- Belgium

- /

- Oil and Gas

- /

- ENXTBR:EXM

3 Undiscovered European Gems To Enhance Your Portfolio

Reviewed by Simply Wall St

As the European market navigates a mixed landscape, with the pan-European STOXX Europe 600 Index inching higher amid dovish signals from the U.S. Federal Reserve and easing trade tensions, investors are keenly observing economic indicators like industrial production and labor market dynamics. In this environment, identifying promising small-cap stocks that can withstand volatility and capitalize on emerging opportunities is crucial for enhancing portfolio resilience.

Top 10 Undiscovered Gems With Strong Fundamentals In Europe

| Name | Debt To Equity | Revenue Growth | Earnings Growth | Health Rating |

|---|---|---|---|---|

| Dekpol | 64.28% | 9.75% | 13.77% | ★★★★★☆ |

| Grenobloise d'Electronique et d'Automatismes Société Anonyme | 0.01% | 7.01% | -1.81% | ★★★★★☆ |

| Sparta | NA | nan | nan | ★★★★★☆ |

| Inversiones Doalca SOCIMI | 13.10% | 6.72% | 3.11% | ★★★★★☆ |

| va-Q-tec | 43.54% | 8.03% | -34.33% | ★★★★★☆ |

| Deutsche Balaton | 4.58% | -18.46% | -16.14% | ★★★★★☆ |

| ABG Sundal Collier Holding | 35.58% | -7.59% | -18.30% | ★★★★☆☆ |

| Procimmo Group | 141.47% | 6.84% | 6.01% | ★★★★☆☆ |

| Dn Agrar Group | 63.27% | 15.46% | 33.00% | ★★★★☆☆ |

| Alantra Partners | 11.48% | -5.76% | -30.16% | ★★★★☆☆ |

Let's explore several standout options from the results in the screener.

Exmar (ENXTBR:EXM)

Simply Wall St Value Rating: ★★★★★★

Overview: Exmar NV provides shipping and floating infrastructure solutions globally, with a market capitalization of €822.20 million.

