The Australian market has shown a mixed performance, with the ASX200 closing up 0.22% at 8,297 points, driven by gains in the IT and Financials sectors while Real Estate and Energy lagged behind. In this context of sectoral shifts and investor sentiment changes, growth companies with high insider ownership can be particularly appealing as they often signal strong confidence from those closest to the business's operations and strategic direction.

Top 10 Growth Companies With High Insider Ownership In Australia

| Name | Insider Ownership | Earnings Growth |

| Alfabs Australia (ASX:AAL) | 10.8% | 41.3% |

| Acrux (ASX:ACR) | 15.5% | 106.9% |

| Cyclopharm (ASX:CYC) | 11.3% | 97.8% |

| Fenix Resources (ASX:FEX) | 21.1% | 53.4% |

| Newfield Resources (ASX:NWF) | 31.5% | 72.1% |

| Brightstar Resources (ASX:BTR) | 11.6% | 105.2% |

| Titomic (ASX:TTT) | 11.2% | 77.2% |

| Plenti Group (ASX:PLT) | 12.7% | 89.6% |

| Image Resources (ASX:IMA) | 20.6% | 79.9% |

| BETR Entertainment (ASX:BBT) | 38.6% | 121.8% |

Below we spotlight a couple of our favorites from our exclusive screener.

Clarity Pharmaceuticals (ASX:CU6)

Simply Wall St Growth Rating: ★★★★★☆

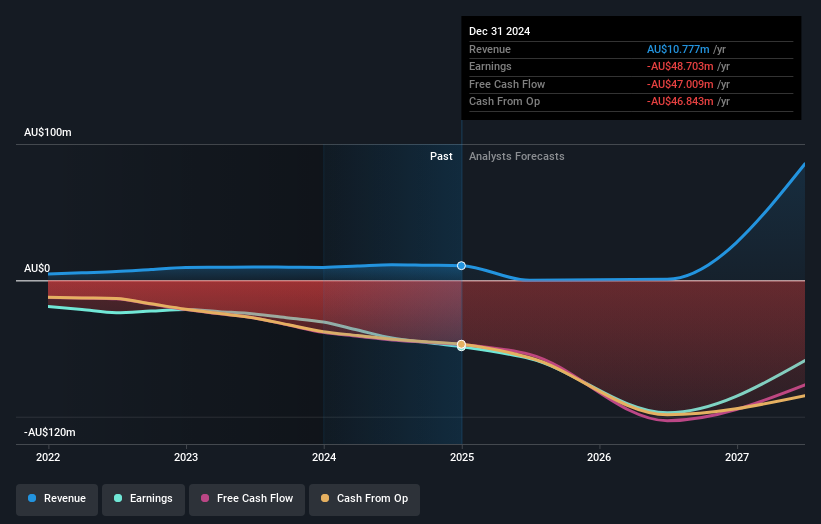

Overview: Clarity Pharmaceuticals Ltd is a clinical stage radiopharmaceutical company focused on research and development of radiopharmaceutical products in Australia and the United States, with a market cap of A$809.81 million.

Operations: Clarity Pharmaceuticals Ltd generates revenue of A$10.78 million from its radiopharmaceutical development segment.

Insider Ownership: 17.8%

Earnings Growth Forecast: 10.6% p.a.

Clarity Pharmaceuticals demonstrates significant growth potential with high insider ownership, driven by its innovative radiopharmaceuticals pipeline and strategic partnerships. The company's revenue is forecast to grow at a robust 62.9% annually, surpassing the Australian market average. Recent developments include a commercial-scale supply agreement for copper-64 with Nusano and promising clinical trial results for its prostate cancer treatment, Cu-SAR-bisPSMA. Despite current unprofitability, Clarity is expected to become profitable within three years, indicating strong future prospects in the healthcare sector.

- Get an in-depth perspective on Clarity Pharmaceuticals' performance by reading our analyst estimates report here.

- Insights from our recent valuation report point to the potential overvaluation of Clarity Pharmaceuticals shares in the market.

Dropsuite (ASX:DSE)

Simply Wall St Growth Rating: ★★★★☆☆

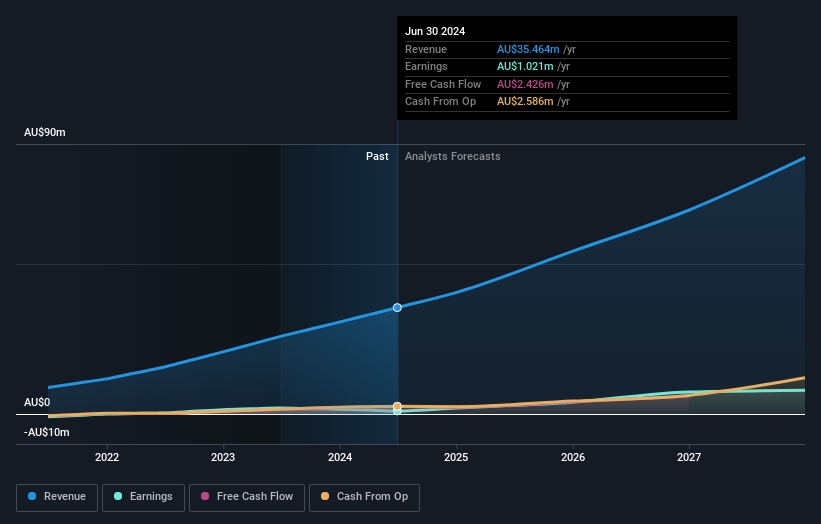

Overview: Dropsuite Limited offers cloud-based data backup and archiving solutions across various regions including Australia, Singapore, Europe, and the United States, with a market cap of A$418.23 million.

