- Australia

- /

- Specialty Stores

- /

- ASX:SSG

Discover Three ASX Dividend Stocks With Yields Up To 8.7%

Reviewed by Simply Wall St

Over the past year, the Australian market has shown a positive uptrend with an 8.2% increase, despite a flat performance in the last week. In this context of forecasted earnings growth of 14% annually, dividend stocks that offer high yields may be particularly appealing to investors looking for both stability and potential income.

Top 10 Dividend Stocks In Australia

| Name | Dividend Yield | Dividend Rating |

| Lindsay Australia (ASX:LAU) | 7.06% | ★★★★★☆ |

| Nick Scali (ASX:NCK) | 5.01% | ★★★★★☆ |

| Fiducian Group (ASX:FID) | 3.95% | ★★★★★☆ |

| Centuria Capital Group (ASX:CNI) | 6.69% | ★★★★★☆ |

| Charter Hall Group (ASX:CHC) | 3.58% | ★★★★★☆ |

| Eagers Automotive (ASX:APE) | 7.23% | ★★★★★☆ |

| Premier Investments (ASX:PMV) | 4.66% | ★★★★★☆ |

| Fortescue (ASX:FMG) | 8.56% | ★★★★★☆ |

| Diversified United Investment (ASX:DUI) | 3.12% | ★★★★★☆ |

| Australian United Investment (ASX:AUI) | 3.57% | ★★★★☆☆ |

Click here to see the full list of 28 stocks from our Top ASX Dividend Stocks screener.

Underneath we present a selection of stocks filtered out by our screen.

Eagers Automotive (ASX:APE)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Eagers Automotive Limited is an automotive retail company that owns and operates motor vehicle dealerships in Australia and New Zealand, with a market capitalization of approximately A$2.64 billion.

Operations: Eagers Automotive Limited generates its revenue primarily through car retailing, which accounted for A$9.85 billion.

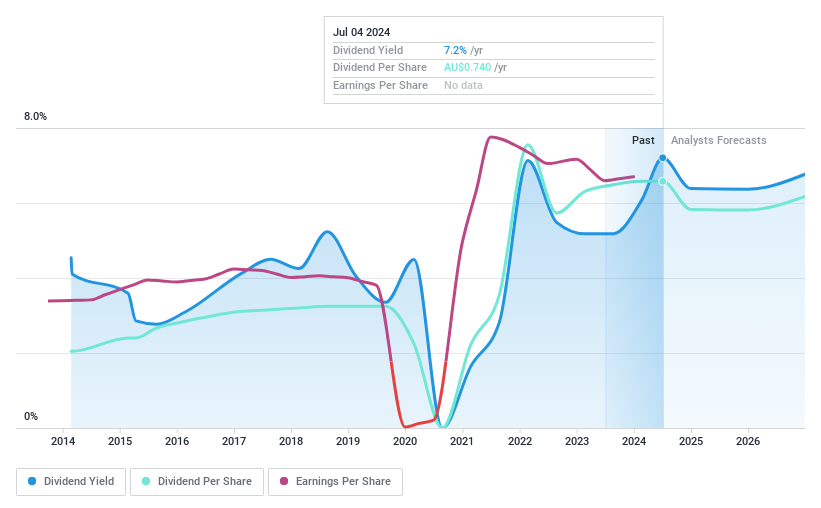

Dividend Yield: 7.2%

Eagers Automotive's dividend yield stands at 7.23%, positioning it in the top 25% of Australian dividend payers. However, its dividend history is marked by volatility and inconsistency over the past decade, with an unstable track record despite a reasonable payout ratio of 66.8%. The company recently announced a share buyback program, signaling potential confidence in its financial health, yet earnings are expected to decline slightly by an average of 0.8% annually over the next three years. Meanwhile, revenue growth is projected at 5.57% per year, suggesting some operational momentum which might support future dividends if sustained.

- Navigate through the intricacies of Eagers Automotive with our comprehensive dividend report here.

- Our expertly prepared valuation report Eagers Automotive implies its share price may be lower than expected.

Australian United Investment (ASX:AUI)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Australian United Investment Company Limited, a publicly owned investment manager, operates with a market capitalization of approximately A$1.28 billion.

Operations: Australian United Investment Company Limited generates revenue primarily through its investment activities, totaling approximately A$58.33 million.

