The Australian market has remained flat over the last week but is up 22% over the past year, with earnings forecasted to grow by 12% annually. In this environment, identifying high growth tech stocks like Life360 can be crucial for investors seeking to capitalize on potential opportunities in a rapidly evolving sector.

Top 10 High Growth Tech Companies In Australia

| Name | Revenue Growth | Earnings Growth | Growth Rating |

|---|---|---|---|

| Clinuvel Pharmaceuticals | 22.32% | 27.42% | ★★★★★★ |

| Pureprofile | 14.94% | 80.73% | ★★★★★☆ |

| Adherium | 86.80% | 73.66% | ★★★★★★ |

| ImExHS | 20.47% | 111.20% | ★★★★★★ |

| Telix Pharmaceuticals | 21.54% | 38.44% | ★★★★★★ |

| AVA Risk Group | 32.56% | 118.83% | ★★★★★★ |

| Pointerra | 56.62% | 126.45% | ★★★★★★ |

| Wrkr | 36.31% | 100.29% | ★★★★★★ |

| Adveritas | 57.98% | 144.21% | ★★★★★★ |

| SiteMinder | 19.65% | 60.64% | ★★★★★☆ |

Click here to see the full list of 64 stocks from our ASX High Growth Tech and AI Stocks screener.

We'll examine a selection from our screener results.

Life360 (ASX:360)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Life360, Inc. operates a technology platform for locating people, pets, and things across various regions including North America, Europe, the Middle East, Africa, and beyond with a market capitalization of A$4.96 billion.

Operations: The company generates revenue primarily from its Software & Programming segment, amounting to $328.68 million. It focuses on providing a technology platform for locating people, pets, and things across multiple regions.

