- Australia

- /

- Specialty Stores

- /

- ASX:LOV

Codan And 2 Other Stocks On The ASX That May Be Undervalued

Reviewed by Simply Wall St

Over the last 7 days, the Australian market has dropped 5.0%, but it has risen by 4.4% over the past year, with earnings expected to grow by 13% per annum in the coming years. In this fluctuating environment, identifying undervalued stocks can offer significant opportunities for investors looking to capitalize on potential growth and value.

Top 10 Undervalued Stocks Based On Cash Flows In Australia

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| LaserBond (ASX:LBL) | A$0.705 | A$1.38 | 48.8% |

| Regal Partners (ASX:RPL) | A$3.29 | A$6.42 | 48.8% |

| Shine Justice (ASX:SHJ) | A$0.725 | A$1.33 | 45.4% |

| Nanosonics (ASX:NAN) | A$3.00 | A$5.84 | 48.6% |

| Infomedia (ASX:IFM) | A$1.65 | A$3.07 | 46.2% |

| HMC Capital (ASX:HMC) | A$7.58 | A$13.78 | 45% |

| Millennium Services Group (ASX:MIL) | A$1.145 | A$2.24 | 48.9% |

| Life360 (ASX:360) | A$14.87 | A$27.86 | 46.6% |

| Little Green Pharma (ASX:LGP) | A$0.093 | A$0.17 | 45.1% |

| Airtasker (ASX:ART) | A$0.27 | A$0.52 | 48.5% |

Let's dive into some prime choices out of the screener.

Codan (ASX:CDA)

Overview: Codan Limited develops technology solutions for a diverse range of clients including United Nations organizations, mining companies, security and military groups, government departments, individuals, and small-scale miners; the company has a market cap of A$2.12 billion.

Operations: The company's revenue segments comprise A$291.50 million from Communications and A$212.20 million from Metal Detection.

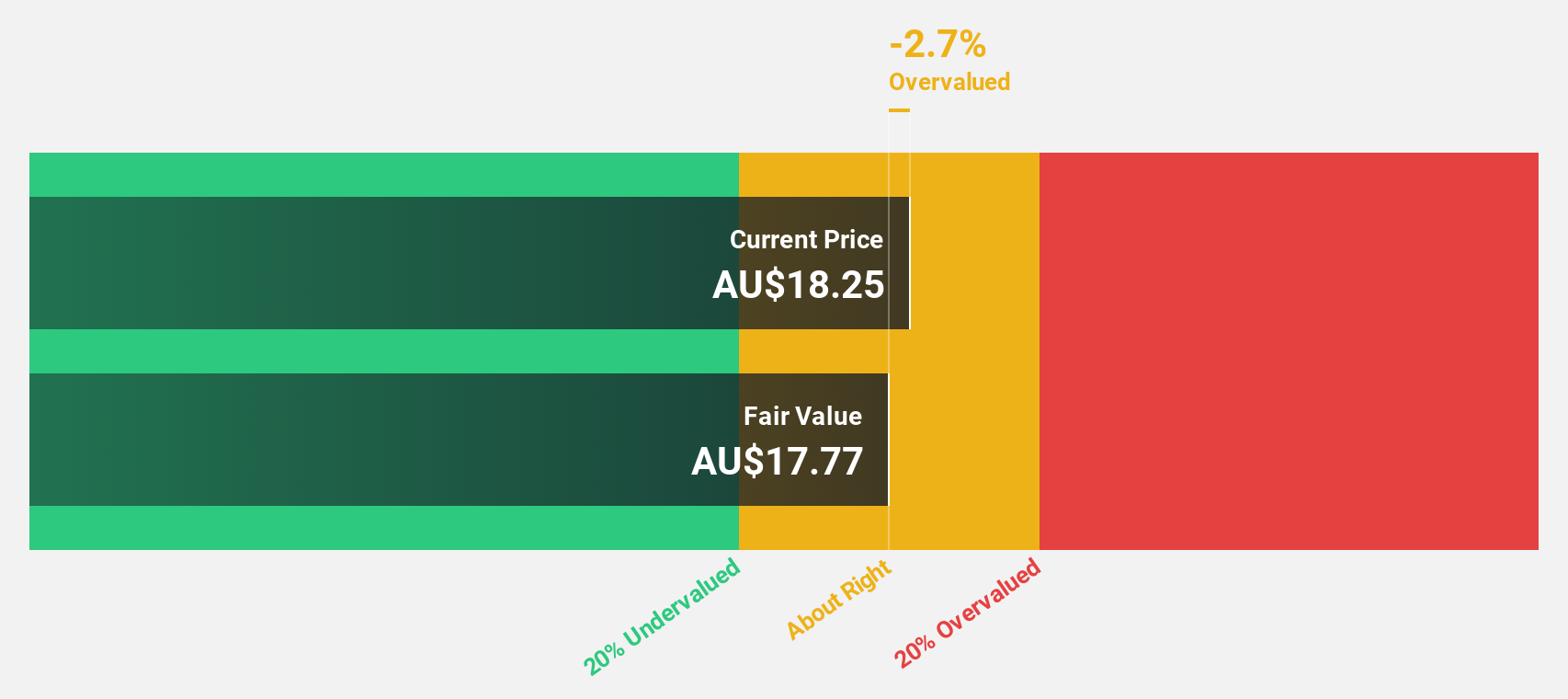

Estimated Discount To Fair Value: 37.3%

Codan (A$11.69) is trading at 37.3% below its estimated fair value of A$18.65, based on discounted cash flow analysis, making it highly undervalued. The company's earnings are forecast to grow at 16.2% per year, outpacing the Australian market's 12.8%. Revenue is also expected to grow faster than the market at 9.1% annually, though not significantly high overall. Codan's Return on Equity is projected to be a robust 21.5% in three years.