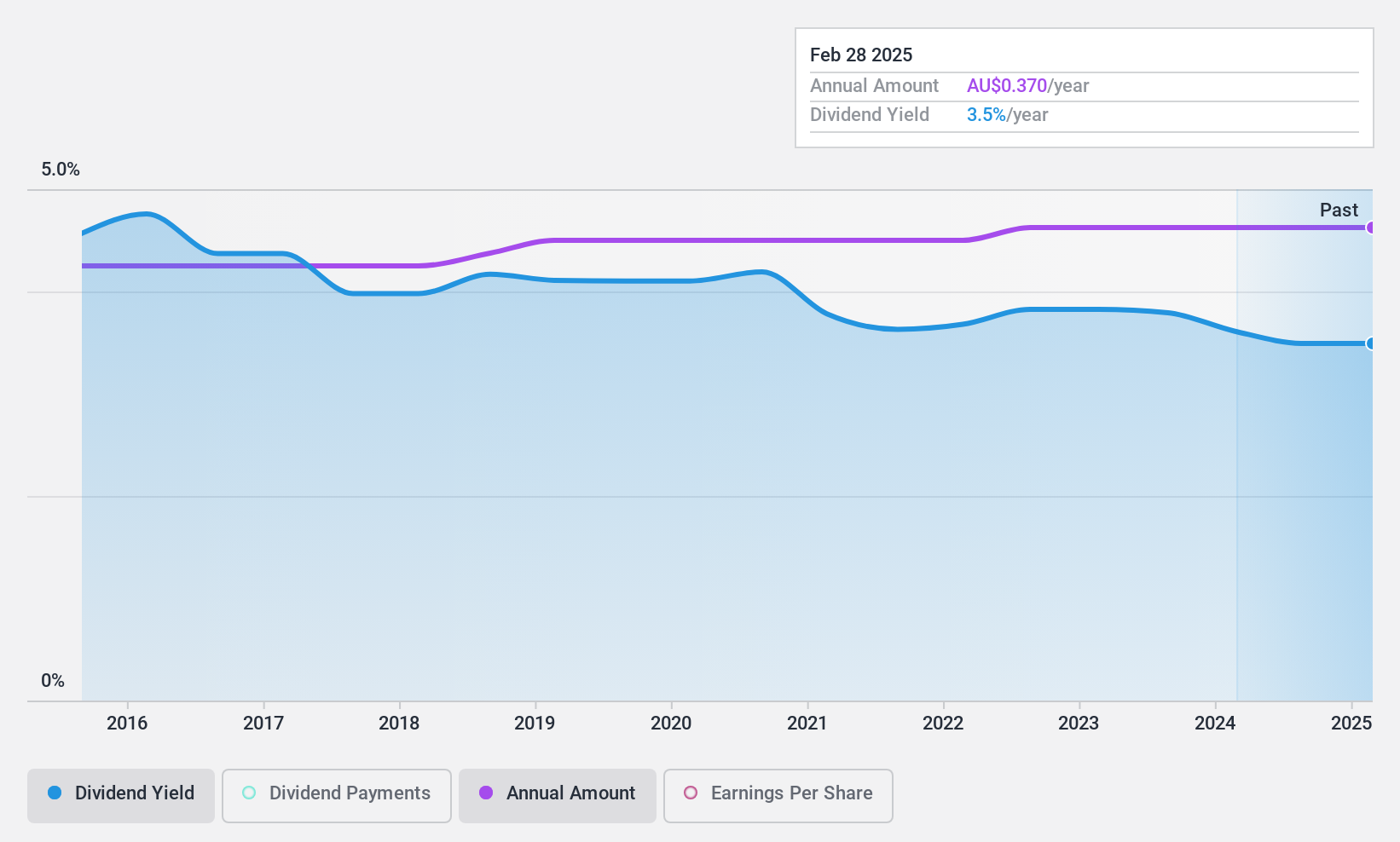

Dividend Yield: 3.6%

Australian United Investment has maintained stable dividends over the past decade, reflecting reliability in its distributions. However, with a payout ratio of 92.4% and a cash payout ratio of 86.8%, these dividends are not well-covered by earnings or free cash flows, raising concerns about sustainability. Its dividend yield at 3.57% is also lower than many top Australian dividend stocks. Recently, the company extended its buyback plan until May 2025, potentially indicating confidence in its financial management despite coverage issues.

- Click here and access our complete dividend analysis report to understand the dynamics of Australian United Investment.

- The analysis detailed in our Australian United Investment valuation report hints at an inflated share price compared to its estimated value.

Shaver Shop Group (ASX:SSG)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Shaver Shop Group Limited operates as a retailer specializing in personal care and grooming products across Australia and New Zealand, with a market capitalization of approximately A$152.63 million.

Operations: Shaver Shop Group Limited generates its revenue primarily through retail store sales of specialist personal grooming products, totaling approximately A$219.66 million.

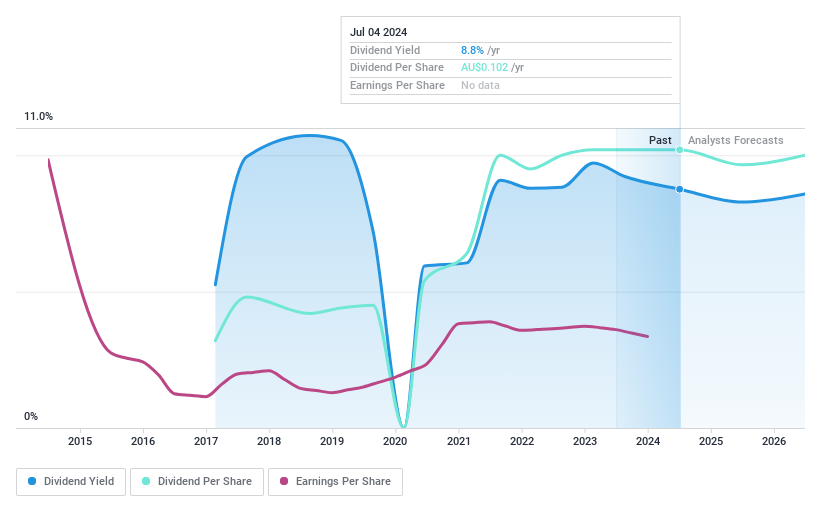

Dividend Yield: 8.8%

Shaver Shop Group offers a dividend yield of 8.76%, ranking in the top 25% of Australian dividend payers. However, its dividend history is marked by volatility and inconsistency over its seven-year payout period, with an earnings coverage payout ratio at 83.6% and cash flow coverage at 52.9%. Despite recent growth in dividends, the company's short and unstable dividend history coupled with significant insider selling raises questions about future reliability and sustainability of payouts.

- Click to explore a detailed breakdown of our findings in Shaver Shop Group's dividend report.

- Insights from our recent valuation report point to the potential undervaluation of Shaver Shop Group shares in the market.

Seize The Opportunity

- Reveal the 28 hidden gems among our Top ASX Dividend Stocks screener with a single click here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:SSG

Shaver Shop Group

Shaver Shop Group Limited retails personal care and grooming products in Australia and New Zealand.

Flawless balance sheet, undervalued and pays a dividend.