Operations: The company generates revenue primarily through its provision of backup services, amounting to A$41.17 million.

Insider Ownership: 13.9%

Earnings Growth Forecast: 33.8% p.a.

Dropsuite shows promising growth potential with high insider ownership. Its revenue is forecast to grow at 19.3% annually, outpacing the Australian market average of 5.5%. Earnings are expected to increase significantly by 33.8% per year, despite a decline in profit margins from 5.2% to 2%. Recent challenges include being dropped from key indices like the S&P/ASX All Ordinaries and Emerging Companies Indexes, which may impact investor sentiment temporarily but do not alter its growth trajectory fundamentals.

- Unlock comprehensive insights into our analysis of Dropsuite stock in this growth report.

- Our comprehensive valuation report raises the possibility that Dropsuite is priced higher than what may be justified by its financials.

Kogan.com (ASX:KGN)

Simply Wall St Growth Rating: ★★★★★☆

Overview: Kogan.com Ltd is an online retailer operating in Australia with a market capitalization of A$465.79 million.

Operations: The company's revenue segments include A$9.96 million from Mighty Ape in Australia, A$309.36 million from Kogan Parent in Australia, A$124.88 million from Mighty Ape in New Zealand, and A$40.02 million from Kogan Parent in New Zealand.

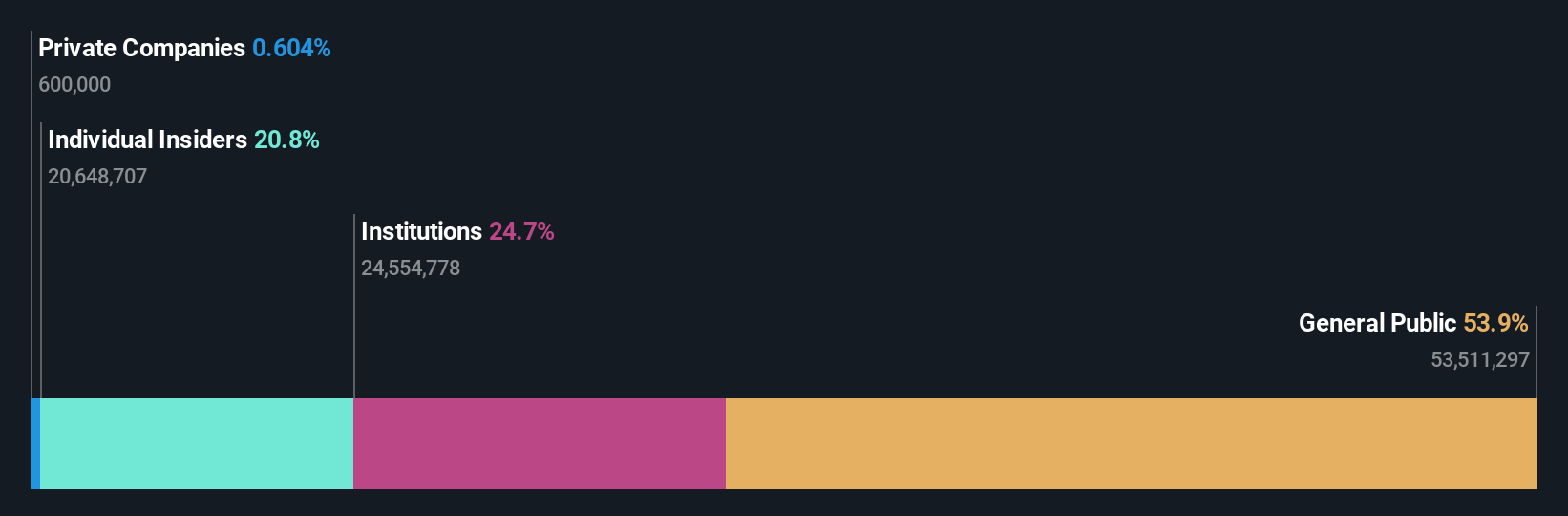

Insider Ownership: 20.8%

Earnings Growth Forecast: 38.1% p.a.

Kogan.com demonstrates strong growth prospects with substantial insider ownership. Its earnings are forecast to grow significantly at 38.1% annually, outpacing the Australian market's 11.6%. Recent insider activity shows more shares bought than sold in the past three months, indicating confidence in future performance. However, profit margins have decreased from 1.4% to 0.4%, and its dividend yield of 2.99% is not well covered by earnings, suggesting potential challenges in sustaining dividends long-term.

- Take a closer look at Kogan.com's potential here in our earnings growth report.

- According our valuation report, there's an indication that Kogan.com's share price might be on the expensive side.

Next Steps

- Take a closer look at our Fast Growing ASX Companies With High Insider Ownership list of 98 companies by clicking here.

- Seeking Other Investments? The best AI stocks today may lie beyond giants like Nvidia and Microsoft. Find the next big opportunity with these 29 smaller AI-focused companies with strong growth potential through early-stage innovation in machine learning, automation, and data intelligence that could fund your retirement.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About ASX:DSE

Dropsuite

Provides cloud-based suite of data backup and archiving solutions in Australia, Singapore, Europe, the United States, and internationally.

Flawless balance sheet with reasonable growth potential.

Market Insights

Community Narratives