Xero (ASX:XRO) grows 3.1% this week, taking five-year gains to 120%

When you buy shares in a company, it's worth keeping in mind the possibility that it could fail, and you could lose your money. But when you pick a company that is really flourishing, you can make more than 100%. Long term Xero Limited (ASX:XRO) shareholders would be well aware of this, since the stock is up 120% in five years. On top of that, the share price is up 15% in about a quarter.

The past week has proven to be lucrative for Xero investors, so let's see if fundamentals drove the company's five-year performance.

View our latest analysis for Xero

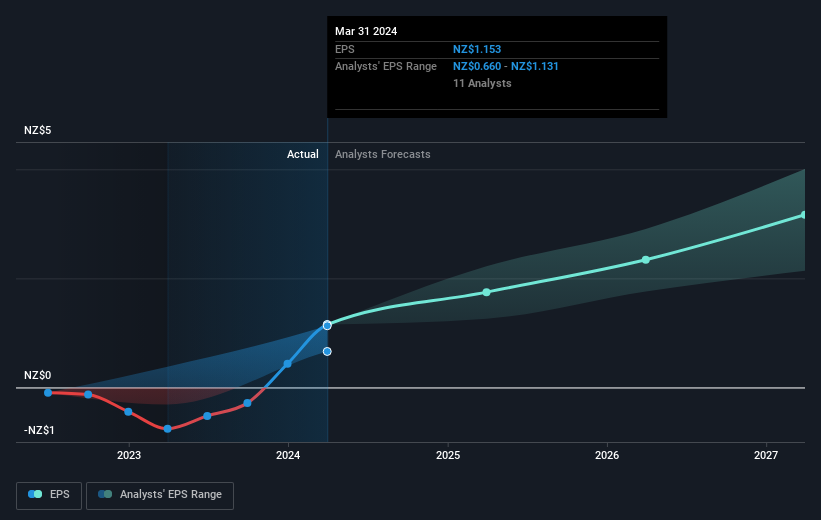

While markets are a powerful pricing mechanism, share prices reflect investor sentiment, not just underlying business performance. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

During the last half decade, Xero became profitable. That kind of transition can be an inflection point that justifies a strong share price gain, just as we have seen here. Since the company was unprofitable five years ago, but not three years ago, it's worth taking a look at the returns in the last three years, too. In fact, the Xero stock price is 5.9% lower in the last three years. During the same period, EPS grew by 102% each year. It would appear there's a real mismatch between the increasing EPS and the share price, which has declined -2.0% a year for three years.

The image below shows how EPS has tracked over time (if you click on the image you can see greater detail).

It's probably worth noting we've seen significant insider buying in the last quarter, which we consider a positive. That said, we think earnings and revenue growth trends are even more important factors to consider. Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here..

A Different Perspective

It's good to see that Xero has rewarded shareholders with a total shareholder return of 16% in the last twelve months. However, that falls short of the 17% TSR per annum it has made for shareholders, each year, over five years. Investors who like to make money usually check up on insider purchases, such as the price paid, and total amount bought. You can find out about the insider purchases of Xero by clicking this link.

There are plenty of other companies that have insiders buying up shares. You probably do not want to miss this free list of undervalued small cap companies that insiders are buying.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on Australian exchanges.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:XRO

Xero

A software as a service company, provides online business solutions for small businesses and their advisors in Australia, New Zealand, and internationally.

Flawless balance sheet with reasonable growth potential.