The external fund manager backed by Berkshire Hathaway's Charlie Munger, Li Lu, makes no bones about it when he says 'The biggest investment risk is not the volatility of prices, but whether you will suffer a permanent loss of capital.' It's only natural to consider a company's balance sheet when you examine how risky it is, since debt is often involved when a business collapses. As with many other companies Chimimport AD (BUL:CHIM) makes use of debt. But the more important question is: how much risk is that debt creating?

Why Does Debt Bring Risk?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. In the worst case scenario, a company can go bankrupt if it cannot pay its creditors. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. Of course, debt can be an important tool in businesses, particularly capital heavy businesses. When we examine debt levels, we first consider both cash and debt levels, together.

View our latest analysis for Chimimport AD

What Is Chimimport AD's Net Debt?

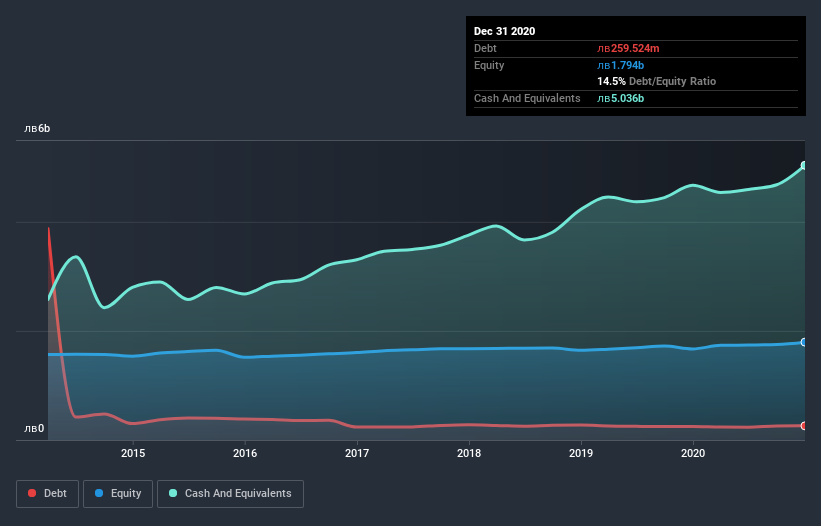

As you can see below, at the end of December 2020, Chimimport AD had лв259.5m of debt, up from лв248.3m a year ago. Click the image for more detail. However, it does have лв5.04b in cash offsetting this, leading to net cash of лв4.78b.

A Look At Chimimport AD's Liabilities

We can see from the most recent balance sheet that Chimimport AD had liabilities of лв563.8m falling due within a year, and liabilities of лв8.38b due beyond that. On the other hand, it had cash of лв5.04b and лв3.28b worth of receivables due within a year. So it has liabilities totalling лв630.9m more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the лв213.0m company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we'd watch its balance sheet closely, without a doubt. After all, Chimimport AD would likely require a major re-capitalisation if it had to pay its creditors today. Given that Chimimport AD has more cash than debt, we're pretty confident it can handle its debt, despite the fact that it has a lot of liabilities in total.

Importantly, Chimimport AD's EBIT fell a jaw-dropping 50% in the last twelve months. If that earnings trend continues then paying off its debt will be about as easy as herding cats on to a roller coaster. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Chimimport AD will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

Finally, while the tax-man may adore accounting profits, lenders only accept cold hard cash. Chimimport AD may have net cash on the balance sheet, but it is still interesting to look at how well the business converts its earnings before interest and tax (EBIT) to free cash flow, because that will influence both its need for, and its capacity to manage debt. Over the last three years, Chimimport AD actually produced more free cash flow than EBIT. There's nothing better than incoming cash when it comes to staying in your lenders' good graces.

Summing up

While Chimimport AD does have more liabilities than liquid assets, it also has net cash of лв4.78b. And it impressed us with free cash flow of лв237m, being 266% of its EBIT. Despite the cash, we do find Chimimport AD's level of total liabilities concerning, so we're not particularly comfortable with the stock. When analysing debt levels, the balance sheet is the obvious place to start. However, not all investment risk resides within the balance sheet - far from it. Be aware that Chimimport AD is showing 2 warning signs in our investment analysis , and 1 of those is concerning...

If, after all that, you're more interested in a fast growing company with a rock-solid balance sheet, then check out our list of net cash growth stocks without delay.

When trading Chimimport AD or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About BUL:CHIM

Chimimport AD

Engages in the acquisition, management, and sale of shares in Bulgarian and foreign companies.

Solid track record with excellent balance sheet.

Market Insights

Community Narratives