The Australian stock market recently closed on a positive note, with the ASX 200 gaining 0.29% amid ongoing concerns about inflation and interest rates remaining steady as per the Reserve Bank of Australia's latest minutes. For investors looking beyond established names, penny stocks—often smaller or newer companies—continue to present intriguing opportunities despite their somewhat outdated terminology. These stocks can offer significant growth potential when backed by solid financials, and in this article, we explore three examples that combine balance sheet strength with promising prospects for future returns.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.765 | A$140.36M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.55 | A$64.47M | ★★★★★★ |

| SHAPE Australia (ASX:SHA) | A$2.85 | A$236.3M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.95 | A$317.49M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.51 | A$316.27M | ★★★★★☆ |

| Navigator Global Investments (ASX:NGI) | A$1.68 | A$823.33M | ★★★★★☆ |

| EZZ Life Science Holdings (ASX:EZZ) | A$3.17 | A$146.32M | ★★★★★★ |

| SKS Technologies Group (ASX:SKS) | A$1.59 | A$199.48M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$1.88 | A$105.46M | ★★★★★★ |

| Servcorp (ASX:SRV) | A$4.87 | A$480.5M | ★★★★☆☆ |

Click here to see the full list of 1,055 stocks from our ASX Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Nickel Industries (ASX:NIC)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Nickel Industries Limited is involved in nickel ore mining and the production of nickel pig iron, cobalt, and nickel matte, with a market cap of A$3.56 billion.

Operations: The company's revenue is primarily derived from its RKEF projects in Indonesia and Singapore, which contribute $1.66 billion, alongside nickel ore mining activities in Indonesia generating $48.97 million.

Market Cap: A$3.56B

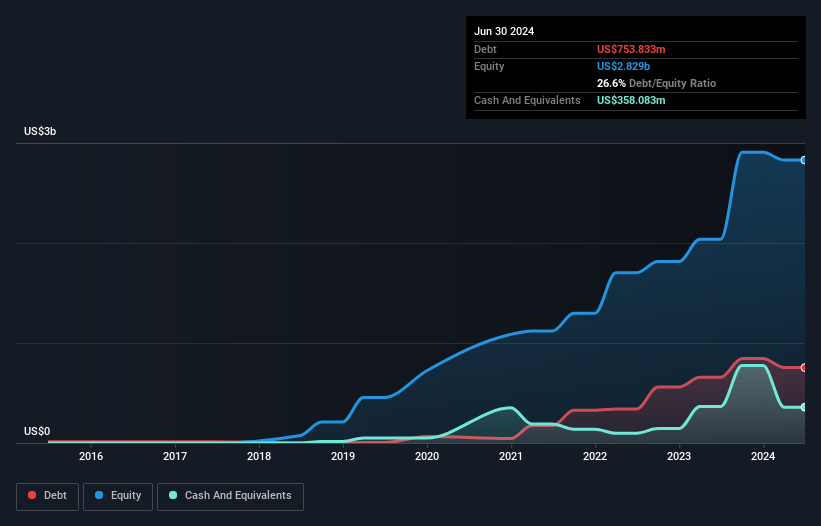

Nickel Industries Limited, with a market cap of A$3.56 billion, derives substantial revenue from its RKEF projects in Indonesia and Singapore. The company's management and board are experienced, with average tenures of 3.6 and 3.3 years respectively. NIC's debt is well covered by operating cash flow at 47.8%, though its dividend yield of 6.02% isn't well supported by earnings. Despite stable weekly volatility over the past year, NIC's net profit margin has slightly decreased to 5.6%. Earnings growth has accelerated recently but remains modest compared to industry standards, while the return on equity is considered low at 5%.

- Get an in-depth perspective on Nickel Industries' performance by reading our balance sheet health report here.

- Understand Nickel Industries' earnings outlook by examining our growth report.

Ridley (ASX:RIC)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Ridley Corporation Limited, with a market cap of A$868.98 million, operates in Australia providing animal nutrition solutions through its subsidiaries.

Operations: The company's revenue is derived from Bulk Stockfeeds, generating A$886.59 million, and Packaged/Ingredients, contributing A$376.31 million.

Market Cap: A$868.98M

Ridley Corporation Limited, with a market cap of A$868.98 million, is actively involved in the competitive landscape of Australia's animal nutrition sector. Recent board changes include the appointment of Dan Masters as a non-executive director, reflecting strategic ties with major shareholder AGR Agricultural Investments LLC. Despite low return on equity at 12.3%, Ridley's financial health shows resilience with short-term assets exceeding liabilities and debt well covered by operating cash flow (70%). Earnings have grown significantly over five years but faced recent setbacks, and profit margins slightly declined to 3.2%. The company remains undervalued relative to its estimated fair value.

- Dive into the specifics of Ridley here with our thorough balance sheet health report.

- Assess Ridley's future earnings estimates with our detailed growth reports.

Talius Group (ASX:TAL)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Talius Group Limited offers technology-enabled care solutions for the aged and disability sectors across retirement living, residential aged care, home, and community settings, with a market cap of A$25.74 million.

Operations: The company's revenue is derived entirely from its Software & Programming segment, amounting to A$9.81 million.

Market Cap: A$25.74M

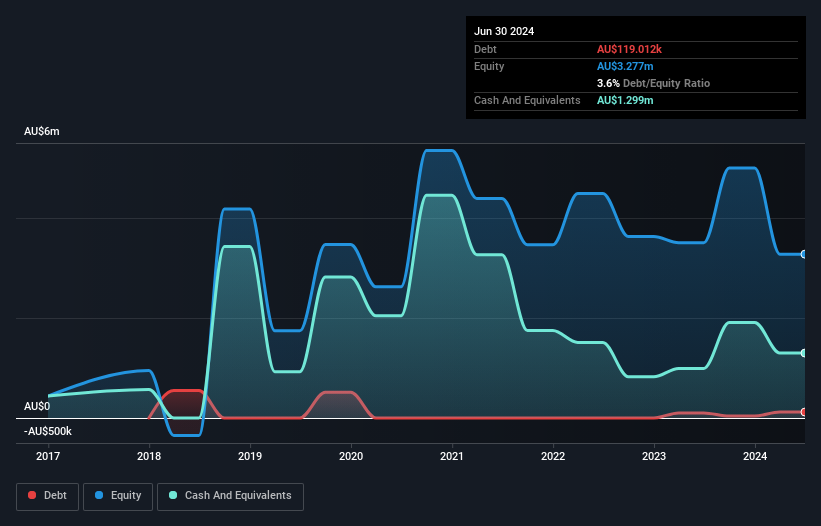

Talius Group Limited, with a market cap of A$25.74 million, operates in the technology-enabled care sector and is currently unprofitable. Its short-term assets of A$5.4 million exceed both short-term liabilities (A$2.7 million) and long-term liabilities (A$54.5K), highlighting solid liquidity despite volatility in share price over recent months. The company has managed to reduce its losses by 26.4% annually over five years and recently raised A$2.57 million through a follow-on equity offering to bolster its cash runway beyond nine months, indicating strategic financial maneuvering amidst ongoing challenges in achieving profitability.

- Jump into the full analysis health report here for a deeper understanding of Talius Group.

- Explore historical data to track Talius Group's performance over time in our past results report.

Next Steps

- Embark on your investment journey to our 1,055 ASX Penny Stocks selection here.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:RIC

Ridley

Engages in the provision of animal nutrition solutions in Australia.

Flawless balance sheet, undervalued and pays a dividend.

Market Insights

Community Narratives