- Belgium

- /

- Construction

- /

- ENXTBR:DEME

How New BC-Wind Contracts Could Shape DEME Group’s (ENXTBR:DEME) Offshore Wind Investment Narrative

Reviewed by Sasha Jovanovic

- DEME Group has recently secured three contracts to install monopile foundations, inter-array cables and an export cable for the BC-Wind offshore wind farm in Poland, reinforcing its role in the country’s renewable energy rollout.

- These wins further deepen DEME’s exposure to offshore wind infrastructure, expanding its project pipeline in a market focused on accelerating its energy transition.

- We’ll now examine how securing BC-Wind’s foundation and cable installation work could influence DEME’s broader investment narrative and long-term outlook.

Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 37 best rare earth metal stocks of the very few that mine this essential strategic resource.

DEME Group Investment Narrative Recap

To own DEME Group, you need to believe that global demand for offshore wind, coastal protection and marine infrastructure will keep supporting a healthy project pipeline and solid margins. The BC Wind contracts in Poland add to order book visibility in European offshore wind, but do not fundamentally change the near term picture where project execution risk and margin volatility on large, complex contracts remain the key swing factors.

Among recent announcements, the sizable inter array cable contract for the Nordseecluster B offshore wind farm in Germany looks most relevant, as it reinforces DEME’s role in complex offshore cable installation alongside BC Wind. Together, these wins highlight how the company’s growing cable and foundation capabilities could be a meaningful earnings driver, while also increasing its exposure to concentrated offshore wind project risk if schedules slip or costs rise.

Yet behind the growing order book in offshore wind, investors still need to weigh the risk that a small number of large projects can...

Read the full narrative on DEME Group (it's free!)

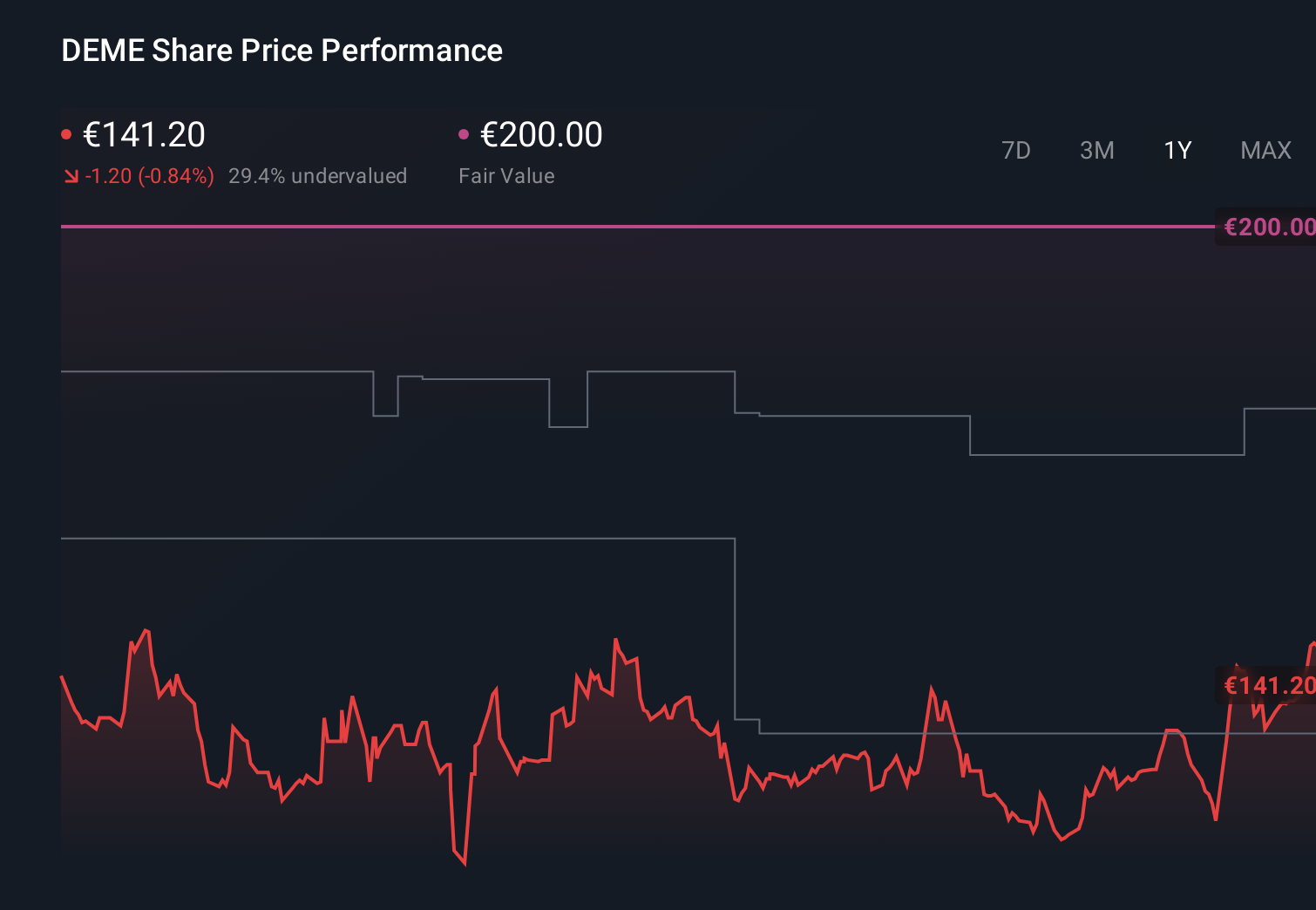

DEME Group's narrative projects €4.7 billion revenue and €382.7 million earnings by 2028. This requires 2.9% yearly revenue growth and about a €56.6 million earnings increase from €326.1 million today.

Uncover how DEME Group's forecasts yield a €176.67 fair value, a 24% upside to its current price.

Exploring Other Perspectives

Eight members of the Simply Wall St Community currently see DEME’s fair value between €110.45 and about €250.16, reflecting a wide spread of expectations. Against this, the growing concentration in large offshore wind projects highlighted earlier could magnify both the upside and the operational risk that you may want to examine more closely.

Explore 8 other fair value estimates on DEME Group - why the stock might be worth 22% less than the current price!

Build Your Own DEME Group Narrative

Disagree with existing narratives? Create your own in under 3 minutes - extraordinary investment returns rarely come from following the herd.

- A great starting point for your DEME Group research is our analysis highlighting 4 key rewards that could impact your investment decision.

- Our free DEME Group research report provides a comprehensive fundamental analysis summarized in a single visual - the Snowflake - making it easy to evaluate DEME Group's overall financial health at a glance.

Seeking Other Investments?

Our daily scans reveal stocks with breakout potential. Don't miss this chance:

- The end of cancer? These 29 emerging AI stocks are developing tech that will allow early identification of life changing diseases like cancer and Alzheimer's.

- Uncover the next big thing with financially sound penny stocks that balance risk and reward.

- Trump's oil boom is here - pipelines are primed to profit. Discover the 22 US stocks riding the wave.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ENXTBR:DEME

DEME Group

Provides marine solutions in the fields of offshore energy, dredging, marine infrastructure, and environmental works in Belgium, Europe, Africa, the United States, Asia, Oceania, and the Middle East.

Very undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Unicycive Therapeutics (Nasdaq: UNCY) – Preparing for a Second Shot at Bringing a New Kidney Treatment to Market (TEST)

Rocket Lab USA Will Ignite a 30% Revenue Growth Journey

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026