- Denmark

- /

- Life Sciences

- /

- CPSE:CHEMM

3 Undiscovered European Gems Including ChemoMetec

Reviewed by Simply Wall St

As European markets navigate the turbulence of intensified global trade tensions, with the pan-European STOXX Europe 600 Index recently ending 1.92% lower, investors are increasingly vigilant about the economic landscape and its impact on small-cap stocks. Despite these challenges, there remains potential for discovering promising opportunities within Europe's diverse market, where unique companies like ChemoMetec can offer intriguing prospects for those seeking to identify hidden gems amidst broader market volatility.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Linc | NA | 19.35% | 23.17% | ★★★★★★ |

| Martifer SGPS | 123.58% | -2.38% | 5.61% | ★★★★★★ |

| La Forestière Equatoriale | NA | -58.49% | 45.78% | ★★★★★★ |

| ABG Sundal Collier Holding | 8.55% | -4.14% | -12.38% | ★★★★★☆ |

| Sparta | NA | -5.54% | -15.40% | ★★★★★☆ |

| Dekpol | 73.04% | 15.36% | 16.35% | ★★★★★☆ |

| Procimmo Group | 157.49% | 0.65% | 4.94% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Castellana Properties Socimi | 53.49% | 6.64% | 21.96% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

Below we spotlight a couple of our favorites from our exclusive screener.

ChemoMetec (CPSE:CHEMM)

Simply Wall St Value Rating: ★★★★★★

Overview: ChemoMetec A/S specializes in the development, production, and sale of analytical equipment for cell counting and analysis across the United States, Canada, Europe, and other international markets with a market capitalization of DKK8.34 billion.

Operations: ChemoMetec generates revenue primarily from the sale of consumables, instruments, and services, with consumables contributing DKK208.76 million and instruments DKK142.83 million. The company's market capitalization stands at DKK8.34 billion.

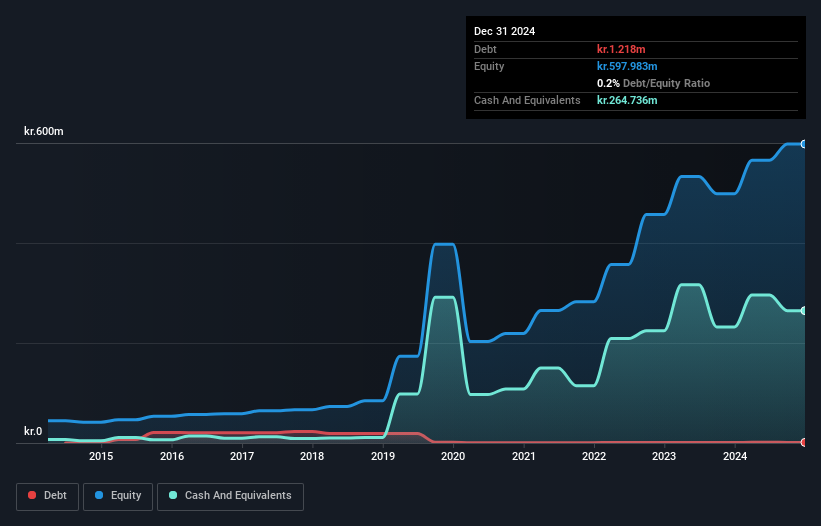

ChemoMetec, a nimble player in the life sciences sector, has showcased robust growth with earnings climbing 17.6% over the past year, outpacing the industry average of 7.5%. The company's debt to equity ratio has impressively halved from 0.4 to 0.2 over five years, reflecting prudent financial management. Recent half-year results reveal sales jumping to DKK 251 million from DKK 199 million and net income rising to DKK 103 million from DKK 71 million year-on-year. With high-quality earnings and a solid cash position exceeding total debt, ChemoMetec seems well-positioned for continued success in its niche market.

- Delve into the full analysis health report here for a deeper understanding of ChemoMetec.