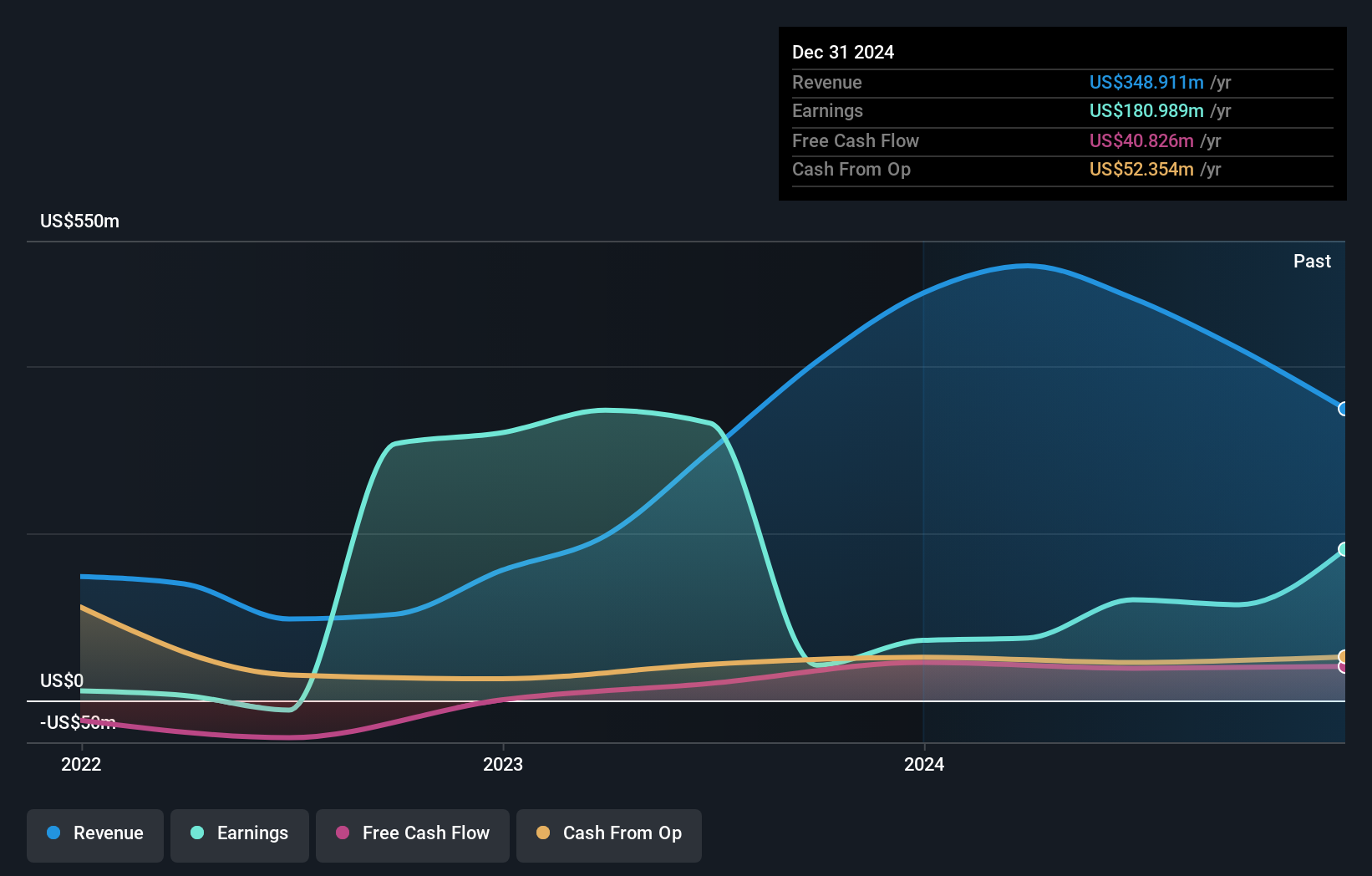

Operations: Exmar NV generates revenue primarily from its Shipping and Infrastructure segments, with $141.51 million and $145.34 million respectively. The Supporting Services segment contributes $90.12 million.

Exmar, a niche player in the oil and gas industry, has shown impressive earnings growth of 29.4% over the past year, outpacing the industry's negative trend. The company has significantly reduced its debt-to-equity ratio from 76.2% to 44.5% over five years and boasts more cash than total debt, indicating strong financial health. Despite a substantial one-off gain of $81.7M impacting recent results, Exmar's shares trade at nearly 80% below estimated fair value, suggesting potential undervaluation. However, shareholder dilution remains a concern alongside volatile share prices observed recently in this small cap stock’s performance narrative.

- Click here to discover the nuances of Exmar with our detailed analytical health report.

Examine Exmar's past performance report to understand how it has performed in the past.

Etablissements Maurel & Prom (ENXTPA:MAU)

Simply Wall St Value Rating: ★★★★★★

Overview: Etablissements Maurel & Prom S.A. is involved in the exploration and production of oil, gas, and hydrocarbons across Gabon, Tanzania, Angola, and Venezuela with a market capitalization of €941.15 million.

Operations: Maurel & Prom generates revenue primarily from its production segment, which accounts for $554.05 million, while the drilling segment contributes $22.23 million.

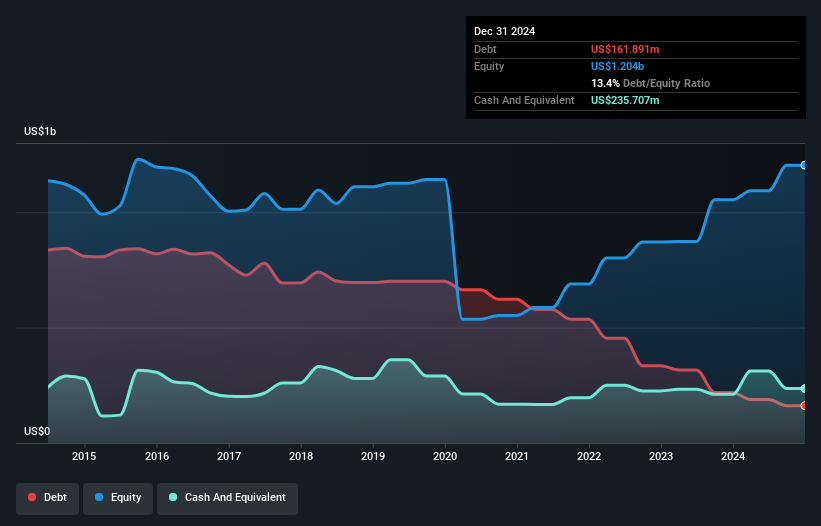

Etablissements Maurel & Prom, a notable player in the oil and gas sector, has demonstrated resilience with high-quality earnings and a significant reduction in its debt to equity ratio from 123.8% to 11% over five years. Despite trading at 82.2% below estimated fair value, the company's earnings are expected to decline by an average of 0.4% per year over the next three years. Recent strategic changes include appointing Wisnu Santoso as Chairman, who brings extensive industry experience that could bolster future growth initiatives. For Q3 2025, production reached 37,973 boepd with consolidated sales at $200 million US$.

JDC Group (XTRA:JDC)

Simply Wall St Value Rating: ★★★★★☆

Overview: JDC Group AG is a financial services company operating in Germany and Austria with a market capitalization of approximately €386.71 million.

