- Belgium

- /

- Electronic Equipment and Components

- /

- ENXTBR:BAR

Top Three Dividend Stocks To Consider

Reviewed by Simply Wall St

As global markets continue to reach record highs, driven by domestic policy shifts and geopolitical developments, investors are increasingly looking for stability and income in their portfolios. In this context, dividend stocks stand out as a compelling option, offering potential for steady income streams while navigating the current economic landscape marked by tariff uncertainties and inflationary pressures.

Top 10 Dividend Stocks

| Name | Dividend Yield | Dividend Rating |

| Guaranty Trust Holding (NGSE:GTCO) | 7.01% | ★★★★★★ |

| Peoples Bancorp (NasdaqGS:PEBO) | 4.53% | ★★★★★★ |

| Wuliangye YibinLtd (SZSE:000858) | 3.22% | ★★★★★★ |

| GakkyushaLtd (TSE:9769) | 4.67% | ★★★★★★ |

| Padma Oil (DSE:PADMAOIL) | 7.18% | ★★★★★★ |

| Financial Institutions (NasdaqGS:FISI) | 4.46% | ★★★★★★ |

| Nihon Parkerizing (TSE:4095) | 3.91% | ★★★★★★ |

| FALCO HOLDINGS (TSE:4671) | 6.84% | ★★★★★★ |

| Premier Financial (NasdaqGS:PFC) | 4.44% | ★★★★★★ |

| Citizens & Northern (NasdaqCM:CZNC) | 5.44% | ★★★★★★ |

Click here to see the full list of 1956 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

