- Brazil

- /

- Food and Staples Retail

- /

- BOVESPA:PCAR3

The three-year returns have been respectable for Companhia Brasileira De Distribuicao (BVMF:PCAR3) shareholders despite underlying losses increasing

It's nice to see the Companhia Brasileira De Distribuicao (BVMF:PCAR3) share price up 11% in a week. We really hope anyone holding through that price crash has a diversified portfolio. Even when you lose money, you don't have to lose the lesson.

The recent uptick of 11% could be a positive sign of things to come, so let's take a look at historical fundamentals.

Check out our latest analysis for Companhia Brasileira De Distribuicao

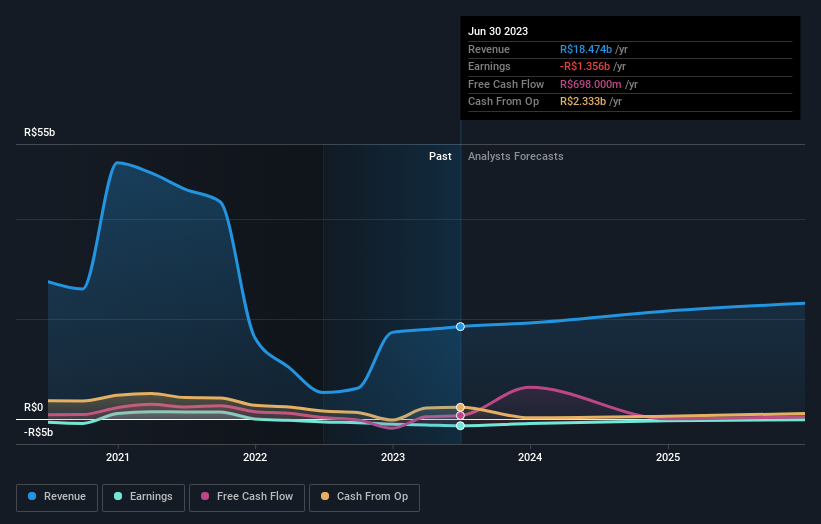

Companhia Brasileira De Distribuicao wasn't profitable in the last twelve months, it is unlikely we'll see a strong correlation between its share price and its earnings per share (EPS). Arguably revenue is our next best option. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. As you can imagine, fast revenue growth, when maintained, often leads to fast profit growth.

In the last three years Companhia Brasileira De Distribuicao saw its revenue shrink by 40% per year. That means its revenue trend is very weak compared to other loss making companies. The swift share price decline at an annual compound rate of 25%, reflects this weak fundamental performance. Never forget that loss making companies with falling revenue can and do cause losses for everyday investors. It's worth remembering that investors call buying a steeply falling share price 'catching a falling knife' because it is a dangerous pass time.

The company's revenue and earnings (over time) are depicted in the image below (click to see the exact numbers).

If you are thinking of buying or selling Companhia Brasileira De Distribuicao stock, you should check out this FREE detailed report on its balance sheet.

What About The Total Shareholder Return (TSR)?

Investors should note that there's a difference between Companhia Brasileira De Distribuicao's total shareholder return (TSR) and its share price change, which we've covered above. The TSR is a return calculation that accounts for the value of cash dividends (assuming that any dividend received was reinvested) and the calculated value of any discounted capital raisings and spin-offs. Dividends have been really beneficial for Companhia Brasileira De Distribuicao shareholders, and that cash payout contributed to why its TSR of 60%, over the last 3 years, is better than the share price return.

A Different Perspective

Companhia Brasileira De Distribuicao shareholders are down 35% for the year, but the broader market is up 1.8%. Of course the long term matters more than the short term, and even great stocks will sometimes have a poor year. Fortunately the longer term story is brighter, with total returns averaging about 17% per year over three years. Sometimes when a good quality long term winner has a weak period, it's turns out to be an opportunity, but you really need to be sure that the quality is there. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. For instance, we've identified 1 warning sign for Companhia Brasileira De Distribuicao that you should be aware of.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Brazilian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About BOVESPA:PCAR3

Companhia Brasileira De Distribuicao

Operates supermarkets, specialized stores, and department stores in Brazil.

Good value with very low risk.

Market Insights

Community Narratives