Floridienne And 2 Other Undiscovered Gems with Strong Fundamentals

Reviewed by Simply Wall St

As the pan-European STOXX Europe 600 Index remains relatively stable amid ongoing U.S. and European trade discussions, investors are keenly observing economic indicators such as the Eurozone's expanding industrial output and widening trade surplus. In this environment, identifying stocks with strong fundamentals becomes crucial for those seeking opportunities beyond the mainstream market movements.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Caisse Régionale de Crédit Agricole Mutuel Brie Picardie Société coopérative | 26.90% | 4.14% | 7.22% | ★★★★★★ |

| Martifer SGPS | 102.88% | -0.23% | 7.16% | ★★★★★★ |

| Caisse Regionale de Credit Agricole Mutuel Toulouse 31 | 19.46% | 0.47% | 7.14% | ★★★★★☆ |

| Decora | 18.47% | 11.59% | 10.86% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Viohalco | 93.48% | 11.98% | 14.19% | ★★★★☆☆ |

| Evergent Investments | 5.39% | 9.41% | 21.17% | ★★★★☆☆ |

| Practic | 5.21% | 4.49% | 7.23% | ★★★★☆☆ |

Let's review some notable picks from our screened stocks.

Floridienne (ENXTBR:FLOB)

Simply Wall St Value Rating: ★★★★★☆

Overview: Floridienne S.A. is a diversified company operating through its subsidiaries in the life sciences, food, and chemistry sectors both in Belgium and internationally, with a market capitalization of approximately €651.36 million.

Operations: Floridienne generates revenue primarily from its Life Sciences Division (€507.08 million), followed by the Food (€150.96 million) and Chemicals Divisions (€39.34 million).

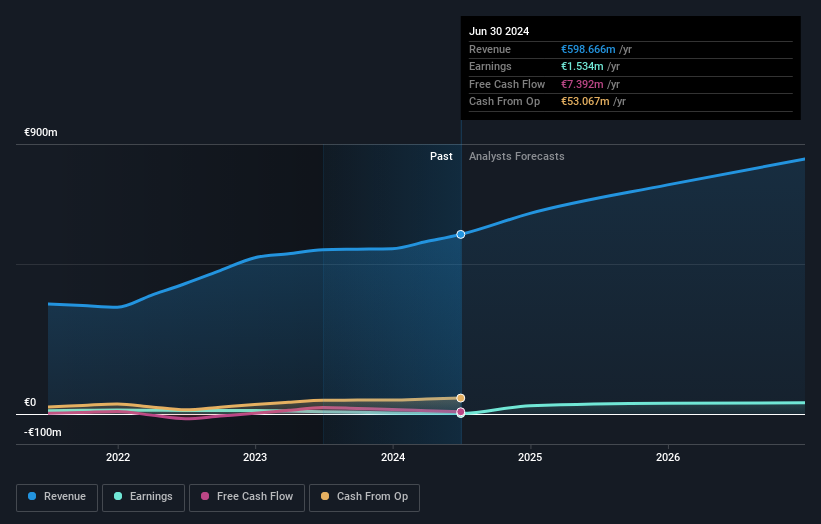

Floridienne, a promising player in its sector, has shown impressive growth with net income soaring to €15.74 million from €3.55 million the previous year. Revenue increased to €716.22 million from €558.76 million, reflecting robust business operations and market demand. The company's basic earnings per share jumped significantly to €16.07 from €3.62, indicating strong profitability improvements over the past year. Recently, Floridienne announced a cash dividend of €2.10 per share payable in July 2025, highlighting shareholder value focus and financial health that could attract attention in the European investment landscape.

- Click here and access our complete health analysis report to understand the dynamics of Floridienne.

Review our historical performance report to gain insights into Floridienne's's past performance.

Lindex Group Oyj (HLSE:LINDEX)

Simply Wall St Value Rating: ★★★★☆☆

Overview: Lindex Group Oyj operates in the retail sector, offering its products both in Finland and internationally, with a market capitalization of approximately €464.24 million.

Operations: Lindex Group Oyj generates revenue primarily from its Lindex segment, contributing €627 million, and its Stockmann segment, adding €309 million. The company's net profit margin reflects the efficiency of its operations in translating revenue into profit.