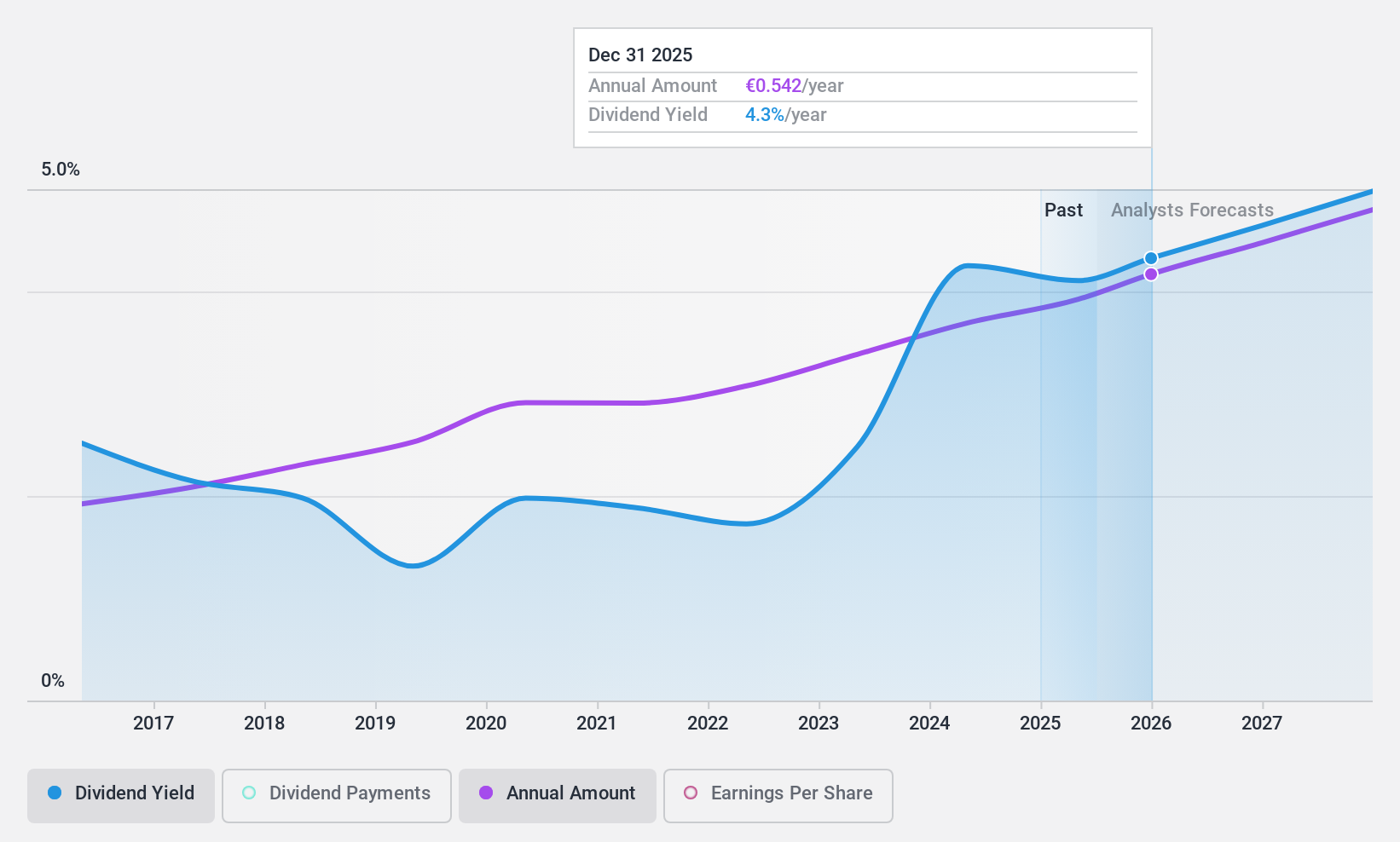

ING Groep (ENXTAM:INGA)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: ING Groep N.V. offers a range of banking products and services across the Netherlands, Belgium, Germany, other parts of Europe, and internationally, with a market cap of €45.97 billion.

Operations: ING Groep N.V.'s revenue is derived from its diverse banking operations across multiple regions, including the Netherlands, Belgium, Germany, and other international markets.

Dividend Yield: 7.3%

ING Groep's recent announcement of a special dividend, including a €500 million cash payout and a €2 billion share buyback, highlights its commitment to returning capital to shareholders. Despite this, the dividend coverage remains concerning with high payout ratios and earnings not fully covering dividends. The company's net income has declined compared to last year, impacting profit margins. However, ING's dividends have grown over the past decade but remain volatile and unreliable historically.

- Get an in-depth perspective on ING Groep's performance by reading our dividend report here.

- According our valuation report, there's an indication that ING Groep's share price might be on the cheaper side.