- Insights from our recent growth report point to a promising forecast for Codan's business outlook.

- Delve into the full analysis health report here for a deeper understanding of Codan.

Infomedia (ASX:IFM)

Overview: Infomedia Ltd (ASX:IFM) is a technology company that develops and supplies electronic parts catalogues, service quoting software, and e-commerce solutions for the automotive industry worldwide, with a market cap of A$618.99 million.

Operations: Revenue Segments (in millions of A$): Publishing - Periodicals: 136.58

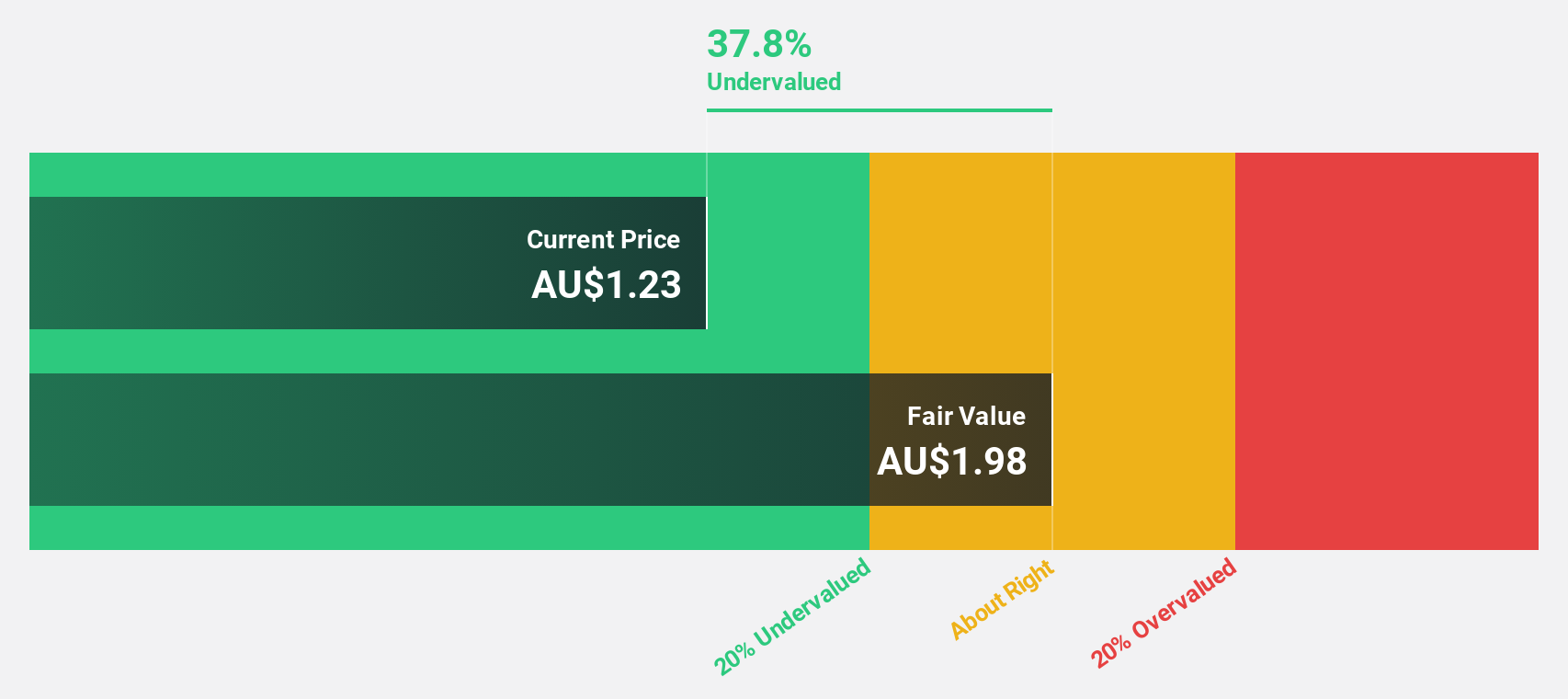

Estimated Discount To Fair Value: 46.2%

Infomedia (A$1.65) is trading 46.2% below its estimated fair value of A$3.07, indicating significant undervaluation based on discounted cash flow analysis. The company's earnings are forecast to grow at 27.83% per year, significantly outpacing the Australian market's 12.8%. Revenue growth is expected at 7.9% annually, higher than the market average of 5.1%. Recent board changes include plans for a new Chairman and appointment of Joanne Hawkins as joint Company Secretary.

