In recent weeks, European markets have experienced a positive shift, with the pan-European STOXX Europe 600 Index rising by 2.10% as optimism grew following a de-escalation in the U.S.-China trade tensions. This environment presents an opportune moment to explore lesser-known small-cap stocks that could benefit from improving economic conditions and increased investor confidence. Identifying promising small caps often involves looking for companies with strong fundamentals and growth potential that may be overlooked in broader market rallies.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Flügger group | 20.98% | 3.24% | -29.82% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Alantra Partners | 3.79% | -3.99% | -23.83% | ★★★★★☆ |

| Viohalco | 91.31% | 12.25% | 17.37% | ★★★★☆☆ |

| Evergent Investments | 5.59% | 5.88% | 16.36% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| Inversiones Doalca SOCIMI | 15.57% | 6.53% | 7.16% | ★★★★☆☆ |

Here's a peek at a few of the choices from the screener.

REVO Insurance (BIT:REVO)

Simply Wall St Value Rating: ★★★★★☆

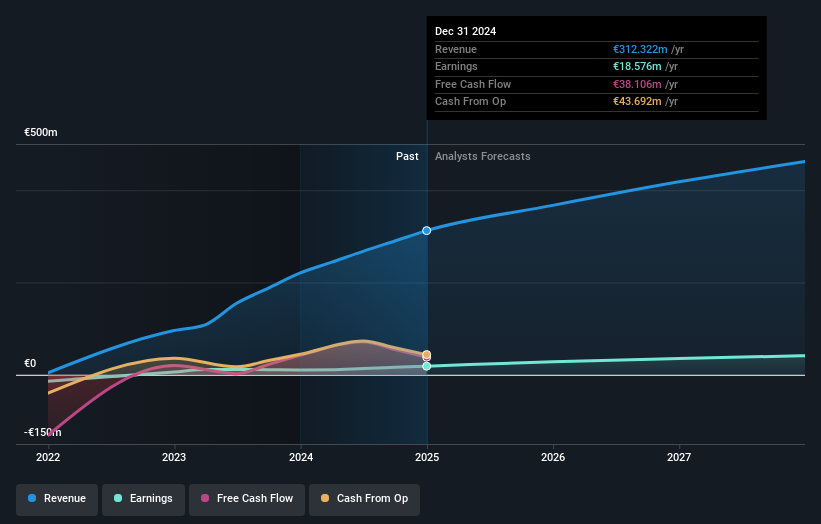

Overview: REVO Insurance S.p.A. is an Italian insurance company with a market capitalization of €368.42 million.

Operations: REVO Insurance generates revenue primarily from its Damage Management segment, which reported €317.62 million.

REVO Insurance, a nimble player in the European insurance sector, showcases impressive growth with earnings surging 75.8% last year, outpacing the industry's 9.7%. The company reported net income of €18.58 million for 2024, up from €10.57 million in 2023, reflecting robust performance and high-quality earnings. Debt-free for five years and boasting positive free cash flow of €71.73 million by mid-2024, REVO demonstrates financial resilience and operational efficiency. With a forecasted annual earnings growth rate of 24.33%, this insurer seems well-positioned to continue its upward trajectory amidst industry challenges.

- Take a closer look at REVO Insurance's potential here in our health report.

Gain insights into REVO Insurance's past trends and performance with our Past report.

Wereldhave Belgium (ENXTBR:WEHB)