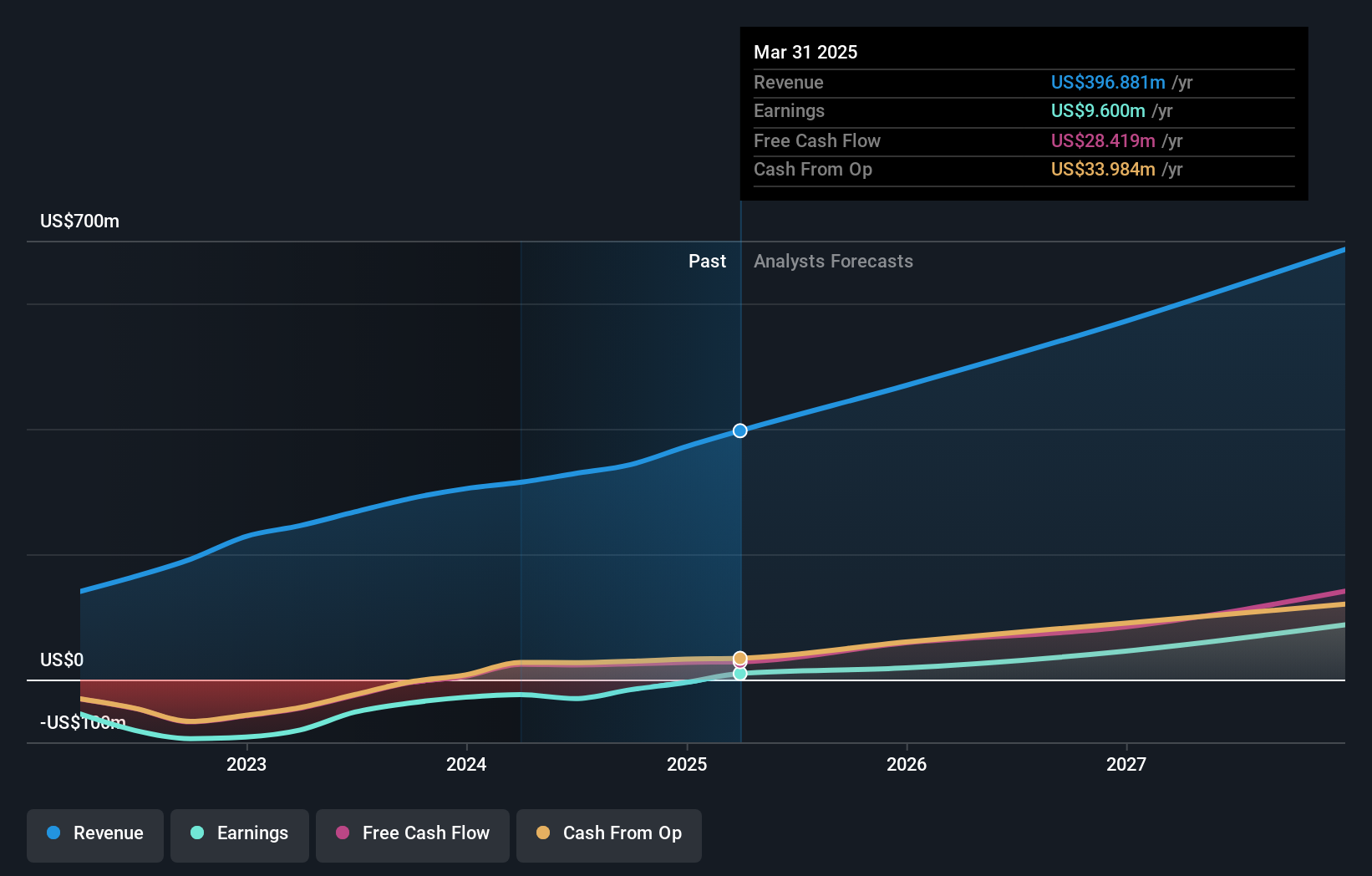

Amidst a challenging financial landscape, Life360 continues to innovate, as evidenced by its recent launch of an updated Tile product line. These enhancements not only improve the practicality and range of their offerings but also integrate seamlessly with Life360's app, enhancing user safety through features like the SOS alert. This move reflects a strategic pivot towards integrating hardware with software solutions, potentially increasing user engagement and retention rates. Financially, despite a net loss increase to $20.74 million in the first half of 2024 from $18.48 million in the previous year, revenue growth remains robust at 15.7% annually. The company's R&D commitment is evident from its continuous product innovation and updates to partnerships with Arity and Placer.ai, which are expected to bolster future revenue streams significantly.

- Click here and access our complete health analysis report to understand the dynamics of Life360.

Review our historical performance report to gain insights into Life360's's past performance.

Hansen Technologies (ASX:HSN)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Hansen Technologies Limited specializes in developing, integrating, and supporting billing systems software for the energy, utilities, communications, and media sectors with a market cap of A$1.00 billion.

Operations: Hansen Technologies generates revenue primarily from its billing segment, which accounts for A$347.61 million. The company operates within the energy, utilities, communications, and media sectors.

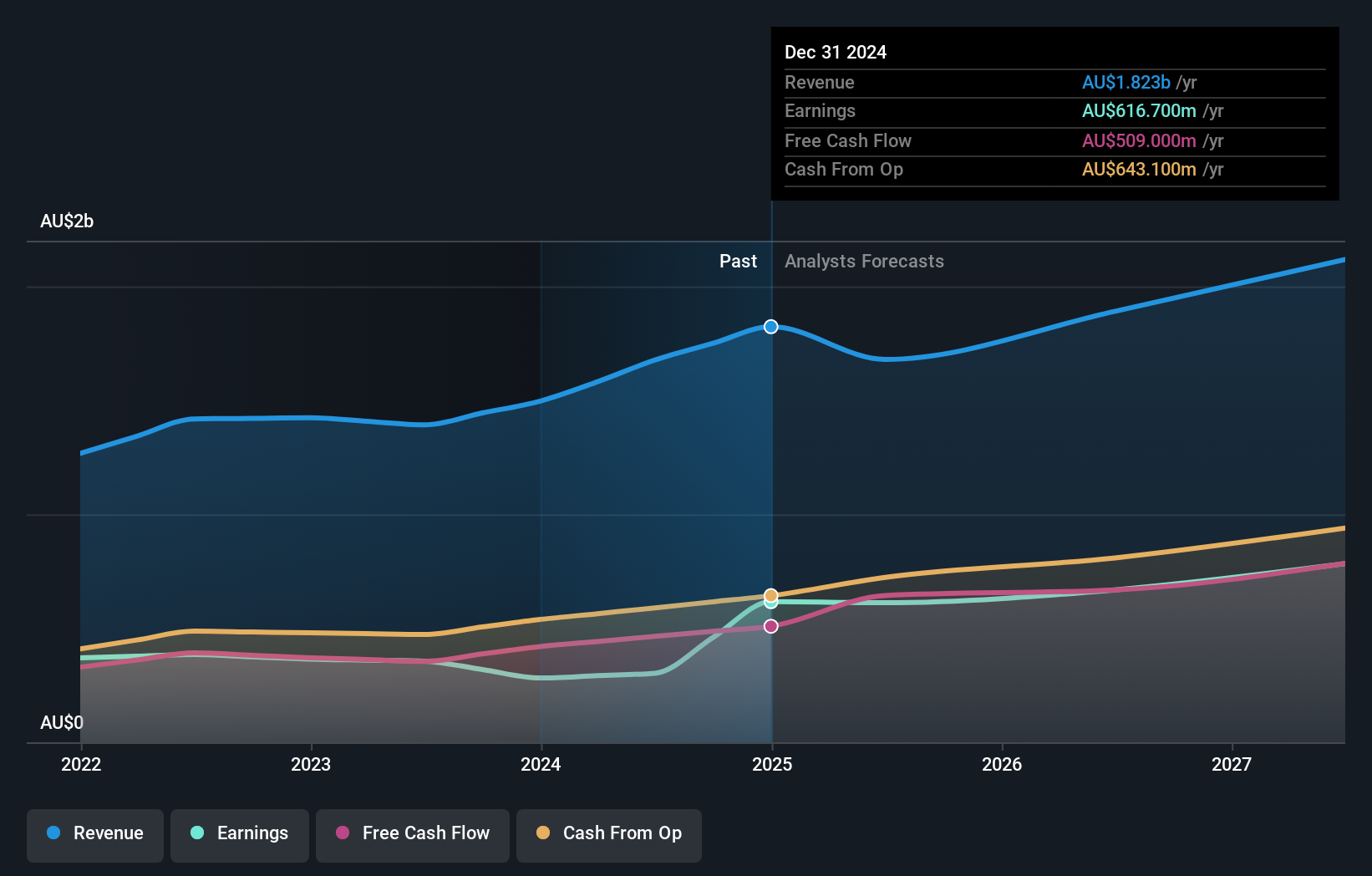

Despite a challenging year with a net income drop to AUD 21.06 million from AUD 42.8 million, Hansen Technologies is poised for recovery, leveraging its strategic client relationships and innovative solutions like the Hansen CIS for Area Nett AS. This system, pivotal in enhancing operational efficiencies through cloud-based SaaS models, underscores Hansen's commitment to technological advancement and customer satisfaction. Furthermore, the company's significant R&D investment aligns with its revenue growth projections of 5.6% annually, outpacing the broader Australian market forecast of 5.5%. This focus on innovation is crucial as earnings are expected to surge by an impressive 20.9% per year, showcasing Hansen’s potential in navigating future market dynamics effectively.

- Click here to discover the nuances of Hansen Technologies with our detailed analytical health report.

Gain insights into Hansen Technologies' past trends and performance with our Past report.

REA Group (ASX:REA)

Simply Wall St Growth Rating: ★★★★☆☆

Overview: REA Group Limited operates an online property advertising business across Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and other international markets with a market capitalization of A$29.99 billion.

Operations: REA Group generates revenue primarily from its property and online advertising segment in Australia, amounting to A$1.25 billion, followed by financial services in Australia at A$320.60 million and operations in India contributing A$103.10 million. The company's focus on digital platforms supports its expansive reach across multiple international markets.

REA Group, amid a 15% earnings drop this past year, still projects robust future growth with anticipated revenue increases at 6.3% annually—surpassing the Australian market's expectation of 5.5%. This resilience is further underscored by an aggressive R&D spend, aligning closely with its revenue trajectory, ensuring continuous innovation in interactive media and services. Additionally, the company's strategic dividend increase by 23%, alongside a promising forecast of earnings growth at 17.5% per year, signals strong financial health and shareholder value enhancement in a competitive landscape.

Taking Advantage

- Embark on your investment journey to our 64 ASX High Growth Tech and AI Stocks selection here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Ready To Venture Into Other Investment Styles?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:REA

REA Group

Engages in online property advertising business in Australia, India, the United States, Malaysia, Singapore, Thailand, Vietnam, and internationally.

Flawless balance sheet with reasonable growth potential.