- Brazil

- /

- Metals and Mining

- /

- BOVESPA:VALE3

Vale S.A.'s (BVMF:VALE3) Stock Has Shown A Decent Performance: Have Financials A Role To Play?

Most readers would already know that Vale's (BVMF:VALE3) stock increased by 4.5% over the past week. We wonder if and what role the company's financials play in that price change as a company's long-term fundamentals usually dictate market outcomes. Particularly, we will be paying attention to Vale's ROE today.

ROE or return on equity is a useful tool to assess how effectively a company can generate returns on the investment it received from its shareholders. In short, ROE shows the profit each dollar generates with respect to its shareholder investments.

How Do You Calculate Return On Equity?

Return on equity can be calculated by using the formula:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Vale is:

13% = R$28b ÷ R$221b (Based on the trailing twelve months to June 2025).

The 'return' is the income the business earned over the last year. Another way to think of that is that for every R$1 worth of equity, the company was able to earn R$0.13 in profit.

See our latest analysis for Vale

Why Is ROE Important For Earnings Growth?

We have already established that ROE serves as an efficient profit-generating gauge for a company's future earnings. Depending on how much of these profits the company reinvests or "retains", and how effectively it does so, we are then able to assess a company’s earnings growth potential. Assuming all else is equal, companies that have both a higher return on equity and higher profit retention are usually the ones that have a higher growth rate when compared to companies that don't have the same features.

Vale's Earnings Growth And 13% ROE

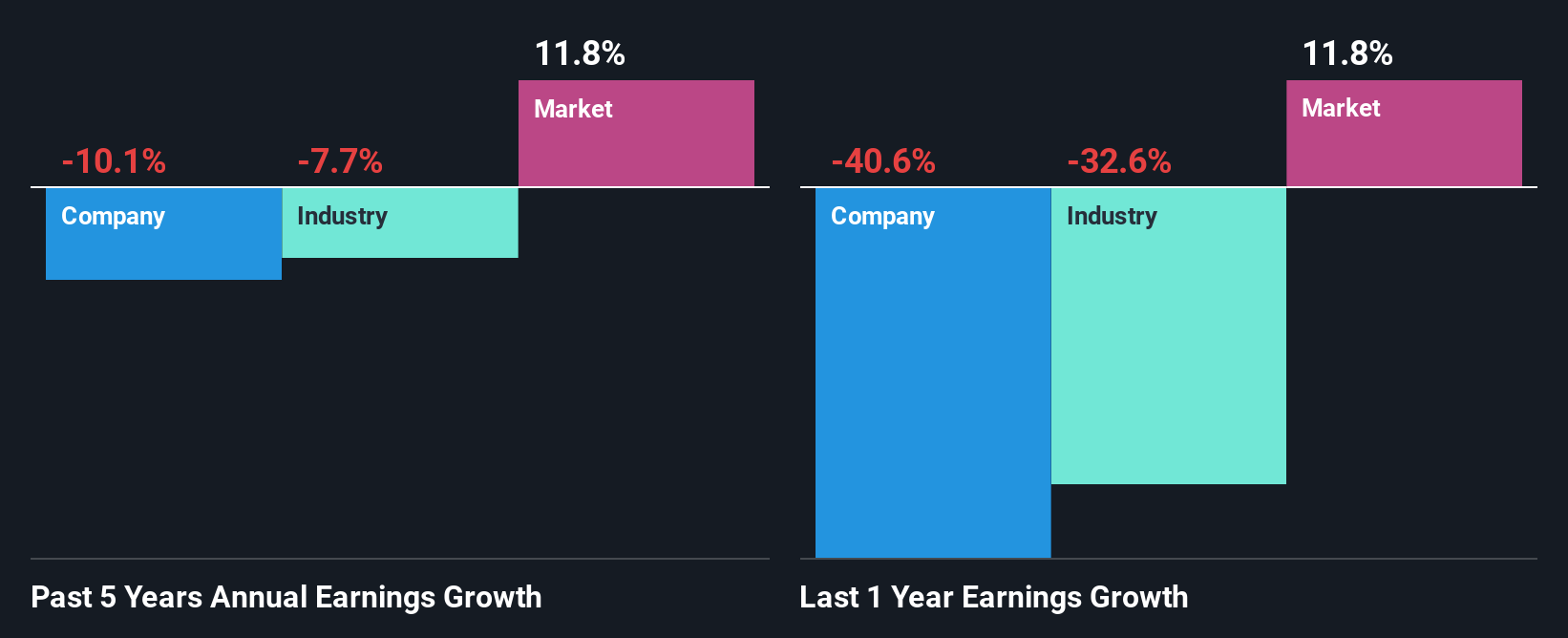

It is quite clear that Vale's ROE is rather low. Still, the company's ROE is higher than the average industry ROE of 10% so that's certainly interesting. But seeing Vale's five year net income decline of 10% over the past five years, we might rethink that. Remember, the company's ROE is quite low to begin with, just that it is higher than the industry average. Hence, this goes some way in explaining the shrinking earnings.

Next, when we compared with the industry, which has shrunk its earnings at a rate of 7.7% in the same 5-year period, we still found Vale's performance to be quite bleak, because the company has been shrinking its earnings faster than the industry.

Earnings growth is a huge factor in stock valuation. What investors need to determine next is if the expected earnings growth, or the lack of it, is already built into the share price. This then helps them determine if the stock is placed for a bright or bleak future. Is Vale fairly valued compared to other companies? These 3 valuation measures might help you decide.

Is Vale Making Efficient Use Of Its Profits?

In spite of a normal three-year median payout ratio of 43% (that is, a retention ratio of 57%), the fact that Vale's earnings have shrunk is quite puzzling. So there might be other factors at play here which could potentially be hampering growth. For example, the business has faced some headwinds.

Additionally, Vale has paid dividends over a period of at least ten years, which means that the company's management is determined to pay dividends even if it means little to no earnings growth. Existing analyst estimates suggest that the company's future payout ratio is expected to drop to 28% over the next three years. Accordingly, the expected drop in the payout ratio explains the expected increase in the company's ROE to 16%, over the same period.

Summary

On the whole, we do feel that Vale has some positive attributes. However, while the company does have a decent ROE and a high profit retention, its earnings growth number is quite disappointing. This suggests that there might be some external threat to the business, that's hampering growth. Having said that, looking at current analyst estimates, we found that the company's earnings growth rate is expected to see a huge improvement. To know more about the latest analysts predictions for the company, check out this visualization of analyst forecasts for the company.

Mobile Infrastructure for Defense and Disaster

The next wave in robotics isn't humanoid. Its fully autonomous towers delivering 5G, ISR, and radar in under 30 minutes, anywhere.

Get the investor briefing before the next round of contracts

Sponsored On Behalf of CiTechNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:VALE3

Vale

Produces iron ore and nickel in Asia, the Americas, Europe, and internationally.

Excellent balance sheet second-rate dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Deep Value Multi Bagger Opportunity

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Trending Discussion