KBC Group NV (EBR:KBC) has announced that it will pay a dividend of €0.70 per share on the 14th of November. Based on this payment, the dividend yield on the company's stock will be 6.1%, which is an attractive boost to shareholder returns.

Check out our latest analysis for KBC Group

KBC Group's Earnings Will Easily Cover The Distributions

We like to see robust dividend yields, but that doesn't matter if the payment isn't sustainable.

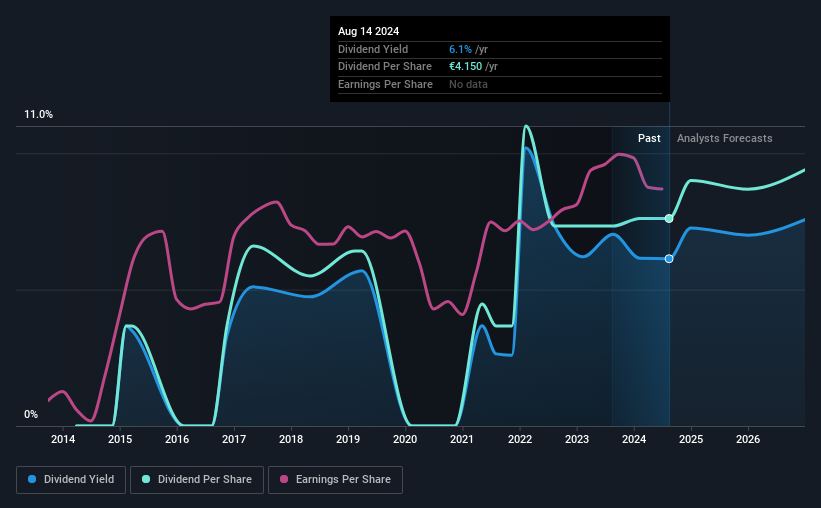

KBC Group has a long history of paying out dividends, with its current track record at a minimum of 10 years. Taking data from its last earnings report, calculating for the company's payout ratio shows 58%, which means that KBC Group would be able to pay its last dividend without pressure on the balance sheet.

Over the next 3 years, EPS is forecast to expand by 17.7%. Analysts estimate the future payout ratio will be 61% over the same time period, which is in the range that makes us comfortable with the sustainability of the dividend.

Dividend Volatility

Although the company has a long dividend history, it has been cut at least once in the last 10 years. Since 2014, the dividend has gone from €2.00 total annually to €4.15. This means that it has been growing its distributions at 7.6% per annum over that time. A reasonable rate of dividend growth is good to see, but we're wary that the dividend history is not as solid as we'd like, having been cut at least once.

Dividend Growth May Be Hard To Achieve

Given that the dividend has been cut in the past, we need to check if earnings are growing and if that might lead to stronger dividends in the future. Earnings has been rising at 4.5% per annum over the last five years, which admittedly is a bit slow. Growth of 4.5% per annum is not particularly high, which might explain why the company is paying out a higher proportion of earnings. This isn't necessarily bad, but we wouldn't expect rapid dividend growth in the future.

Our Thoughts On KBC Group's Dividend

Overall, we think KBC Group is a solid choice as a dividend stock, even though the dividend wasn't raised this year. The payout ratio looks good, but unfortunately the company's dividend track record isn't stellar. Taking all of this into consideration, the dividend looks viable moving forward, but investors should be mindful that the company has pushed the boundaries of sustainability in the past and may do so again.

Market movements attest to how highly valued a consistent dividend policy is compared to one which is more unpredictable. However, there are other things to consider for investors when analysing stock performance. Taking the debate a bit further, we've identified 1 warning sign for KBC Group that investors need to be conscious of moving forward. Is KBC Group not quite the opportunity you were looking for? Why not check out our selection of top dividend stocks.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentValuation is complex, but we're here to simplify it.

Discover if KBC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ENXTBR:KBC

KBC Group

Provides banking, insurance, and asset management services primarily for retail, private banking, small and medium sized enterprises, and mid-cap clients in Belgium, Bulgaria, the Czech Republic, Hungary, and Slovakia.

Solid track record with excellent balance sheet and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

Amazon: Why the World’s Biggest Platform Still Runs on Invisible Economics

Sunrun Stock: When the Energy Transition Collides With the Cost of Capital

Salesforce Stock: AI-Fueled Growth Is Real — But Can Margins Stay This Strong?

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)