Simply Wall St Value Rating: ★★★★☆☆

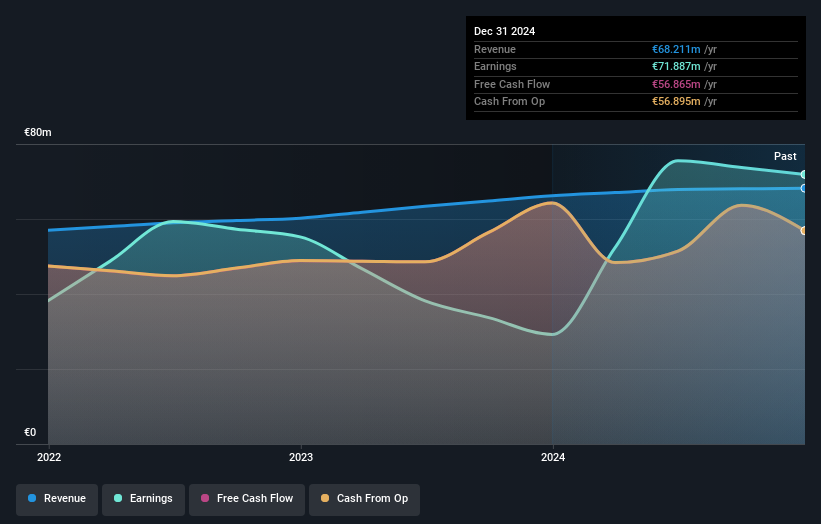

Overview: Wereldhave Belgium is a public regulated real estate company specializing in commercial property within Belgium, with a market capitalization of €475.24 million.

Operations: The company's primary revenue streams are derived from its retail and office segments, generating €62.55 million and €5.66 million, respectively.

Wereldhave Belgium, a smaller player in the European real estate market, is trading at 42.1% below its estimated fair value, suggesting potential undervaluation. The company has shown robust financial health with a net debt to equity ratio of 31.6%, considered satisfactory, and interest payments well covered by EBIT at six times coverage. Over the past year, earnings surged by 146%, significantly outpacing the Retail REITs industry average of 9.7%. However, recent results were impacted by a one-off gain of €29M as of December 2024. A dividend increase to €3.01 per share further indicates confidence in its cash flow stability.

- Click here and access our complete health analysis report to understand the dynamics of Wereldhave Belgium.

Evaluate Wereldhave Belgium's historical performance by accessing our past performance report.

Caisse Régionale de Crédit Agricole du Morbihan (ENXTPA:CMO)

Simply Wall St Value Rating: ★★★★★★

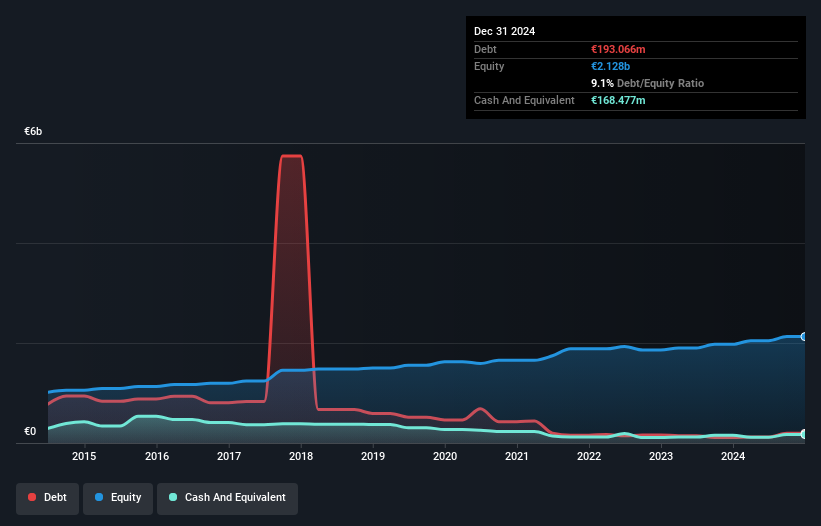

Overview: Caisse Régionale de Crédit Agricole du Morbihan offers a range of banking products and services to diverse clients including individuals, professionals, farmers, and businesses in France, with a market cap of €426.78 million.

Operations: Caisse Régionale de Crédit Agricole du Morbihan generates revenue primarily from its retail banking segment, amounting to €229.27 million.

Caisse Régionale de Crédit Agricole du Morbihan, with total assets of €13.7 billion and equity of €2.1 billion, showcases strong financial health. Total deposits stand at €11 billion against loans of €11.4 billion, indicating robust operations backed by primarily low-risk customer deposits (96% of liabilities). The company has a sufficient allowance for bad loans at 105%, while non-performing loans are kept in check at 1.8%. Earnings growth outpaced the industry average significantly last year with a 33% increase compared to the industry's 3.2%, highlighting its competitive edge in the market landscape.

Make It Happen

- Navigate through the entire inventory of 327 European Undiscovered Gems With Strong Fundamentals here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTPA:CMO

Caisse Régionale de Crédit Agricole du Morbihan

Provides various banking products and services to individuals, private banking, professionals, farmers, associations, businesses, and public community and social housing in France.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives