Even when a business is losing money, it's possible for shareholders to make money if they buy a good business at the right price. By way of example, Nuix (ASX:NXL) has seen its share price rise 147% over the last year, delighting many shareholders. But while history lauds those rare successes, those that fail are often forgotten; who remembers Pets.com?

In light of its strong share price run, we think now is a good time to investigate how risky Nuix's cash burn is. For the purposes of this article, cash burn is the annual rate at which an unprofitable company spends cash to fund its growth; its negative free cash flow. Let's start with an examination of the business' cash, relative to its cash burn.

Check out our latest analysis for Nuix

When Might Nuix Run Out Of Money?

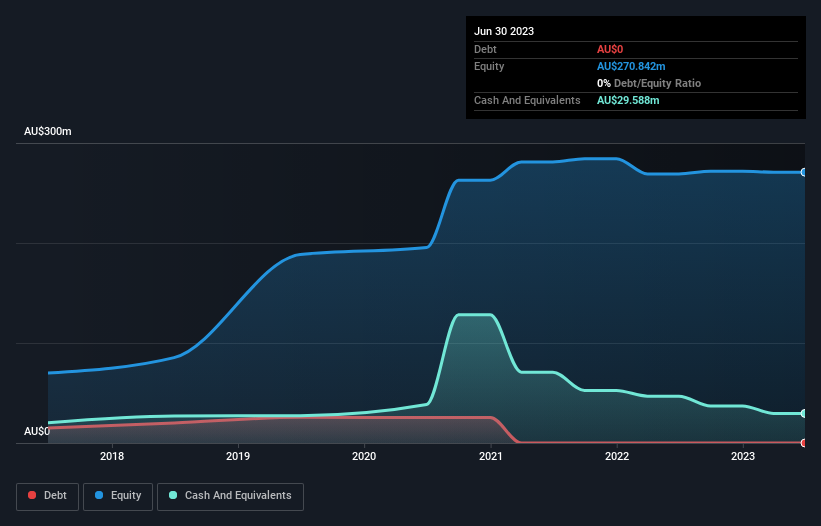

A company's cash runway is calculated by dividing its cash hoard by its cash burn. As at June 2023, Nuix had cash of AU$30m and no debt. In the last year, its cash burn was AU$6.0m. Therefore, from June 2023 it had 5.0 years of cash runway. A runway of this length affords the company the time and space it needs to develop the business. The image below shows how its cash balance has been changing over the last few years.

How Well Is Nuix Growing?

We reckon the fact that Nuix managed to shrink its cash burn by 54% over the last year is rather encouraging. Revenue also improved during the period, increasing by 20%. We think it is growing rather well, upon reflection. Clearly, however, the crucial factor is whether the company will grow its business going forward. So you might want to take a peek at how much the company is expected to grow in the next few years.

Can Nuix Raise More Cash Easily?

We are certainly impressed with the progress Nuix has made over the last year, but it is also worth considering how costly it would be if it wanted to raise more cash to fund faster growth. Issuing new shares, or taking on debt, are the most common ways for a listed company to raise more money for its business. One of the main advantages held by publicly listed companies is that they can sell shares to investors to raise cash and fund growth. By looking at a company's cash burn relative to its market capitalisation, we gain insight on how much shareholders would be diluted if the company needed to raise enough cash to cover another year's cash burn.

Nuix's cash burn of AU$6.0m is about 1.1% of its AU$551m market capitalisation. That means it could easily issue a few shares to fund more growth, and might well be in a position to borrow cheaply.

How Risky Is Nuix's Cash Burn Situation?

As you can probably tell by now, we're not too worried about Nuix's cash burn. In particular, we think its cash runway stands out as evidence that the company is well on top of its spending. Its revenue growth wasn't quite as good, but was still rather encouraging! After considering a range of factors in this article, we're pretty relaxed about its cash burn, since the company seems to be in a good position to continue to fund its growth. An in-depth examination of risks revealed 1 warning sign for Nuix that readers should think about before committing capital to this stock.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of companies insiders are buying, and this list of stocks growth stocks (according to analyst forecasts)

Valuation is complex, but we're here to simplify it.

Discover if Nuix might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

About ASX:NXL

Nuix

Provides investigative analytics and intelligence software solutions in the Asia Pacific, the Americas, Europe, the Middle East, and Africa.

Flawless balance sheet and undervalued.

Market Insights

Weekly Picks

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)

Fiducian: Compliance Clouds or Value Opportunity?

Willamette Valley Vineyards (WVVI): Not-So-Great Value

Recently Updated Narratives

Positioned globally, partnered locally

When will fraudsters be investigated in depth. Fraud was ongoing in France too.

Staggered by dilution; positions for growth

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026