Codan Limited (ASX:CDA) Stocks Shoot Up 26% But Its P/E Still Looks Reasonable

Despite an already strong run, Codan Limited (ASX:CDA) shares have been powering on, with a gain of 26% in the last thirty days. The last month tops off a massive increase of 100% in the last year.

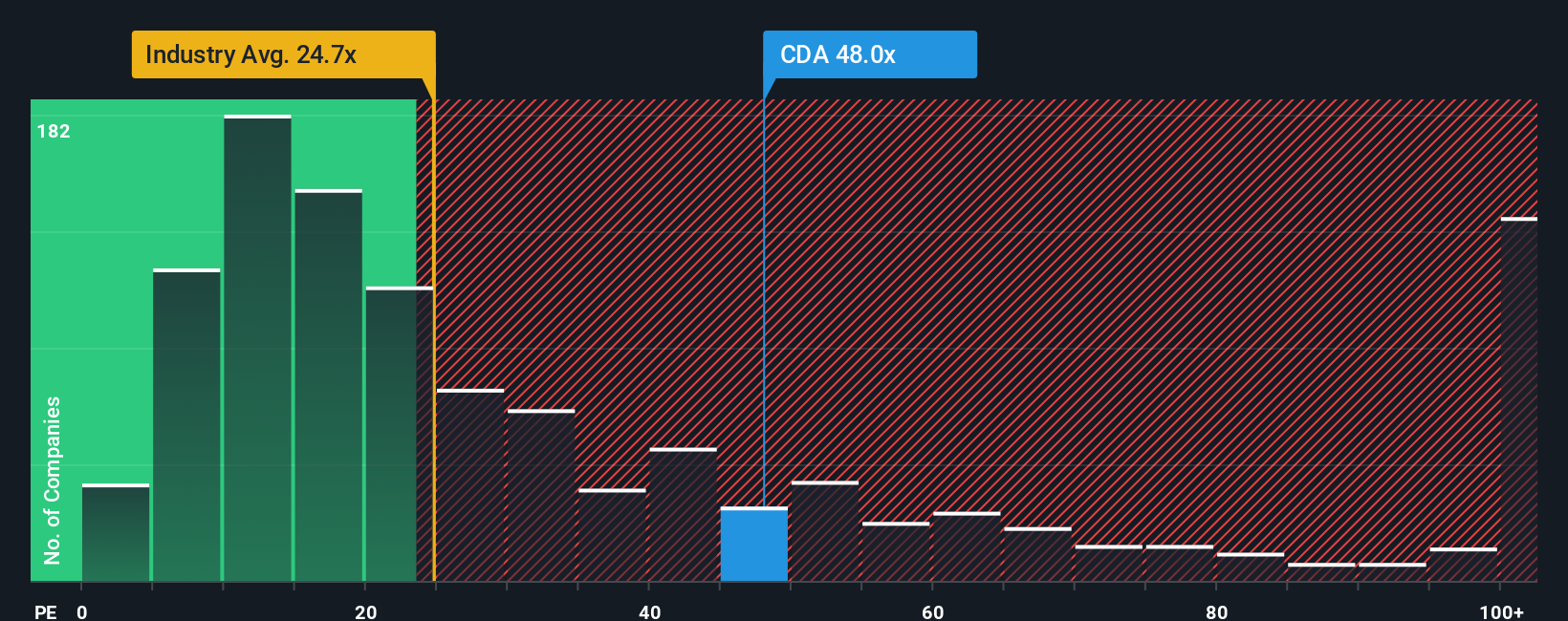

Since its price has surged higher, given close to half the companies in Australia have price-to-earnings ratios (or "P/E's") below 19x, you may consider Codan as a stock to avoid entirely with its 48x P/E ratio. However, the P/E might be quite high for a reason and it requires further investigation to determine if it's justified.

Recent times have been advantageous for Codan as its earnings have been rising faster than most other companies. The P/E is probably high because investors think this strong earnings performance will continue. You'd really hope so, otherwise you're paying a pretty hefty price for no particular reason.

See our latest analysis for Codan

What Are Growth Metrics Telling Us About The High P/E?

In order to justify its P/E ratio, Codan would need to produce outstanding growth well in excess of the market.

If we review the last year of earnings growth, the company posted a terrific increase of 19%. However, this wasn't enough as the latest three year period has seen a very unpleasant 10% drop in EPS in aggregate. Therefore, it's fair to say the earnings growth recently has been undesirable for the company.

Shifting to the future, estimates from the seven analysts covering the company suggest earnings should grow by 18% per year over the next three years. That's shaping up to be materially higher than the 15% per year growth forecast for the broader market.

With this information, we can see why Codan is trading at such a high P/E compared to the market. Apparently shareholders aren't keen to offload something that is potentially eyeing a more prosperous future.

The Bottom Line On Codan's P/E

Shares in Codan have built up some good momentum lately, which has really inflated its P/E. While the price-to-earnings ratio shouldn't be the defining factor in whether you buy a stock or not, it's quite a capable barometer of earnings expectations.

We've established that Codan maintains its high P/E on the strength of its forecast growth being higher than the wider market, as expected. Right now shareholders are comfortable with the P/E as they are quite confident future earnings aren't under threat. It's hard to see the share price falling strongly in the near future under these circumstances.

A lot of potential risks can sit within a company's balance sheet. You can assess many of the main risks through our free balance sheet analysis for Codan with six simple checks.

If P/E ratios interest you, you may wish to see this free collection of other companies with strong earnings growth and low P/E ratios.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:CDA

Codan

Develops technology solutions for United Nations organizations, security and military agencies, government departments, corporates, individuals consumers, and small-scale miners.

Solid track record with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

Solutions by stc: 34% Upside in Saudi's Digital Transformation Leader

The AI Infrastructure Giant Grows Into Its Valuation

Recently Updated Narratives

The "AI-Immunology" Asymmetric Opportunity – Validated by Merck (MSD)

The Hidden Gem of AI Hardware – Solving the Data Center Bottleneck

Moving from "Science Fiction" to "Science Fact" – A Bullish Valuation Case

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026