Amid the backdrop of trade tensions and economic fluctuations, European markets have shown resilience, with the pan-European STOXX Europe 600 Index ending 1.15% higher recently, buoyed by hopes for new trade deals. As investors navigate these complex dynamics, identifying small-cap stocks with strong potential requires a keen eye for companies that can capitalize on emerging opportunities and demonstrate robust fundamentals despite broader market uncertainties.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| AB Traction | NA | 5.39% | 5.24% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| La Forestière Equatoriale | NA | -65.30% | 37.55% | ★★★★★★ |

| Dekpol | 63.20% | 11.06% | 13.37% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| ABG Sundal Collier Holding | 46.02% | -6.02% | -15.62% | ★★★★☆☆ |

| Darwin | 3.03% | 84.88% | 5.63% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

| Eurofins-Cerep | 0.46% | 6.80% | 6.93% | ★★★★☆☆ |

| MCH Group | 124.09% | 12.40% | 43.58% | ★★★★☆☆ |

We're going to check out a few of the best picks from our screener tool.

Philogen (BIT:PHIL)

Simply Wall St Value Rating: ★★★★★★

Overview: Philogen S.p.A. is a biotechnology company focused on developing drugs for oncology and chronic inflammatory diseases, with a market capitalization of approximately €887.30 million.

Operations: Philogen generates revenue primarily from its biotechnology segment, amounting to €77.65 million. The company's financials reflect a focus on this core area without additional segment diversification.

Philogen, a small European biotech player, has recently become profitable and boasts a strong financial position with more cash than total debt. Over the past five years, its debt-to-equity ratio impressively dropped from 1.7 to 0.03, indicating prudent financial management. Despite this progress, earnings are projected to decrease by an average of 36.9% annually over the next three years. The company initiated share repurchases in May 2025 under a program allowing up to 902,195 shares or about 2.24% of its share capital to be bought back, aiming for strategic flexibility and liquidity support for Philogen stock amidst volatile market conditions.

- Click here to discover the nuances of Philogen with our detailed analytical health report.

Evaluate Philogen's historical performance by accessing our past performance report.

Viohalco (ENXTBR:VIO)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Viohalco S.A. is a diversified industrial company that, through its subsidiaries, engages in the manufacturing and sale of aluminium, copper, cables, steel, and steel pipe products with a market capitalization of €1.69 billion.

Operations: Viohalco generates revenue through the manufacturing and sale of aluminium, copper, cables, steel, and steel pipe products. The company's financial performance is influenced by its ability to manage production costs effectively.

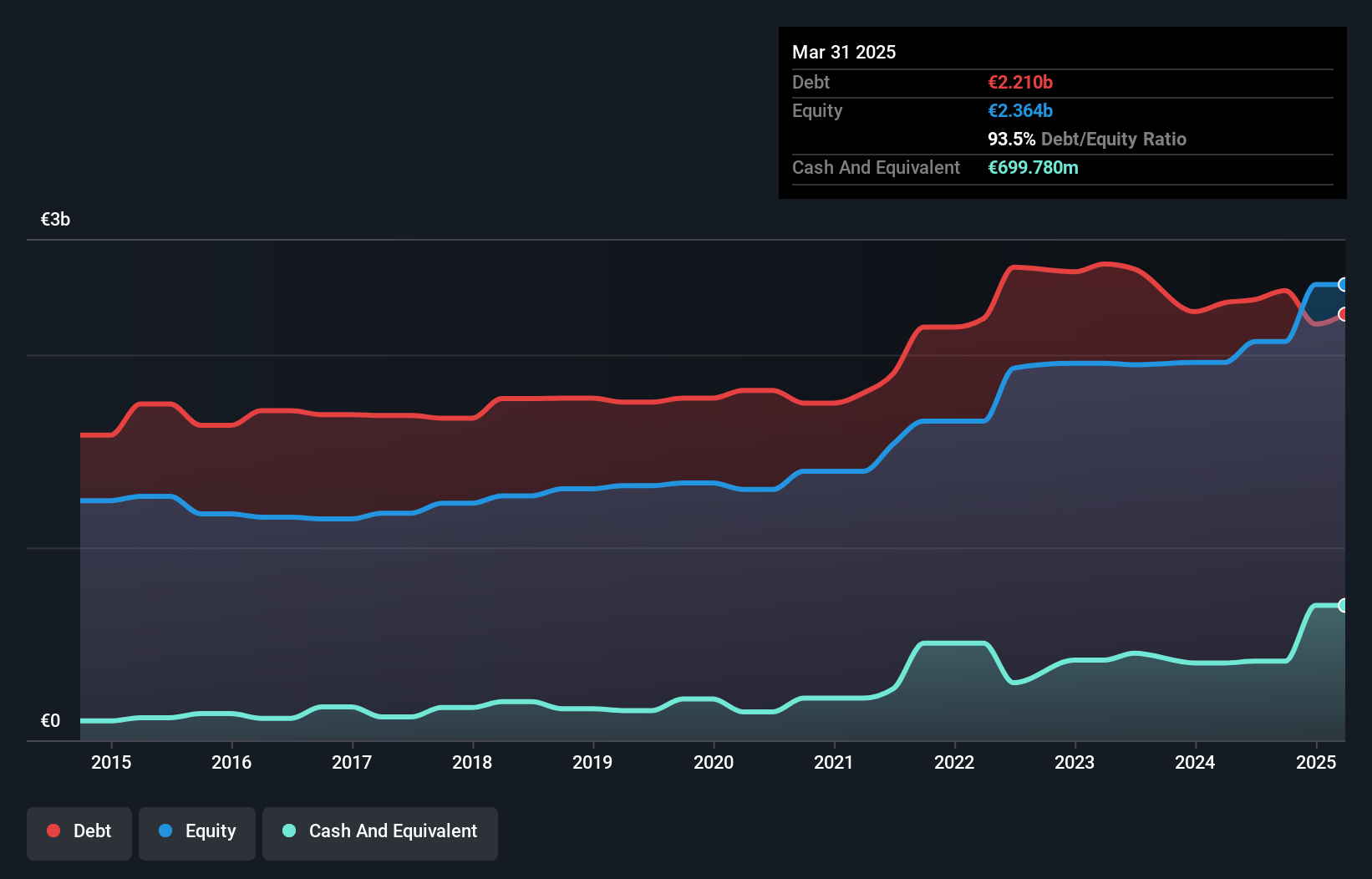

Viohalco, a dynamic player in the metals and mining sector, has shown impressive earnings growth of 336.9% over the past year, outpacing industry averages. Trading at 50.3% below its estimated fair value, it presents an intriguing valuation proposition. The company's debt to equity ratio has improved significantly from 139.5% to 93.5% over five years, though interest payments remain under pressure with EBIT covering them just 2.8 times—below the desired threshold of three times coverage. Recent financials highlight a robust net income jump to €40.29 million for Q1 2025 from €12.94 million previously, with sales reaching €930.93 million compared to €816.59 million last year.

- Click here and access our complete health analysis report to understand the dynamics of Viohalco.

Explore historical data to track Viohalco's performance over time in our Past section.

Bonheur (OB:BONHR)

Simply Wall St Value Rating: ★★★★★★

Overview: Bonheur ASA operates in the renewable energy, wind service, and cruise sectors across various regions including the United Kingdom, Norway, Europe, Asia, the Americas, and Africa with a market capitalization of NOK10.23 billion.

