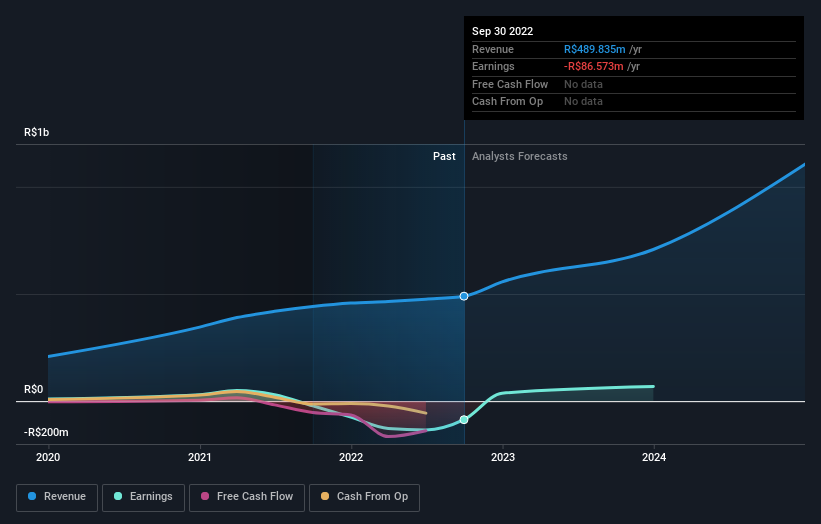

Following the downgrade, the current consensus from ClearSale's three analysts is for revenues of R$708m in 2023 which - if met - would reflect a major 44% increase on its sales over the past 12 months. Before the latest update, the analysts were foreseeing R$829m of revenue in 2023. It looks like forecasts have become a fair bit less optimistic on ClearSale, given the measurable cut to revenue estimates.

View our latest analysis for ClearSale

Notably, the analysts have cut their price target 25% to R$15.50, suggesting concerns around ClearSale's valuation. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. There are some variant perceptions on ClearSale, with the most bullish analyst valuing it at R$36.00 and the most bearish at R$5.00 per share. So we wouldn't be assigning too much credibility to analyst price targets in this case, because there are clearly some widely differing views on what kind of performance this business can generate. As a result it might not be possible to derive much meaning from the consensus price target, which is after all just an average of this wide range of estimates.

Taking a look at the bigger picture now, one of the ways we can understand these forecasts is to see how they compare to both past performance and industry growth estimates. The analysts are definitely expecting ClearSale's growth to accelerate, with the forecast 34% annualised growth to the end of 2023 ranking favourably alongside historical growth of 24% per annum over the past five years. Compare this with other companies in the same industry, which are forecast to grow their revenue 13% annually. Factoring in the forecast acceleration in revenue, it's pretty clear that ClearSale is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that analysts cut their revenue estimates for next year. They're also forecasting more rapid revenue growth than the wider market. Furthermore, there was a cut to the price target, suggesting that the latest news has led to more pessimism about the intrinsic value of the business. Overall, given the drastic downgrade to next year's forecasts, we'd be feeling a little more wary of ClearSale going forwards.

Want more information? At least one of ClearSale's three analysts has provided estimates out to 2024, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:CLSA3

ClearSale

Through its subsidiaries, provides transaction analysis solutions and services for fraud prevention and management in Brazil and internationally.

Flawless balance sheet minimal.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)