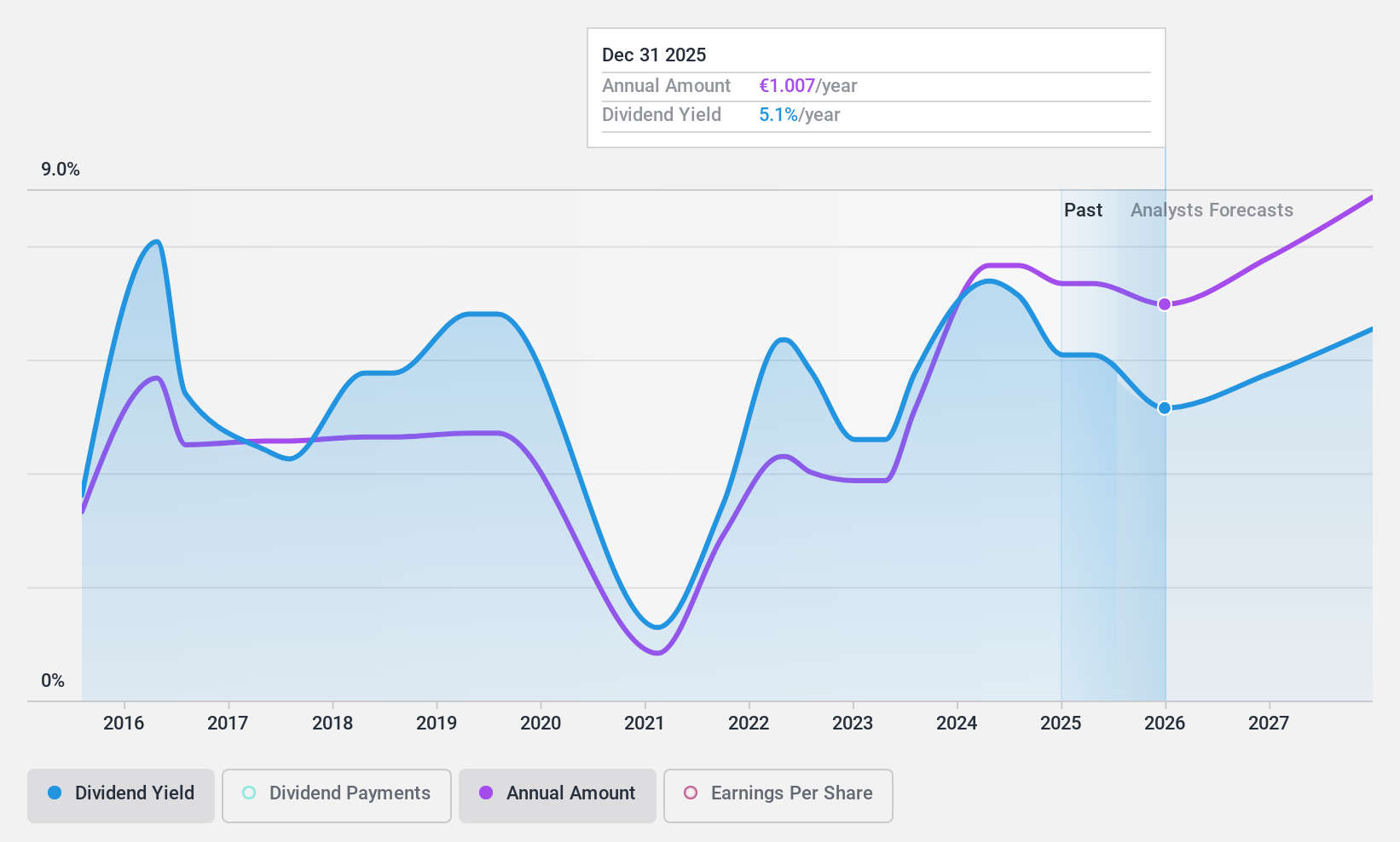

Barco (ENXTBR:BAR)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Barco NV, along with its subsidiaries, develops visualization solutions for the entertainment, enterprise, and healthcare markets across the Americas, Europe, Middle East, Africa, and Asia-Pacific regions with a market cap of €907.07 million.

Operations: Barco NV generates revenue from three primary segments: Entertainment (€422.79 million), Enterprise (€271.43 million), and Healthcare (€269.53 million).

Dividend Yield: 4.5%

Barco's dividends have shown consistent growth and stability over the past decade, supported by a sustainable payout ratio of 77.8% from earnings and 54% from cash flows. Despite offering a reliable yield of 4.51%, it falls short compared to Belgium's top dividend payers. Trading at a discount to its estimated fair value, Barco presents good relative value within its industry, with analysts predicting further stock price appreciation.

- Click to explore a detailed breakdown of our findings in Barco's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Barco shares in the market.

Bénéteau (ENXTPA:BEN)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Bénéteau S.A. designs, manufactures, and sells boats and leisure homes in France and internationally, with a market cap of €627.37 million.

Operations: Bénéteau S.A. generates its revenue primarily from its Boat segment, which accounts for €1.21 billion.

Dividend Yield: 9%

Bénéteau offers a high dividend yield of 9.02%, placing it in the top tier of French dividend payers, yet its payouts are not covered by free cash flows and have been volatile over the past decade. While trading at 73.6% below estimated fair value suggests good relative value, recent earnings show a decline with sales at €556.64 million compared to €812.91 million last year, indicating potential challenges for sustainable dividends.

- Take a closer look at Bénéteau's potential here in our dividend report.

- Our valuation report here indicates Bénéteau may be undervalued.

Taking Advantage

- Unlock more gems! Our Top Dividend Stocks screener has unearthed 1953 more companies for you to explore.Click here to unveil our expertly curated list of 1956 Top Dividend Stocks.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Barco might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:BAR

Barco

Develops visualization solutions for the entertainment, enterprise, and healthcare markets in the Americas, Europe, Middle East, Africa, and the Asia-Pacific.

Very undervalued with excellent balance sheet and pays a dividend.