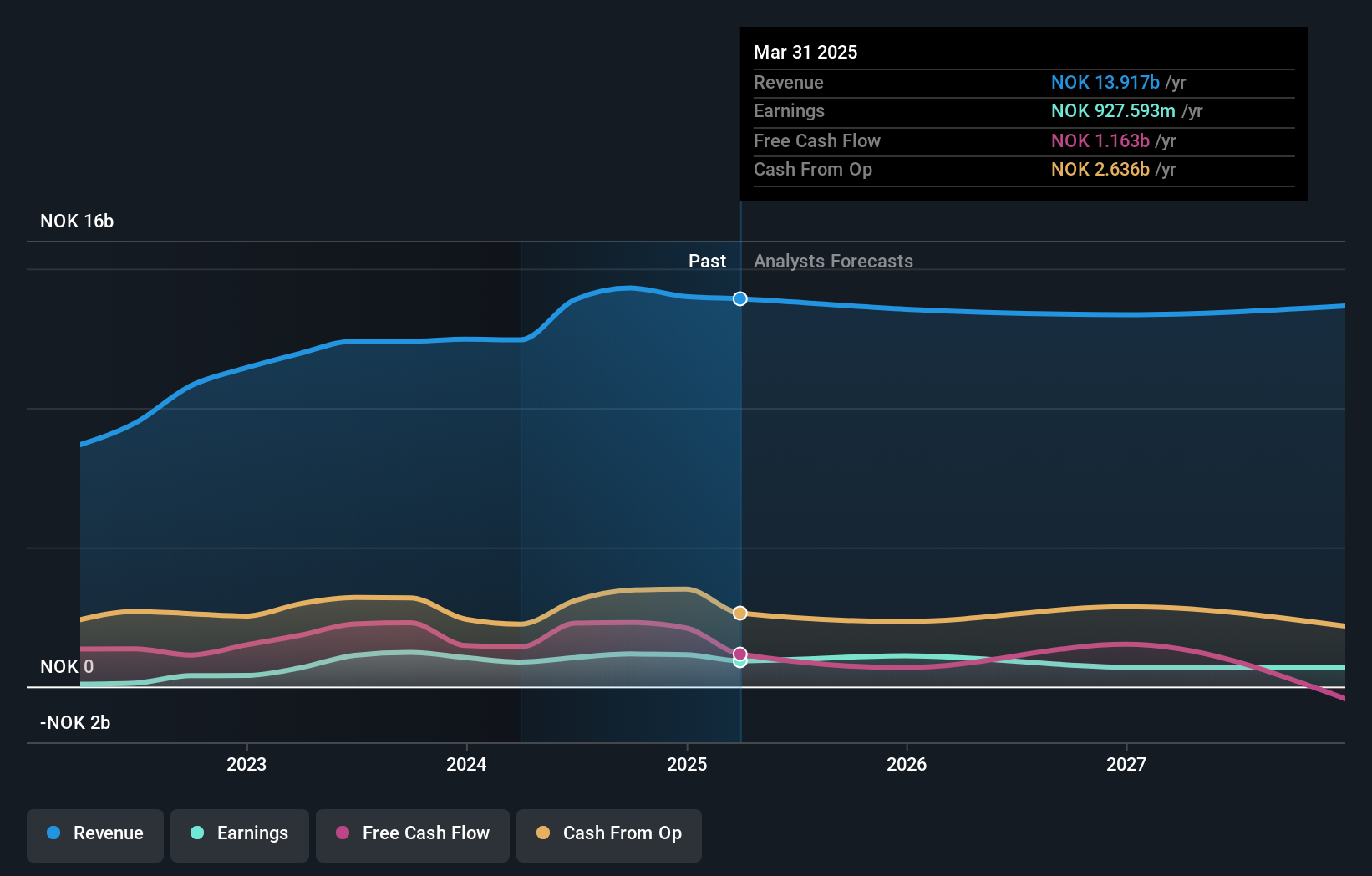

Operations: Bonheur ASA generates revenue primarily from its wind service segment at NOK5.38 billion and cruise operations at NOK3.65 billion, with additional contributions from renewable energy. The company's financial performance is influenced by these diverse revenue streams, where the wind service segment plays a significant role in driving overall income.

Bonheur, a notable player in the renewable energy sector, has seen its debt to equity ratio improve from 180.5% to 90.7% over five years, reflecting prudent financial management. Its net debt to equity ratio stands at a satisfactory 20.9%, with interest payments comfortably covered by EBIT at 3.8 times coverage. Despite earnings growth of 16.3% last year outpacing industry averages, analysts foresee an annual revenue dip of 0.2% and shrinking profit margins over the next three years; however, Bonheur's shares are trading below market value with a P/E ratio of 8.5x against Norway's average of 12.7x, suggesting potential upside for investors considering future earnings growth prospects amidst current challenges like operational downtime and regulatory hurdles.

Key Takeaways

- Unlock more gems! Our European Undiscovered Gems With Strong Fundamentals screener has unearthed 313 more companies for you to explore.Click here to unveil our expertly curated list of 316 European Undiscovered Gems With Strong Fundamentals.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About BIT:PHIL

Philogen

A biotechnology company, develops drugs for oncology and chronic inflammatory diseases in Switzerland and the European Union.

Flawless balance sheet with acceptable track record.

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Cheap if able to sustain revenue, and a potential bargain if able to turn store openings into revenue growth

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)