Review our historical performance report to gain insights into ChemoMetec's's past performance.

Viohalco (ENXTBR:VIO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viohalco S.A. is a global manufacturer and seller of aluminium, copper, cables, and steel and steel pipe products through its subsidiaries, with a market capitalization of approximately €1.37 billion.

Operations: Viohalco generates revenue primarily through the sale of aluminium, copper, cables, and steel products. The company's net profit margin is a key financial metric to consider when evaluating its profitability.

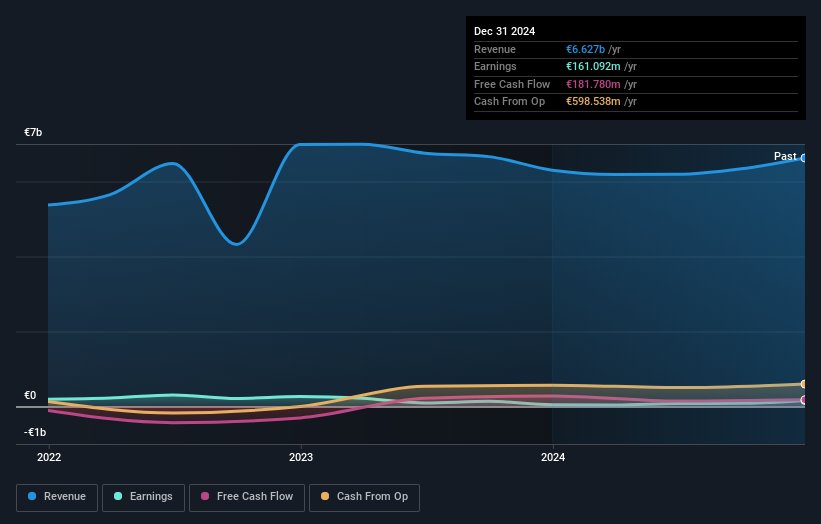

Viohalco, a notable player in the metals and mining sector, has shown impressive financial strides. Its debt to equity ratio decreased from 132.9% to 91.3% over five years, highlighting improved financial health. The company's earnings surged by 234% last year, significantly outpacing the industry's -6.1%. Despite high net debt to equity at 61.8%, Viohalco remains profitable with free cash flow positive status and trades at a substantial discount of 53% below estimated fair value. Recent results revealed sales of €6.63 billion and net income of €161 million for 2024, alongside a proposed dividend payout totaling nearly €42 million.

- Click here to discover the nuances of Viohalco with our detailed analytical health report.

Assess Viohalco's past performance with our detailed historical performance reports.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative (ENXTPA:CRBP2)

Simply Wall St Value Rating: ★★★★★★

Overview: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative offers diverse banking and financial services to various customer segments in France, with a market cap of €1.14 billion.

Operations: Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative generates revenue primarily from its retail banking segment, amounting to €624.79 million. The company operates with a market cap of €1.14 billion, reflecting its significant presence in the financial services sector in France.

Caisse Régionale de Crédit Agricole Mutuel Brie Picardie, a cooperative with total assets of €41 billion and equity of €5.4 billion, is trading at 52.8% below its estimated fair value. Despite earnings growth over the past year being just 0.07%, it has maintained high-quality earnings and a sufficient allowance for bad loans at 110%. The bank's liabilities are primarily low-risk, with customer deposits making up 93%. Total loans stand at €33.9 billion against deposits of €33 billion, indicating robust funding sources. Earnings have grown by an average of 7.2% annually over the last five years, suggesting steady performance amidst industry challenges.

Taking Advantage

- Click through to start exploring the rest of the 353 European Undiscovered Gems With Strong Fundamentals now.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About CPSE:CHEMM

ChemoMetec

Engages in the development, production, and sale of analytical equipment for cell counting and analysis the United States, Canada, Europe, and internationally.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives