- Belgium

- /

- Commercial Services

- /

- ENXTBR:EKOP

Ekopak NV (EBR:EKOP) May Have Run Too Fast Too Soon With Recent 29% Price Plummet

The Ekopak NV (EBR:EKOP) share price has fared very poorly over the last month, falling by a substantial 29%. The drop over the last 30 days has capped off a tough year for shareholders, with the share price down 43% in that time.

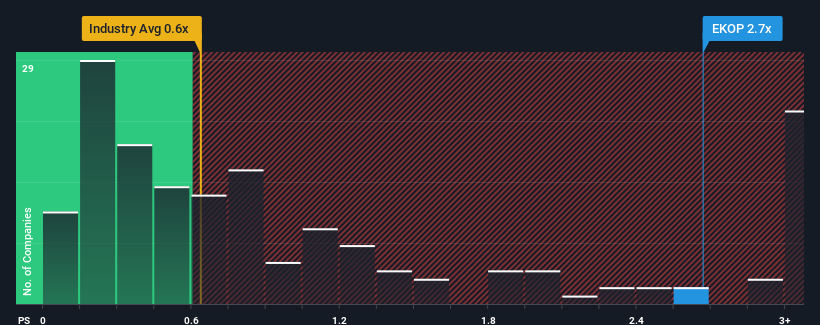

Although its price has dipped substantially, you could still be forgiven for thinking Ekopak is a stock to steer clear of with a price-to-sales ratios (or "P/S") of 2.7x, considering almost half the companies in Belgium's Commercial Services industry have P/S ratios below 0.6x. Although, it's not wise to just take the P/S at face value as there may be an explanation why it's so lofty.

Check out our latest analysis for Ekopak

How Ekopak Has Been Performing

Ekopak certainly has been doing a good job lately as it's been growing revenue more than most other companies. It seems the market expects this form will continue into the future, hence the elevated P/S ratio. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

Want the full picture on analyst estimates for the company? Then our free report on Ekopak will help you uncover what's on the horizon.Do Revenue Forecasts Match The High P/S Ratio?

The only time you'd be truly comfortable seeing a P/S as steep as Ekopak's is when the company's growth is on track to outshine the industry decidedly.

Retrospectively, the last year delivered an exceptional 54% gain to the company's top line. This great performance means it was also able to deliver immense revenue growth over the last three years. Accordingly, shareholders would have been over the moon with those medium-term rates of revenue growth.

Shifting to the future, estimates from the dual analysts covering the company suggest revenue should grow by 22% per year over the next three years. That's shaping up to be materially lower than the 36% per year growth forecast for the broader industry.

In light of this, it's alarming that Ekopak's P/S sits above the majority of other companies. It seems most investors are hoping for a turnaround in the company's business prospects, but the analyst cohort is not so confident this will happen. Only the boldest would assume these prices are sustainable as this level of revenue growth is likely to weigh heavily on the share price eventually.

What Does Ekopak's P/S Mean For Investors?

Ekopak's shares may have suffered, but its P/S remains high. It's argued the price-to-sales ratio is an inferior measure of value within certain industries, but it can be a powerful business sentiment indicator.

We've concluded that Ekopak currently trades on a much higher than expected P/S since its forecast growth is lower than the wider industry. The weakness in the company's revenue estimate doesn't bode well for the elevated P/S, which could take a fall if the revenue sentiment doesn't improve. At these price levels, investors should remain cautious, particularly if things don't improve.

You need to take note of risks, for example - Ekopak has 2 warning signs (and 1 which shouldn't be ignored) we think you should know about.

If strong companies turning a profit tickle your fancy, then you'll want to check out this free list of interesting companies that trade on a low P/E (but have proven they can grow earnings).

Valuation is complex, but we're here to simplify it.

Discover if Ekopak might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:EKOP

Ekopak

Designs, builds, finances, and operates industrial water processing solutions in Belgium, France, and internationally.

Reasonable growth potential very low.

Similar Companies

Market Insights

Community Narratives