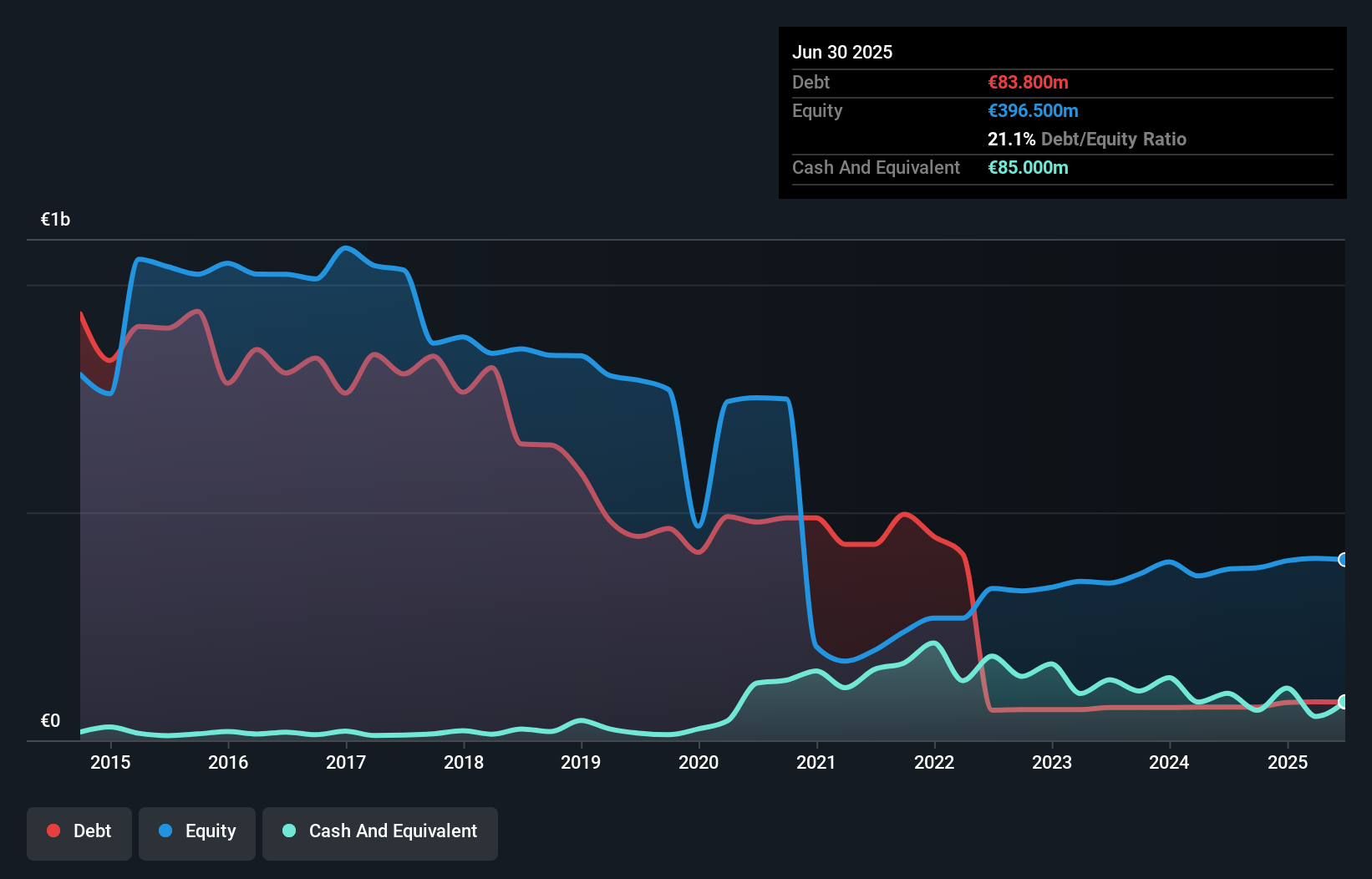

Lindex Group Oyj, a smaller player in the European retail scene, has been navigating its restructuring program while focusing on digital and omnichannel investments. Over the past year, earnings have surged by 45%, outpacing industry growth of 20.2%. Despite this progress, Lindex reported a net loss of EUR 7.1 million for H1 2025 against EUR 8.4 million last year, with sales slightly down to EUR 439.9 million from EUR 444.4 million. The company’s debt-to-equity ratio improved significantly from 63.7% to just over a fifth over five years, indicating better financial health amidst ongoing market challenges and strategic shifts.

Inwido (OM:INWI)

Simply Wall St Value Rating: ★★★★★★

Overview: Inwido AB (publ) is a company that, through its subsidiaries, focuses on the development, manufacture, and sale of windows and doors in Sweden with a market capitalization of SEK10.56 billion.

Operations: Inwido generates revenue primarily from its Scandinavia segment, contributing SEK 4.31 billion, followed by Western Europe at SEK 1.85 billion and Eastern Europe at SEK 1.79 billion. The E-Commerce segment adds another SEK 1.10 billion to the total revenue streams.

