- Belgium

- /

- Food and Staples Retail

- /

- ENXTBR:COLR

Market Participants Recognise Colruyt Group N.V.'s (EBR:COLR) Revenues

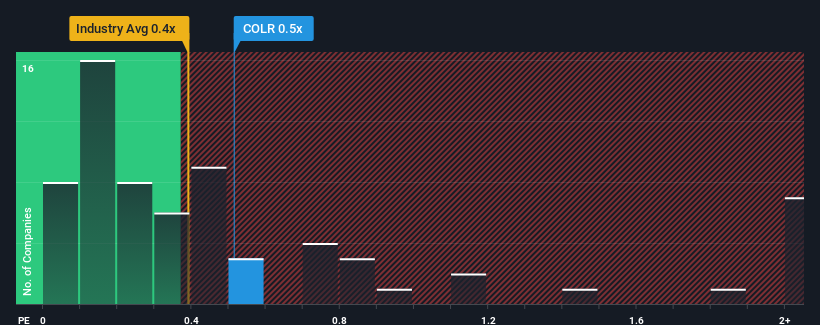

With a median price-to-sales (or "P/S") ratio of close to 0.4x in the Consumer Retailing industry in Belgium, you could be forgiven for feeling indifferent about Colruyt Group N.V.'s (EBR:COLR) P/S ratio of 0.5x. However, investors might be overlooking a clear opportunity or potential setback if there is no rational basis for the P/S.

View our latest analysis for Colruyt Group

How Colruyt Group Has Been Performing

There hasn't been much to differentiate Colruyt Group's and the industry's revenue growth lately. The P/S ratio is probably moderate because investors think this modest revenue performance will continue. If you like the company, you'd be hoping this can at least be maintained so that you could pick up some stock while it's not quite in favour.

If you'd like to see what analysts are forecasting going forward, you should check out our free report on Colruyt Group.What Are Revenue Growth Metrics Telling Us About The P/S?

There's an inherent assumption that a company should be matching the industry for P/S ratios like Colruyt Group's to be considered reasonable.

Taking a look back first, we see that the company managed to grow revenues by a handy 9.2% last year. The latest three year period has also seen a 9.2% overall rise in revenue, aided somewhat by its short-term performance. Therefore, it's fair to say the revenue growth recently has been respectable for the company.

Turning to the outlook, the next three years should generate growth of 4.2% per year as estimated by the eight analysts watching the company. Meanwhile, the rest of the industry is forecast to expand by 5.4% each year, which is not materially different.

With this information, we can see why Colruyt Group is trading at a fairly similar P/S to the industry. Apparently shareholders are comfortable to simply hold on while the company is keeping a low profile.

The Key Takeaway

We'd say the price-to-sales ratio's power isn't primarily as a valuation instrument but rather to gauge current investor sentiment and future expectations.

Our look at Colruyt Group's revenue growth estimates show that its P/S is about what we expect, as both metrics follow closely with the industry averages. Right now shareholders are comfortable with the P/S as they are quite confident future revenue won't throw up any surprises. All things considered, if the P/S and revenue estimates contain no major shocks, then it's hard to see the share price moving strongly in either direction in the near future.

We don't want to rain on the parade too much, but we did also find 2 warning signs for Colruyt Group (1 is a bit unpleasant!) that you need to be mindful of.

It's important to make sure you look for a great company, not just the first idea you come across. So if growing profitability aligns with your idea of a great company, take a peek at this free list of interesting companies with strong recent earnings growth (and a low P/E).

If you're looking to trade Colruyt Group, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:COLR

Colruyt Group

Engages in the retail, wholesale, food service, and other activities in Belgium, France, and internationally.

Adequate balance sheet average dividend payer.

Similar Companies

Market Insights

Community Narratives