- Australia

- /

- Electric Utilities

- /

- ASX:ORG

Is Now The Time To Put Origin Energy (ASX:ORG) On Your Watchlist?

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. Loss-making companies are always racing against time to reach financial sustainability, so investors in these companies may be taking on more risk than they should.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Origin Energy (ASX:ORG). Now this is not to say that the company presents the best investment opportunity around, but profitability is a key component to success in business.

Origin Energy's Improving Profits

In the last three years Origin Energy's earnings per share took off; so much so that it's a bit disingenuous to use these figures to try and deduce long term estimates. As a result, we'll zoom in on growth over the last year, instead. Origin Energy has grown its trailing twelve month EPS from AU$0.81 to AU$0.86, in the last year. That's a modest gain of 6.4%.

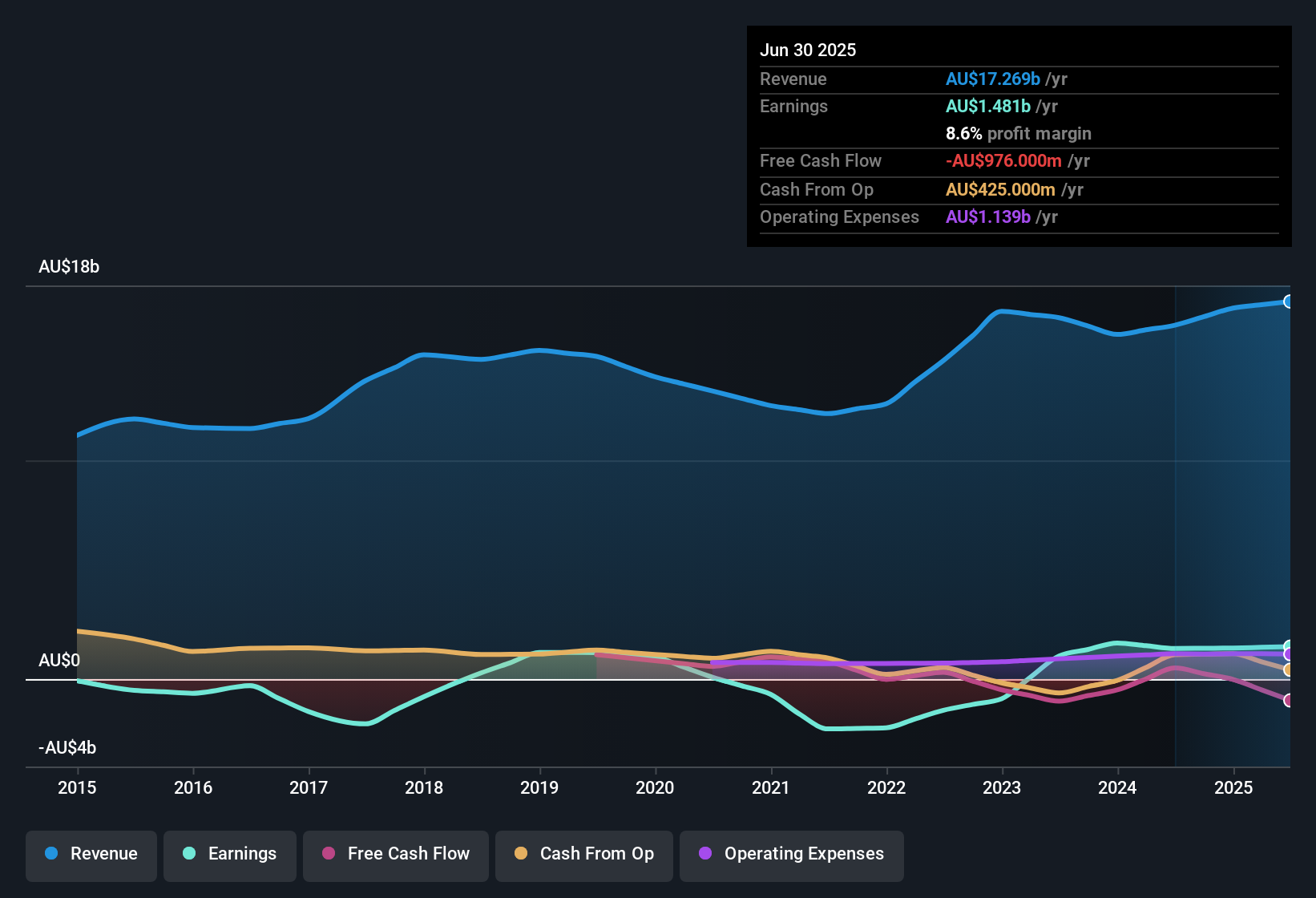

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. Origin Energy maintained stable EBIT margins over the last year, all while growing revenue 6.7% to AU$17b. That's progress.

In the chart below, you can see how the company has grown earnings and revenue, over time. To see the actual numbers, click on the chart.

View our latest analysis for Origin Energy

In investing, as in life, the future matters more than the past. So why not check out this free interactive visualization of Origin Energy's forecast profits?

Are Origin Energy Insiders Aligned With All Shareholders?

Since Origin Energy has a market capitalisation of AU$21b, we wouldn't expect insiders to hold a large percentage of shares. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. To be specific, they have AU$50m worth of shares. That's a lot of money, and no small incentive to work hard. Despite being just 0.2% of the company, the value of that investment is enough to show insiders have plenty riding on the venture.

Is Origin Energy Worth Keeping An Eye On?

One positive for Origin Energy is that it is growing EPS. That's nice to see. For those who are looking for a little more than this, the high level of insider ownership enhances our enthusiasm for this growth. That combination is very appealing. So yes, we do think the stock is worth keeping an eye on. Don't forget that there may still be risks. For instance, we've identified 3 warning signs for Origin Energy (1 is a bit concerning) you should be aware of.

There's always the possibility of doing well buying stocks that are not growing earnings and do not have insiders buying shares. But for those who consider these important metrics, we encourage you to check out companies that do have those features. You can access a tailored list of Australian companies which have demonstrated growth backed by significant insider holdings.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:ORG

Origin Energy

An integrated energy company, engages in the exploration and production of natural gas, electricity generation, wholesale and retail sale of electricity and gas, and sale of liquefied natural gas in Australia and internationally.

Undervalued with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives

Recently Updated Narratives

Bisalloy Steel Group will shine with a projected profit margin increase of 12.8%

Astor Enerji will surge with a fair value of $140.43 in the next 3 years

Proximus: The State-Backed Backup Plan with 7% Gross Yield and 15% Currency Upside.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026