- Brazil

- /

- Specialty Stores

- /

- BOVESPA:UGPA3

Ultrapar Participações S.A. Just Reported A Surprise Loss: Here's What Analysts Think Will Happen Next

Ultrapar Participações S.A. (BVMF:UGPA3) shareholders are probably feeling a little disappointed, since its shares fell 8.8% to R$15.59 in the week after its latest quarterly results. Revenues came in at R$29b, in line with estimates, while Ultrapar Participações reported a statutory loss of R$0.028 per share, well short of prior analyst forecasts for a profit. The analysts typically update their forecasts at each earnings report, and we can judge from their estimates whether their view of the company has changed or if there are any new concerns to be aware of. With this in mind, we've gathered the latest statutory forecasts to see what the analysts are expecting for next year.

See our latest analysis for Ultrapar Participações

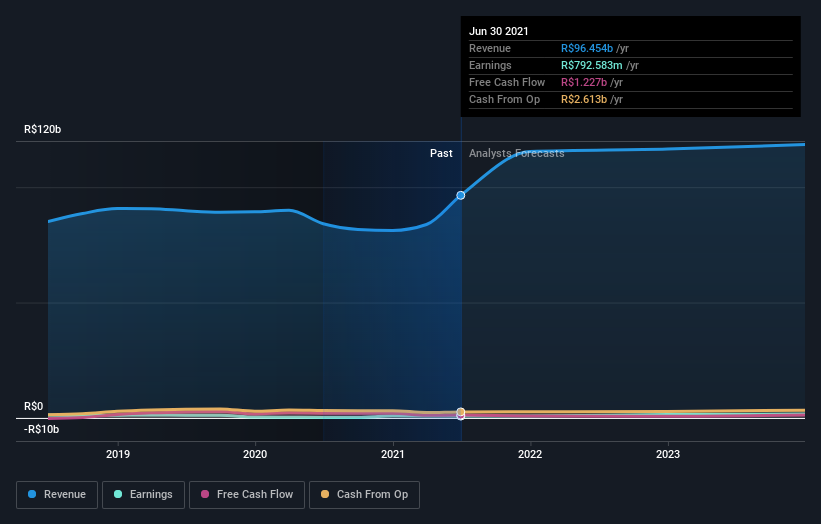

Taking into account the latest results, the current consensus from Ultrapar Participações' eleven analysts is for revenues of R$115.4b in 2021, which would reflect a decent 20% increase on its sales over the past 12 months. Per-share earnings are expected to shoot up 21% to R$0.88. In the lead-up to this report, the analysts had been modelling revenues of R$108.1b and earnings per share (EPS) of R$0.92 in 2021. So it's pretty clear consensus is mixed on Ultrapar Participações after the latest results; whilethe analysts lifted revenue numbers, they also administered a small dip in per-share earnings expectations.

There's been no major changes to the price target of R$23.52, suggesting that the impact of higher forecast sales and lower earnings won't result in a meaningful change to the business' valuation. That's not the only conclusion we can draw from this data however, as some investors also like to consider the spread in estimates when evaluating analyst price targets. The most optimistic Ultrapar Participações analyst has a price target of R$28.00 per share, while the most pessimistic values it at R$20.60. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

One way to get more context on these forecasts is to look at how they compare to both past performance, and how other companies in the same industry are performing. The analysts are definitely expecting Ultrapar Participações' growth to accelerate, with the forecast 43% annualised growth to the end of 2021 ranking favourably alongside historical growth of 3.0% per annum over the past five years. By contrast, our data suggests that other companies (with analyst coverage) in a similar industry are forecast to grow their revenue at 4.1% per year. Factoring in the forecast acceleration in revenue, it's pretty clear that Ultrapar Participações is expected to grow much faster than its industry.

The Bottom Line

The most important thing to take away is that the analysts downgraded their earnings per share estimates, showing that there has been a clear decline in sentiment following these results. Happily, they also upgraded their revenue estimates, and are forecasting revenues to grow faster than the wider industry. There was no real change to the consensus price target, suggesting that the intrinsic value of the business has not undergone any major changes with the latest estimates.

Keeping that in mind, we still think that the longer term trajectory of the business is much more important for investors to consider. We have forecasts for Ultrapar Participações going out to 2023, and you can see them free on our platform here.

Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Ultrapar Participações (1 makes us a bit uncomfortable) you should be aware of.

If you’re looking to trade a wide range of investments, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BOVESPA:UGPA3

Ultrapar Participações

Through its subsidiaries, operates in the energy, mobility, and infrastructure business in Brazil.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Hitit Bilgisayar Hizmetleri will achieve a 19.7% revenue boost in the next five years

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)