Econocom Group SE (EBR:ECONB) Just Reported, And Analysts Assigned A €2.73 Price Target

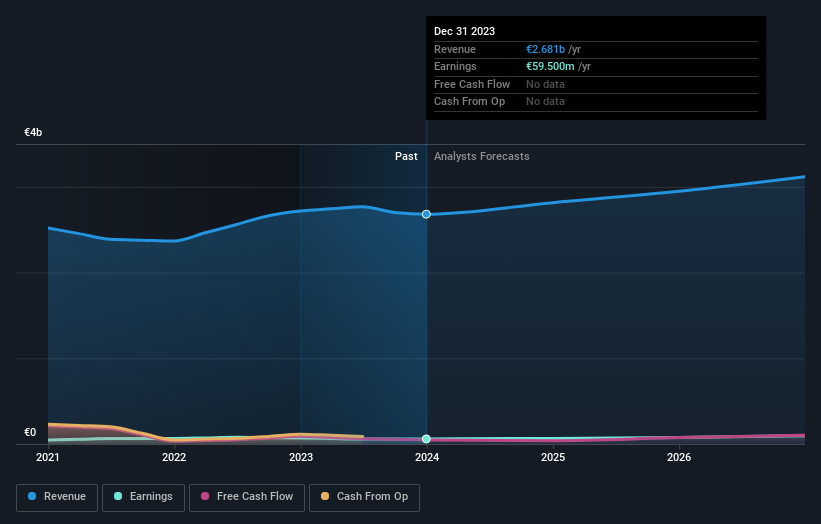

The annual results for Econocom Group SE (EBR:ECONB) were released last week, making it a good time to revisit its performance. It looks like the results were a bit of a negative overall. While revenues of €2.7b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 2.8% to hit €0.35 per share. Following the result, the analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. We thought readers would find it interesting to see the analysts latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Econocom Group

Following the latest results, Econocom Group's four analysts are now forecasting revenues of €2.82b in 2024. This would be a modest 5.0% improvement in revenue compared to the last 12 months. Yet prior to the latest earnings, the analysts had been anticipated revenues of €2.86b and earnings per share (EPS) of €0.36 in 2024. So we can see that while the consensus made no real change to its revenue estimates, it also no longer provides an earnings per share estimate. This suggests that revenues are what the market is focusing on after the latest results.

The average price target fell 9.9% to €2.73, withthe analysts clearly having become less optimistic about Econocom Group'sprospects following its latest earnings. There's another way to think about price targets though, and that's to look at the range of price targets put forward by analysts, because a wide range of estimates could suggest a diverse view on possible outcomes for the business. Currently, the most bullish analyst values Econocom Group at €3.30 per share, while the most bearish prices it at €2.30. Analysts definitely have varying views on the business, but the spread of estimates is not wide enough in our view to suggest that extreme outcomes could await Econocom Group shareholders.

Another way we can view these estimates is in the context of the bigger picture, such as how the forecasts stack up against past performance, and whether forecasts are more or less bullish relative to other companies in the industry. One thing stands out from these estimates, which is that Econocom Group is forecast to grow faster in the future than it has in the past, with revenues expected to display 5.0% annualised growth until the end of 2024. If achieved, this would be a much better result than the 3.0% annual decline over the past five years. Compare this against analyst estimates for the broader industry, which suggest that (in aggregate) industry revenues are expected to grow 6.9% annually for the foreseeable future. Although Econocom Group's revenues are expected to improve, it seems that the analysts are still bearish on the business, forecasting it to grow slower than the broader industry.

The Bottom Line

The most important thing to take away is that the analysts reconfirmed their revenue estimates for next year, suggesting that the business is performing in line with expectations. On the plus side, there were no major changes to revenue estimates; although forecasts imply they will perform worse than the wider industry. The consensus price target fell measurably, with the analysts seemingly not reassured by the latest results, leading to a lower estimate of Econocom Group's future valuation.

At least one of Econocom Group's four analysts has provided estimates out to 2026, which can be seen for free on our platform here.

However, before you get too enthused, we've discovered 1 warning sign for Econocom Group that you should be aware of.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Econocom Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:ECONB

Econocom Group

Designs and develops digital solutions for public and private companies in Belgium and internationally.

Undervalued with adequate balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)