- The growth report we've compiled suggests that Infomedia's future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Infomedia's balance sheet health report.

Lovisa Holdings (ASX:LOV)

Overview: Lovisa Holdings Limited operates in the retail sale of fashion jewelry and accessories with a market cap of A$3.58 billion.

Operations: Revenue from the retail sale of fashion jewelry and accessories amounted to A$654.00 million.

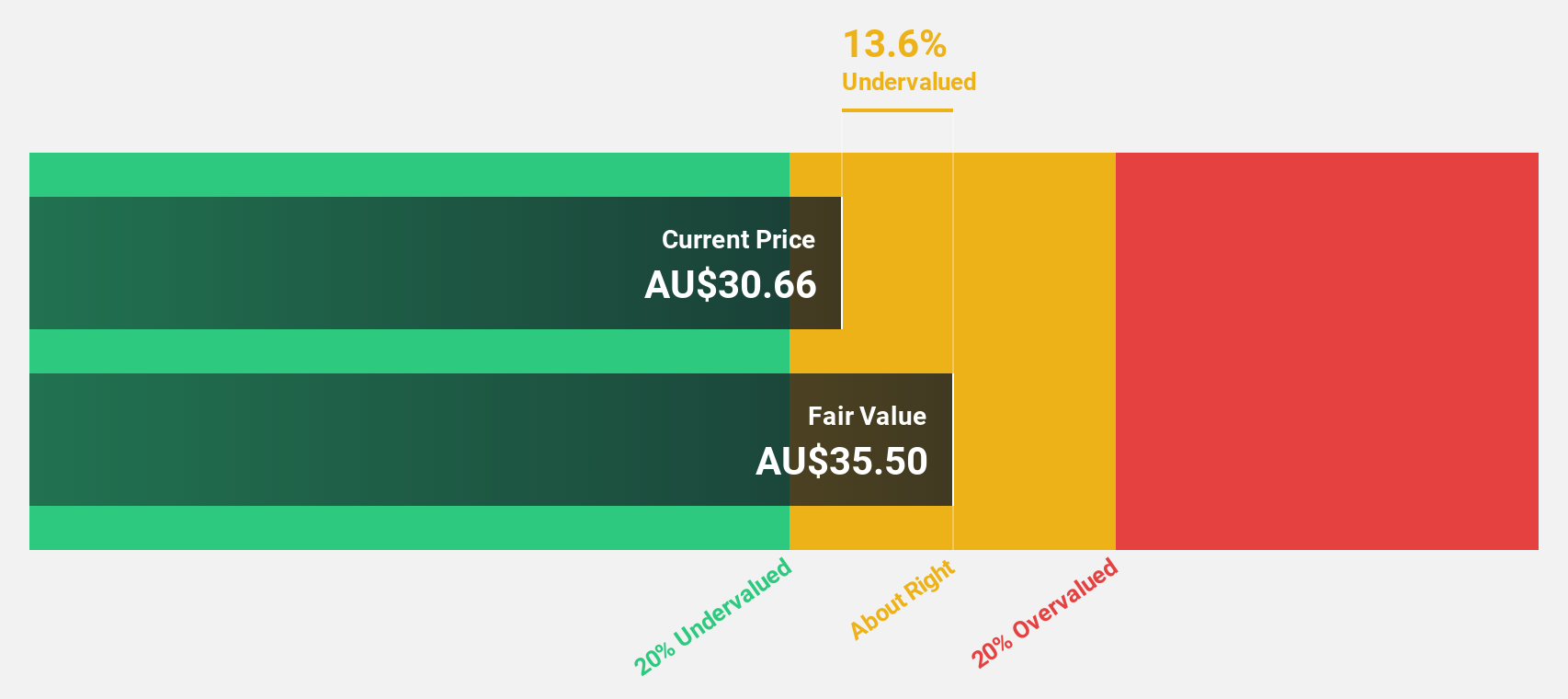

Estimated Discount To Fair Value: 43.3%

Lovisa Holdings (A$32.63) trades 43.3% below its fair value estimate of A$57.51, showing significant undervaluation based on discounted cash flow analysis. Revenue is forecast to grow at 13.4% per year, outpacing the Australian market's 5.1%. Earnings are expected to increase by 17.3% annually, also above market growth rates of 12.8%. The company's Return on Equity is projected to be very high at nearly 100% in three years, highlighting strong future profitability potential.

- In light of our recent growth report, it seems possible that Lovisa Holdings' financial performance will exceed current levels.

- Click here and access our complete balance sheet health report to understand the dynamics of Lovisa Holdings.

Seize The Opportunity

- Access the full spectrum of 38 Undervalued ASX Stocks Based On Cash Flows by clicking on this link.

- Are these companies part of your investment strategy? Use Simply Wall St to consolidate your holdings into a portfolio and gain insights with our comprehensive analysis tools.

- Streamline your investment strategy with Simply Wall St's app for free and benefit from extensive research on stocks across all corners of the world.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:LOV

Lovisa Holdings

Engages in the retail sale of fashion jewelry and accessories.

Solid track record with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives