As the Australian market anticipates a slight uptick, with ASX 200 futures predicting a 0.32% rise, investors are closely watching global economic shifts and local developments. In this context, penny stocks—though an older term—remain relevant for those seeking growth opportunities in smaller or newer companies. These stocks can offer potential upside when supported by strong financials, and we will explore three such promising options on the ASX that combine balance sheet strength with growth potential.

Top 10 Penny Stocks In Australia

| Name | Share Price | Market Cap | Financial Health Rating |

| Embark Early Education (ASX:EVO) | A$0.775 | A$142.2M | ★★★★☆☆ |

| LaserBond (ASX:LBL) | A$0.575 | A$67.4M | ★★★★★★ |

| Austin Engineering (ASX:ANG) | A$0.535 | A$331.78M | ★★★★★☆ |

| SHAPE Australia (ASX:SHA) | A$2.91 | A$241.27M | ★★★★★★ |

| GTN (ASX:GTN) | A$0.555 | A$108.99M | ★★★★★★ |

| MaxiPARTS (ASX:MXI) | A$1.95 | A$107.87M | ★★★★★★ |

| Helloworld Travel (ASX:HLO) | A$1.975 | A$321.56M | ★★★★★★ |

| Vita Life Sciences (ASX:VLS) | A$2.00 | A$111.85M | ★★★★★★ |

| Centrepoint Alliance (ASX:CAF) | A$0.315 | A$62.65M | ★★★★★☆ |

| IVE Group (ASX:IGL) | A$2.12 | A$328.36M | ★★★★☆☆ |

Click here to see the full list of 1,027 stocks from our ASX Penny Stocks screener.

Here's a peek at a few of the choices from the screener.

Catapult Group International (ASX:CAT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Catapult Group International Ltd is a sports science and analytics company that offers technologies to optimize athlete performance, avoid injury, and improve return to play across various regions including Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas; it has a market cap of A$926.61 million.

Operations: The company's revenue is derived from three main segments: Performance & Health ($59.49 million), Tactics & Coaching ($34.43 million), and Media & Other ($14.17 million).

Market Cap: A$926.61M

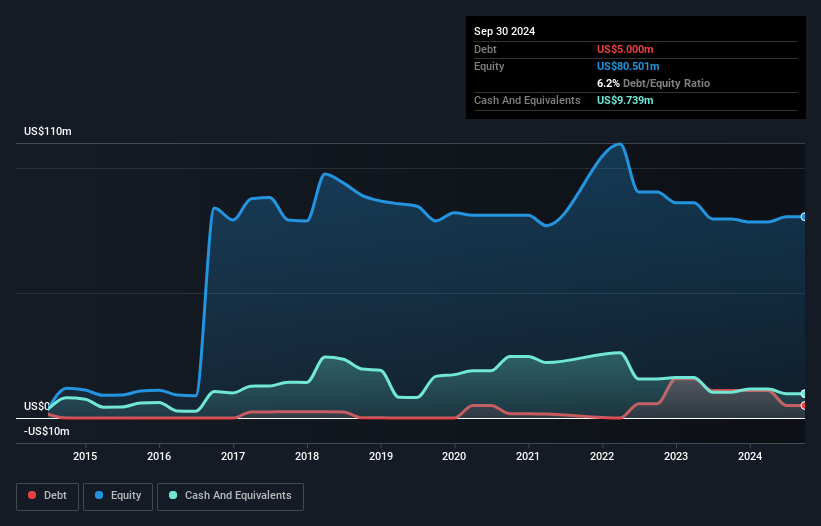

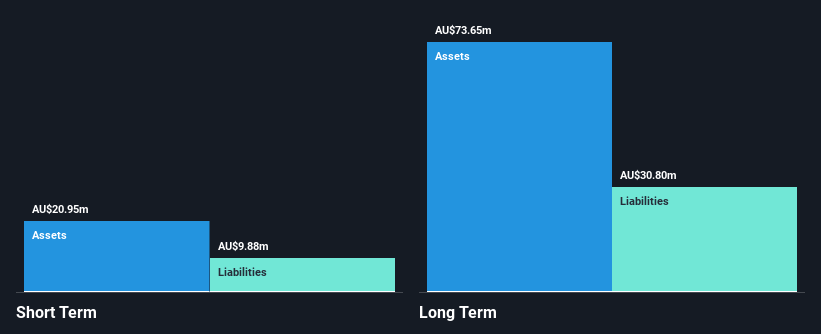

Catapult Group International has shown revenue growth, reporting US$57.84 million for the half year ending September 30, 2024, up from US$49.76 million a year prior. Despite being unprofitable with a net loss of US$7.41 million, the company maintains a cash runway exceeding three years due to positive free cash flow and ample short-term assets relative to long-term liabilities. However, short-term liabilities exceed short-term assets by a significant margin. The management team and board are experienced with average tenures of 3.2 and 8.3 years respectively, providing stability as they navigate financial challenges and pursue forecasted revenue growth of over 14% annually.

- Click here and access our complete financial health analysis report to understand the dynamics of Catapult Group International.

- Explore Catapult Group International's analyst forecasts in our growth report.

LGI (ASX:LGI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: LGI Limited focuses on carbon abatement and renewable energy solutions utilizing biogas from landfill, with a market cap of A$263.76 million.

Operations: The company's revenue is derived from Carbon Abatement (A$14.63 million), Renewable Energy (A$16.15 million), and Infrastructure Construction and Management (A$2.45 million).

Market Cap: A$263.76M

LGI Limited is positioned in the renewable energy sector with a focus on carbon abatement, generating revenue from Carbon Abatement (A$14.63 million), Renewable Energy (A$16.15 million), and Infrastructure Construction and Management (A$2.45 million). The company's earnings have grown significantly over the past five years at an average of 31.2% annually, although recent growth slowed to 3.6%. Despite a low return on equity of 12.6%, LGI's debt management is strong, with interest well-covered by EBIT and a satisfactory net debt to equity ratio of 3.2%. Short-term assets exceed short-term liabilities but fall short against long-term obligations.

- Click to explore a detailed breakdown of our findings in LGI's financial health report.

- Examine LGI's earnings growth report to understand how analysts expect it to perform.

MyState (ASX:MYS)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: MyState Limited operates in Australia offering banking, trustee, and managed fund products and services with a market cap of A$488.15 million.

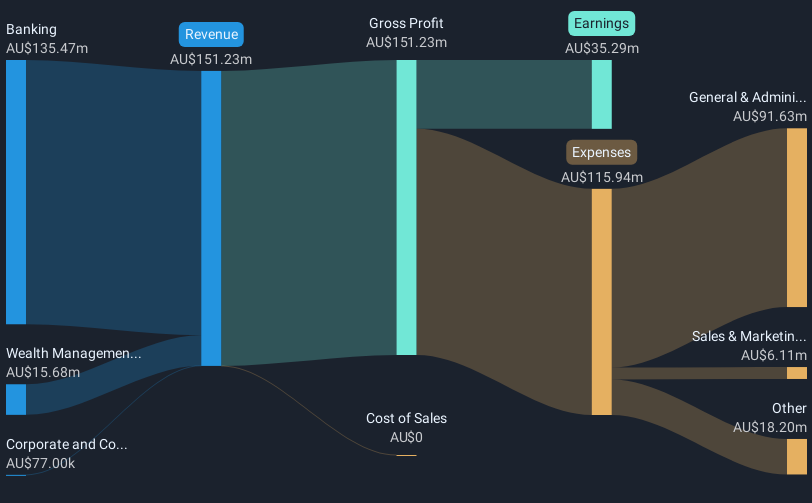

Operations: The company's revenue is primarily derived from Banking at A$135.47 million, followed by Wealth Management contributing A$15.68 million, and a minor portion from Corporate and Consolidation at A$0.08 million.

Market Cap: A$488.15M

MyState Limited, with a market cap of A$488.15 million, primarily generates revenue from banking (A$135.47 million) and wealth management (A$15.68 million). Despite facing negative earnings growth of -8.3% over the past year, its forecasted annual growth is 11.9%. The company's financial stability is supported by an appropriate level of bad loans at 1%, though its high loans to deposits ratio at 128% indicates potential funding pressure. MyState's price-to-earnings ratio of 13.8x suggests it may be undervalued compared to the broader Australian market average of 19.3x, yet it has a low return on equity at 7.6%.

- Dive into the specifics of MyState here with our thorough balance sheet health report.

- Gain insights into MyState's outlook and expected performance with our report on the company's earnings estimates.

Where To Now?

- Explore the 1,027 names from our ASX Penny Stocks screener here.

- Invested in any of these stocks? Simplify your portfolio management with Simply Wall St and stay ahead with our alerts for any critical updates on your stocks.

- Unlock the power of informed investing with Simply Wall St, your free guide to navigating stock markets worldwide.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Jump on the AI train with fast growing tech companies forging a new era of innovation.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:CAT

Catapult Group International

A sports science and analytics company, provides sporting teams and athletes with technologies designed to optimize athlete performance, avoid injury, and improve return to play in Australia, Europe, the Middle East, Africa, the Asia Pacific, and the Americas.

Adequate balance sheet with concerning outlook.

Market Insights

Community Narratives