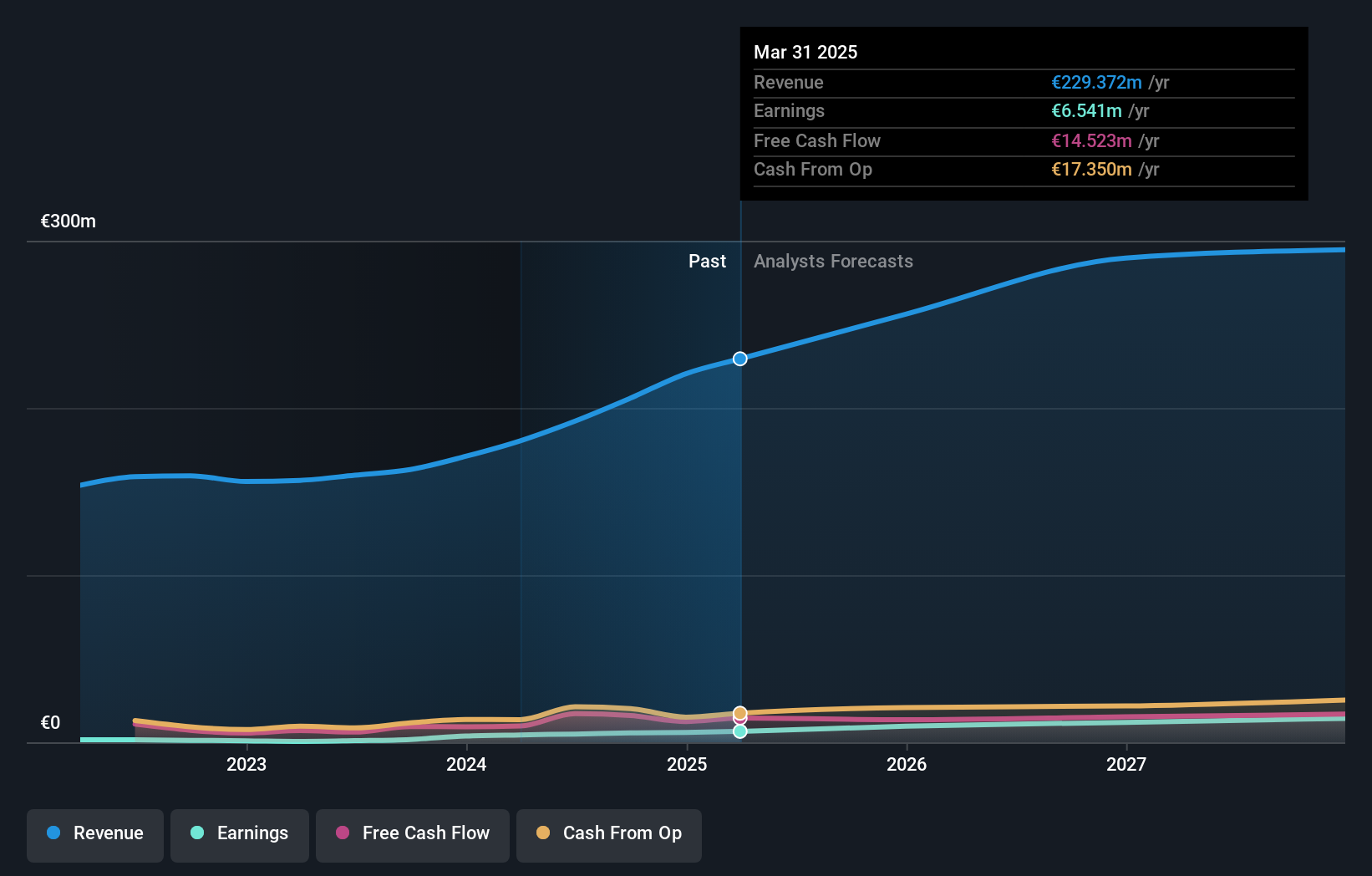

Operations: JDC Group AG generates revenue primarily from its Advisortech segment (€206.29 million) and Advisory segment (€46.99 million), with the Holding segment contributing €3.62 million. The Reconciliation segment shows a negative impact of €19.46 million on overall revenue.

JDC Group, a notable player in the European financial services landscape, has shown impressive earnings growth of 41.8% over the past year, outpacing the industry average of 30.4%. The company's strategic move to integrate FMK is likely enhancing its market position by boosting direct consumer access and enabling cross-selling opportunities. With a reduced debt-to-equity ratio from 69.2% to 32.4% over five years, JDC seems financially healthier while maintaining positive free cash flow. Despite these strengths, reliance on the German market and recent debt-financed acquisitions suggest potential risks if economic conditions shift unfavorably.

Key Takeaways

- Investigate our full lineup of 330 European Undiscovered Gems With Strong Fundamentals right here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Curious About Other Options?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if Exmar might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:EXM

Exmar

Engages in the provision of shipping and floating infrastructure solutions worldwide.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)