- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:RADL3

Here's Why Raia Drogasil (BVMF:RADL3) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

Despite being in the age of tech-stock blue-sky investing, many investors still adopt a more traditional strategy; buying shares in profitable companies like Raia Drogasil (BVMF:RADL3). While profit isn't the sole metric that should be considered when investing, it's worth recognising businesses that can consistently produce it.

Check out the opportunities and risks within the BR Consumer Retailing industry.

How Fast Is Raia Drogasil Growing Its Earnings Per Share?

Even modest earnings per share growth (EPS) can create meaningful value, when it is sustained reliably from year to year. So it's easy to see why many investors focus in on EPS growth. Raia Drogasil boosted its trailing twelve month EPS from R$0.45 to R$0.53, in the last year. That's a 19% gain; respectable growth in the broader scheme of things.

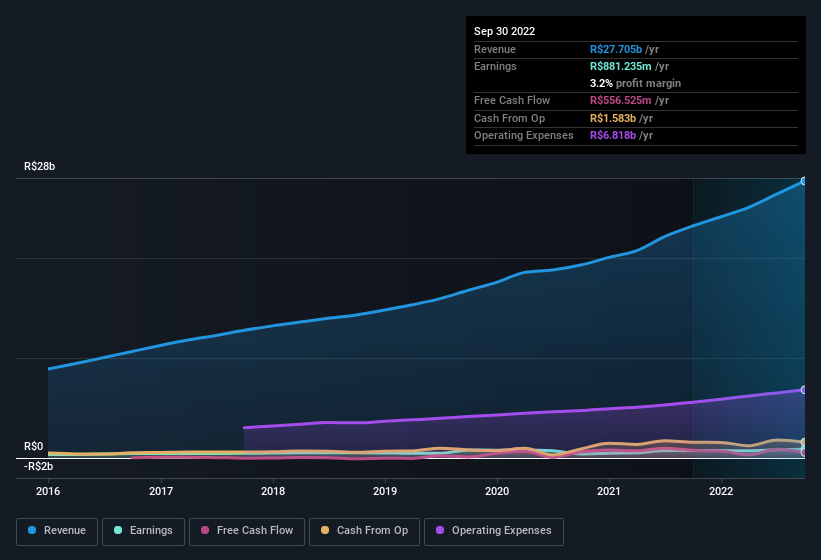

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. While we note Raia Drogasil achieved similar EBIT margins to last year, revenue grew by a solid 19% to R$28b. That's a real positive.

The chart below shows how the company's bottom and top lines have progressed over time. To see the actual numbers, click on the chart.

The trick, as an investor, is to find companies that are going to perform well in the future, not just in the past. While crystal balls don't exist, you can check our visualization of consensus analyst forecasts for Raia Drogasil's future EPS 100% free.

Are Raia Drogasil Insiders Aligned With All Shareholders?

Since Raia Drogasil has a market capitalisation of R$40b, we wouldn't expect insiders to hold a large percentage of shares. But we are reassured by the fact they have invested in the company. Indeed, they have a considerable amount of wealth invested in it, currently valued at R$7.7b. Coming in at 20% of the business, that holding gives insiders a lot of influence, and plenty of reason to generate value for shareholders. Very encouraging.

Is Raia Drogasil Worth Keeping An Eye On?

One important encouraging feature of Raia Drogasil is that it is growing profits. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. While we've looked at the quality of the earnings, we haven't yet done any work to value the stock. So if you like to buy cheap, you may want to check if Raia Drogasil is trading on a high P/E or a low P/E, relative to its industry.

Although Raia Drogasil certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see insider buying, then this free list of growing companies that insiders are buying, could be exactly what you're looking for.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:RADL3

Raia Drogasil

Engages in the retail sale of medicines, perfumery, personal care and beauty products, cosmetics, dermocosmetics, and specialty medicines in Brazil.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives