- Brazil

- /

- Personal Products

- /

- BOVESPA:NTCO3

Natura &Co Holding (BVMF:NTCO3) investors are sitting on a loss of 71% if they invested five years ago

Long term investing works well, but it doesn't always work for each individual stock. We really hate to see fellow investors lose their hard-earned money. For example, we sympathize with anyone who was caught holding Natura &Co Holding S.A. (BVMF:NTCO3) during the five years that saw its share price drop a whopping 72%. And some of the more recent buyers are probably worried, too, with the stock falling 24% in the last year. Shareholders have had an even rougher run lately, with the share price down 15% in the last 90 days. Of course, this share price action may well have been influenced by the 9.2% decline in the broader market, throughout the period.

Now let's have a look at the company's fundamentals, and see if the long term shareholder return has matched the performance of the underlying business.

View our latest analysis for Natura &Co Holding

There is no denying that markets are sometimes efficient, but prices do not always reflect underlying business performance. By comparing earnings per share (EPS) and share price changes over time, we can get a feel for how investor attitudes to a company have morphed over time.

We know that Natura &Co Holding has been profitable in the past. However, it made a loss in the last twelve months, suggesting profit may be an unreliable metric at this stage. Other metrics might give us a better handle on how its value is changing over time.

The steady dividend doesn't really explain why the share price is down. It's not immediately clear to us why the stock price is down but further research might provide some answers.

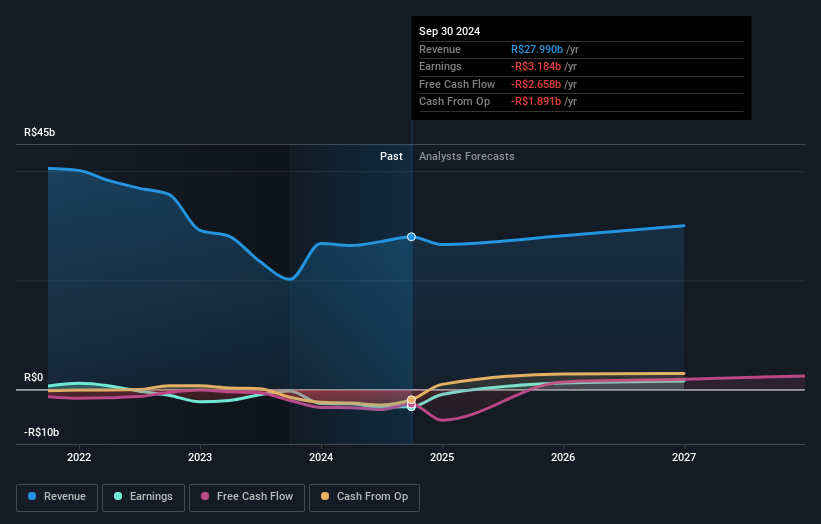

The image below shows how earnings and revenue have tracked over time (if you click on the image you can see greater detail).

Natura &Co Holding is a well known stock, with plenty of analyst coverage, suggesting some visibility into future growth. So it makes a lot of sense to check out what analysts think Natura &Co Holding will earn in the future (free analyst consensus estimates)

A Different Perspective

While the broader market lost about 7.0% in the twelve months, Natura &Co Holding shareholders did even worse, losing 21% (even including dividends). Having said that, it's inevitable that some stocks will be oversold in a falling market. The key is to keep your eyes on the fundamental developments. Unfortunately, longer term shareholders are suffering worse, given the loss of 11% doled out over the last five years. We'd need to see some sustained improvements in the key metrics before we could muster much enthusiasm. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For example, we've discovered 1 warning sign for Natura &Co Holding that you should be aware of before investing here.

If you are like me, then you will not want to miss this free list of undervalued small caps that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

If you're looking to trade Natura &Co Holding, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Natura &Co Holding might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:NTCO3

Natura &Co Holding

Engages in the manufacturing, distribution, and sale of cosmetics, fragrances, and personal care products in Brazil, Asia, Europe, North America, South America, the Middle East, Africa, and Oceania.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives