The simplest way to invest in stocks is to buy exchange traded funds. But if you pick the right individual stocks, you could make more than that. For example, the Crescent NV (EBR:OPTI) share price is up 36% in the last year, clearly besting the market return of around 17% (not including dividends). If it can keep that out-performance up over the long term, investors will do very well! Note that businesses generally develop over the long term, so the returns over the last year might not reflect a long term trend.

See our latest analysis for Crescent

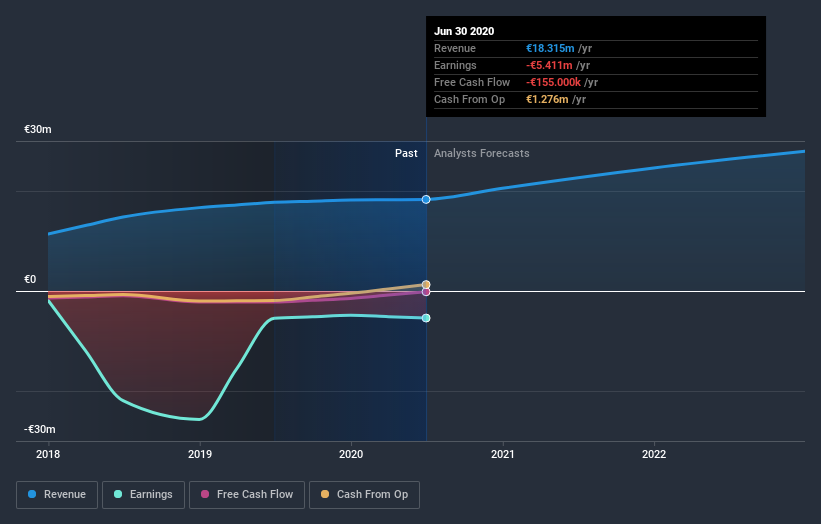

Because Crescent made a loss in the last twelve months, we think the market is probably more focussed on revenue and revenue growth, at least for now. Generally speaking, companies without profits are expected to grow revenue every year, and at a good clip. That's because fast revenue growth can be easily extrapolated to forecast profits, often of considerable size.

Crescent grew its revenue by 3.2% last year. That's not a very high growth rate considering it doesn't make profits. In keeping with the revenue growth, the share price gained 36% in that time. That's not a standout result, but it is solid - much like the level of revenue growth. It could be worth keeping an eye on this one, especially if growth accelerates.

You can see how earnings and revenue have changed over time in the image below (click on the chart to see the exact values).

You can see how its balance sheet has strengthened (or weakened) over time in this free interactive graphic.

A Different Perspective

Crescent boasts a total shareholder return of 36% for the last year. Unfortunately the share price is down 3.0% over the last quarter. It may simply be that the share price got ahead of itself, although there may have been fundamental developments that are weighing on it. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Case in point: We've spotted 2 warning signs for Crescent you should be aware of.

We will like Crescent better if we see some big insider buys. While we wait, check out this free list of growing companies with considerable, recent, insider buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on BE exchanges.

When trading Crescent or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

About ENXTBR:OPTI

Crescent

Provides IoT technology, smart LED lighting, and integration services in Belgium and internationally.

Slight risk with concerning outlook.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)