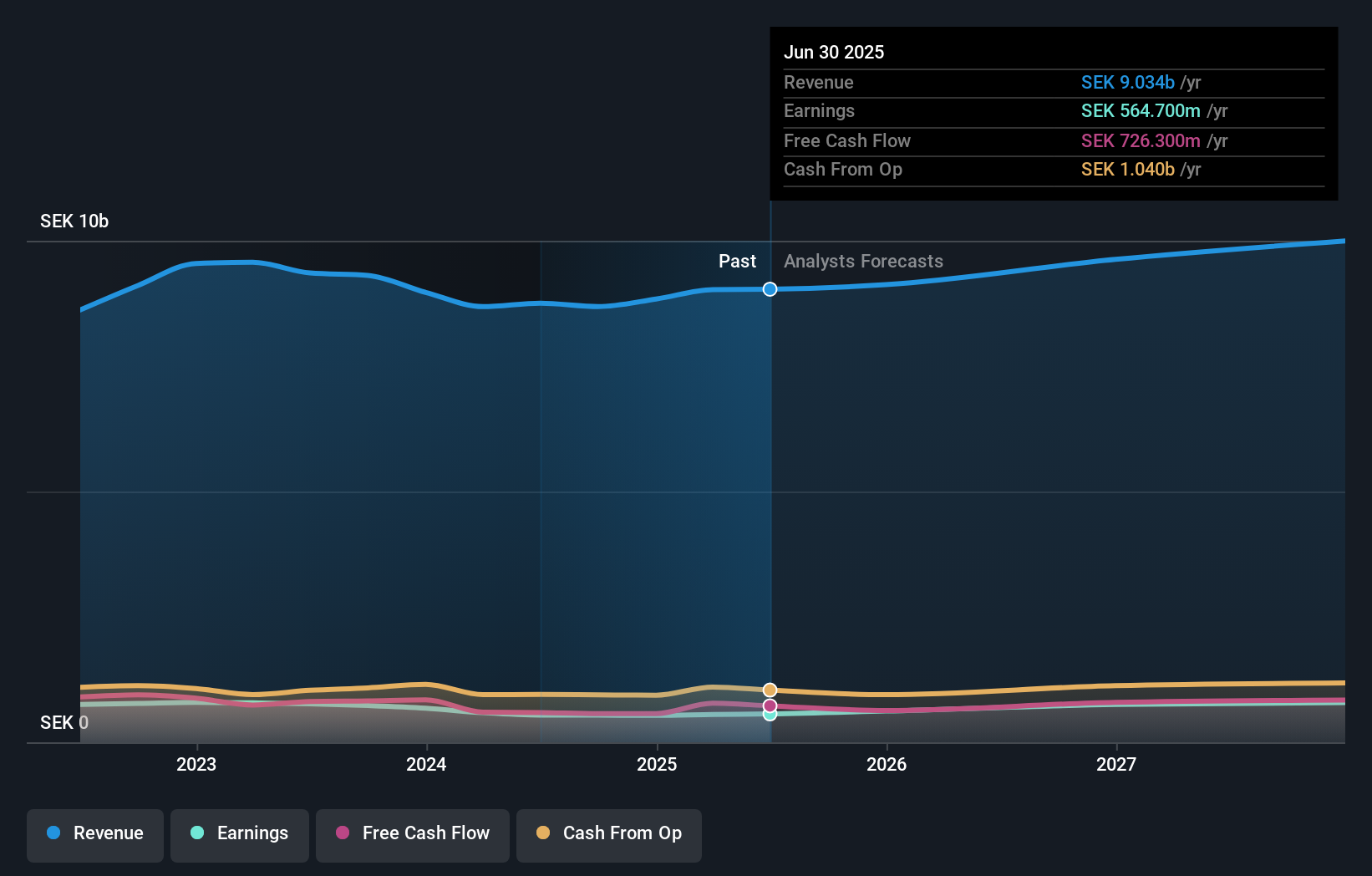

Inwido, a notable player in the European market, is trading at 38.3% below its estimated fair value, showcasing potential for savvy investors. With earnings growth of 4.2% over the past year and a debt to equity reduction from 56.2% to 30.9%, this company demonstrates financial resilience and strategic management. Interest payments are well covered by EBIT at an impressive 11.9x coverage, further indicating solid fiscal health. Recent results show net income for Q2 rose to SEK155.9 million from SEK146.3 million last year, with basic earnings per share increasing to SEK2.69 from SEK2.52, reflecting steady performance despite market challenges.

Where To Now?

- Click through to start exploring the rest of the 319 European Undiscovered Gems With Strong Fundamentals now.

- Have you diversified into these companies? Leverage the power of Simply Wall St's portfolio to keep a close eye on market movements affecting your investments.

- Join a community of smart investors by using Simply Wall St. It's free and delivers expert-level analysis on worldwide markets.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:INWI

Inwido

Through its subsidiaries, engages in development, manufacture, and sale of windows and doors in Sweden.

Very undervalued with flawless balance sheet and pays a dividend.

Market Insights

Community Narratives